Advocates for the Massachusetts film tax credit warn that proposed reforms outlined in the state Senate's 2022 budget will cripple the industry just as it recovers from the pandemic. The changes, including increasing in-state spending requirements and removing the credit's sunset clause, could push Massachusetts down the list of desirable filming locations. Industry professionals highlight the current momentum and numerous projects in the pipeline, urging lawmakers to support the existing tax credit to maintain this progress.

According to advocates of the Massachusetts ’ film tax credit , a series of reforms recommended by the state Senate as part of the 2022 budget will destroy the commonwealth’s film industry just as it gets back on track from the pandemic and stands on the cusp of significant growth., which includes language to keep the current film tax credit and remove its 2023 expiration.

That would be an added blow since he had to lay off more than half of his staff during the pandemic. Yet he remains optimistic about the potential to rebuild. “I’ve never seen an environment more dynamic and successful and growing than what I’m seeing right now,” says Rule. Most recently, his company outfitted “The Tender Bar,” directed by George Clooney, starring Ben Affleck, and shot in Massachusetts earlier this year.

The show "Defending Jacob" was filmed on location in Massachusetts. Actor Chris Evans is seen standing near the sign for Cold Spring Park in Newton in a still from episode two. since its 2005 adoption. In that time, other states have initiated, refined and, in some instances, repealed similar programs. Proponents often say that film production is about the bottom line and incentive programs attract business that would otherwise not exist.

Yet, film tax credit advocates believe that the data does not fully capture the depth of the credit’s impact and lacks proper analysis. For one, there’s always a lag time in numbers collected by the Department of Revenue. that has prepared more than 200 requests for the credit, ticks off receipts she sees for clothing stores, supermarkets, gas stations, fast food chains and other businesses that she thinks have no idea they benefit from film production.

Politics Massachusetts Film Industry Tax Credit Senate Budget Economic Impact

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Massachusetts Film Tax Credits Hit Record High, Sparking DebateMassachusetts issued a record $92.8 million in film tax credits in 2023, fueling debate over the program's economic benefits and cost to taxpayers. While supporters highlight job creation, critics argue the program is a costly subsidy for Hollywood with minimal return on investment.

Massachusetts Film Tax Credits Hit Record High, Sparking DebateMassachusetts issued a record $92.8 million in film tax credits in 2023, fueling debate over the program's economic benefits and cost to taxpayers. While supporters highlight job creation, critics argue the program is a costly subsidy for Hollywood with minimal return on investment.

Read more »

Massachusetts Lawmaker Makes Another Push for Sports Betting Tax HikeSenator John F. Keenan has filed a bill which would increase the tax rate on sports betting operators, limit bettors, and ban certain types of wagers.

Massachusetts Lawmaker Makes Another Push for Sports Betting Tax HikeSenator John F. Keenan has filed a bill which would increase the tax rate on sports betting operators, limit bettors, and ban certain types of wagers.

Read more »

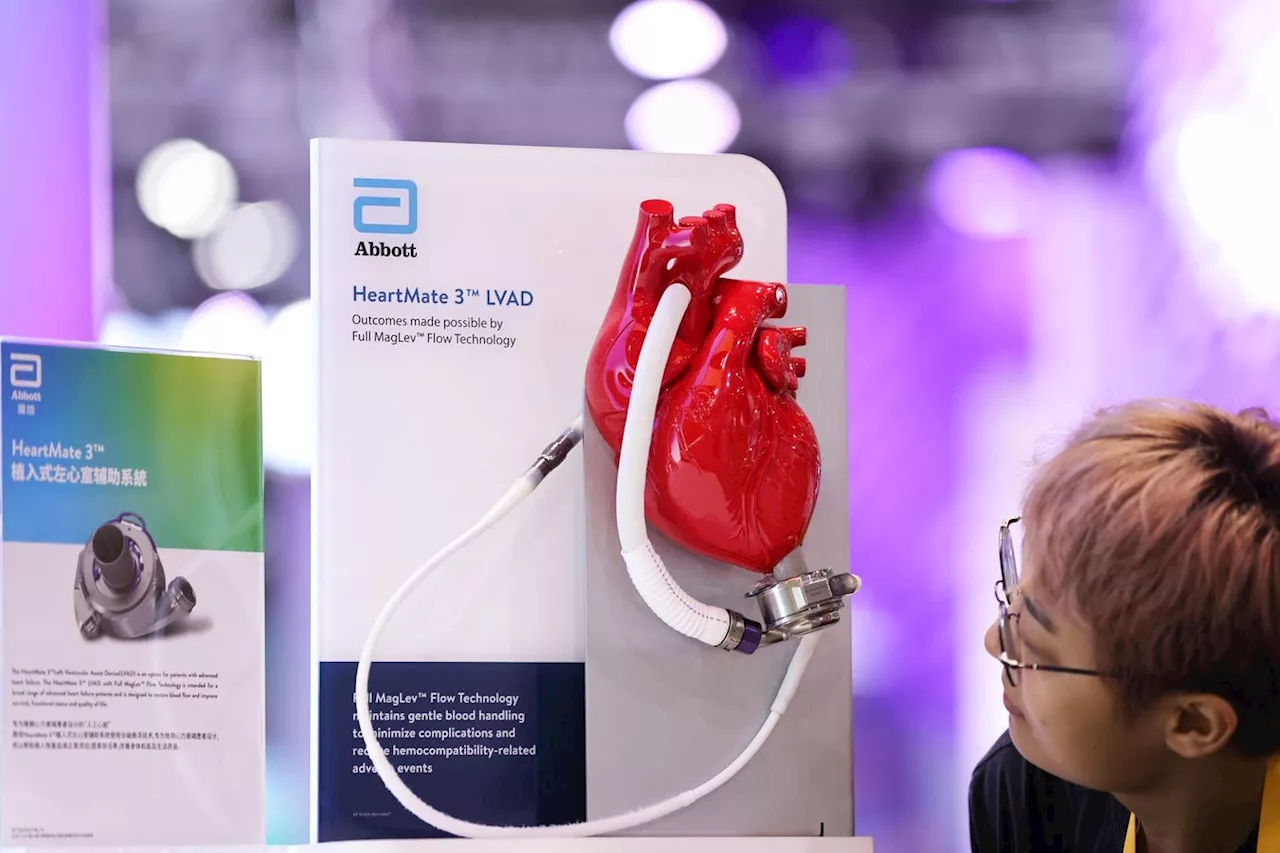

Medical Device Industry Fears Trump Tariffs Will Devastate IndustryThe medical device industry is bracing for higher costs from tariffs imposed by the Trump administration on imports from Canada, Mexico, and China. Companies, including Abbott Laboratories, Johnson & Johnson, and Medtronic, are seeking an exemption from the tariffs, which they say will devastate the industry with higher costs, lead to massive job loss, and stifle innovation.

Medical Device Industry Fears Trump Tariffs Will Devastate IndustryThe medical device industry is bracing for higher costs from tariffs imposed by the Trump administration on imports from Canada, Mexico, and China. Companies, including Abbott Laboratories, Johnson & Johnson, and Medtronic, are seeking an exemption from the tariffs, which they say will devastate the industry with higher costs, lead to massive job loss, and stifle innovation.

Read more »

Auto Industry Fears Impact of EV Tax Credit RemovalThe incoming Trump administration is considering eliminating the $7,500 federal tax credit for electric vehicles (EVs), a move that industry leaders warn could severely harm the US EV market. John Bozzella, head of the Alliance for Automotive Innovation, emphasizes the auto industry's importance to the US economy and urges the administration to consider the risks of jeopardizing its competitiveness. Ford CEO Jim Farley highlights the crucial role production credits play in enabling automakers to convert factories to EV production, while NADA president Mike Stanton expresses concern about the impact on dealerships already holding significant EV inventory.

Auto Industry Fears Impact of EV Tax Credit RemovalThe incoming Trump administration is considering eliminating the $7,500 federal tax credit for electric vehicles (EVs), a move that industry leaders warn could severely harm the US EV market. John Bozzella, head of the Alliance for Automotive Innovation, emphasizes the auto industry's importance to the US economy and urges the administration to consider the risks of jeopardizing its competitiveness. Ford CEO Jim Farley highlights the crucial role production credits play in enabling automakers to convert factories to EV production, while NADA president Mike Stanton expresses concern about the impact on dealerships already holding significant EV inventory.

Read more »

MP Calls for Radical Food Industry Overhaul with New Tax on Unhealthy FoodsAn MP is proposing a new tax on fast food and foods high in salt and sugar to combat obesity. Dr. Simon Opher argues that current policies are insufficient and calls for a 'radical' change in the food industry. He suggests that the revenue from the tax could be used to subsidize healthy food for low-income individuals.

MP Calls for Radical Food Industry Overhaul with New Tax on Unhealthy FoodsAn MP is proposing a new tax on fast food and foods high in salt and sugar to combat obesity. Dr. Simon Opher argues that current policies are insufficient and calls for a 'radical' change in the food industry. He suggests that the revenue from the tax could be used to subsidize healthy food for low-income individuals.

Read more »

Car tax rethink needed to help drive electric vehicle sales, says industryElectric car sales climbed 42% year-on-year in January, but still lagged well behind ZEV mandate targets

Car tax rethink needed to help drive electric vehicle sales, says industryElectric car sales climbed 42% year-on-year in January, but still lagged well behind ZEV mandate targets

Read more »