People can choose to defer claiming their State Pension when they reach retirement age.

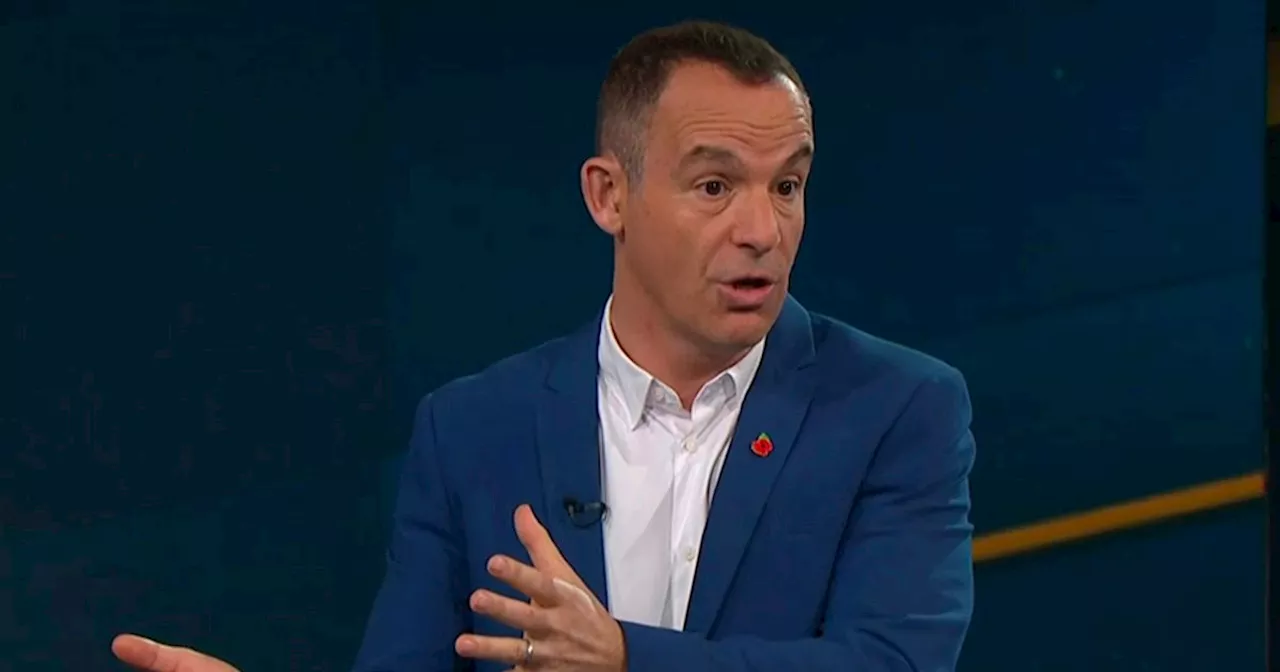

Many people approaching the official age of retirement this year may not be aware they could increase future State Pension payments by choosing not to claim the contributory benefit. Deferring your State Pension could add an extra £660 each year on to the annual payments, however, consumer champion Martin Lewis says it’s something that might only benefit certain groups of people.

There’s a handy step-by-step guide on deferring the State Pension on the MoneySavingexpert.com website here. Those who are eligible for the New State Pension can benefit from a one per cent increase in their weekly State Pension for every nine weeks they delay claiming the payment, equivalent to nearly 5.8 per cent extra income for every full year deferred.

These retirees receive an extra one per cent State Pension income for every five weeks deferred, equal to an annual rise of 10.4 per cent or £916.66, which can be taken either as extra income or a lump sum. Over the 2024/25 financial year, the full New State Pension will be worth £11,502, leaving just £1,068 before the personal tax threshold is exceeded, so anyone with additional income of £89 or more per week - on top of State Pension - may receive a tax bill the following year.

State Pension Pensions Retirement Personal Finance

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Martin Lewis urges people of State Pension age to check for £3,900 income top-upPension Credit can boost income by an average of £3,900 each year.

Martin Lewis urges people of State Pension age to check for £3,900 income top-upPension Credit can boost income by an average of £3,900 each year.

Read more »

Martin Lewis urges women on State Pension to check for back pay of up to £12,500Historical State Pension errors could see hundreds of thousands of women owed money.

Martin Lewis urges women on State Pension to check for back pay of up to £12,500Historical State Pension errors could see hundreds of thousands of women owed money.

Read more »

Martin Lewis urges people to check for £5,400 State Pension top-up this yearThe consumer champion shares simple steps people on or due to receive the New State Pension can take to boost retirement payments.

Martin Lewis urges people to check for £5,400 State Pension top-up this yearThe consumer champion shares simple steps people on or due to receive the New State Pension can take to boost retirement payments.

Read more »

Martin Lewis issues word of warning to anyone with a private or company pensionThe Money Saving Expert founder has shared how you could make a common mistake in your will when it comes to your pension.

Martin Lewis issues word of warning to anyone with a private or company pensionThe Money Saving Expert founder has shared how you could make a common mistake in your will when it comes to your pension.

Read more »

Martin Lewis warns anyone with a pension not to 'leave it to your ex'The Money Saving Expert founder is reminding people to tell their pension provider

Martin Lewis warns anyone with a pension not to 'leave it to your ex'The Money Saving Expert founder is reminding people to tell their pension provider

Read more »

Martin Lewis issues urgent private or company pension warningThe Money Saving Expert founder said it could result in money going to someone you don't want it to

Martin Lewis issues urgent private or company pension warningThe Money Saving Expert founder said it could result in money going to someone you don't want it to

Read more »