The government has exempted unit trusts from Capital Gains Tax (CGT) and taxes on Foreign Sourced Income (FSI) to encourage capital market investments in Malaysia. Finance Minister II Datuk Seri Amir Hamzah Azizan announced the exemption, stating that it aims to make investments more accessible for individuals.

The government has agreed to exempt the imposition of Capital Gains Tax (CGT) and taxes on Foreign Sourced Income (FSI) on unit trusts to make capital market investments in Malaysia rakyat-friendly, according to Finance Minister II Datuk Seri Amir Hamzah Azizan.

Malaysia Capital Gains Tax Foreign Sourced Income Unit Trusts Investments

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Keynote Capital to exit Apollo Food Holdings as Scoop Capital proposes acquisitionKeynote Capital Sdn Bhd, controlling shareholder of Apollo Food Holdings Bhd, is confirmed to be exiting the group, reported The Edge. This followed the proposal by Scoop Capital Sdn Bhd, the franchisee of Baskin-Robbins, to acquire Keynote's entire 51.31 per cent stake in the confectionery maker for RM238.08 million in cash.

Keynote Capital to exit Apollo Food Holdings as Scoop Capital proposes acquisitionKeynote Capital Sdn Bhd, controlling shareholder of Apollo Food Holdings Bhd, is confirmed to be exiting the group, reported The Edge. This followed the proposal by Scoop Capital Sdn Bhd, the franchisee of Baskin-Robbins, to acquire Keynote's entire 51.31 per cent stake in the confectionery maker for RM238.08 million in cash.

Read more »

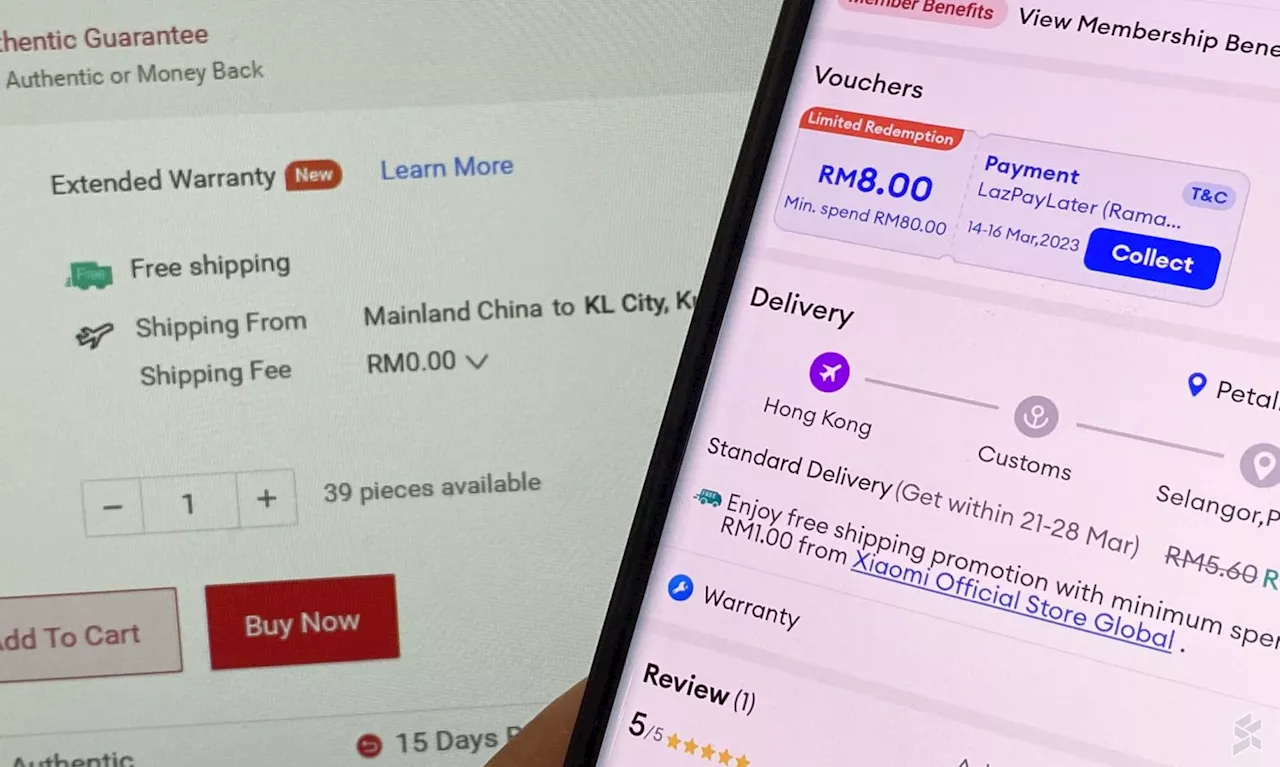

Malaysia to Impose 10% Sales Tax on Online ShoppingMalaysia will start imposing a 10% sales tax on online shopping for items priced under RM500 delivered from abroad. This tax applies to all online sellers, regardless of their location, and excludes imported alcohol or smoking products.

Malaysia to Impose 10% Sales Tax on Online ShoppingMalaysia will start imposing a 10% sales tax on online shopping for items priced under RM500 delivered from abroad. This tax applies to all online sellers, regardless of their location, and excludes imported alcohol or smoking products.

Read more »

Boycott, Divestment, Sanctions (BDS Malaysia) Faces Legal Action from McDonald’s MalaysiaBoycott, Divestment, Sanctions (BDS Malaysia), a grassroots movement standing in solidarity with Palestinian rights, is being sued by McDonald’s Malaysia. The fast-food chain's licensee in Malaysia, Gerbang Alaf Restaurants, issued a legal notice and statement of claim to BDS Malaysia, demanding the cessation of activities that harm McDonald’s reputation. BDS Malaysia is accused of making libellous statements on various online platforms.

Boycott, Divestment, Sanctions (BDS Malaysia) Faces Legal Action from McDonald’s MalaysiaBoycott, Divestment, Sanctions (BDS Malaysia), a grassroots movement standing in solidarity with Palestinian rights, is being sued by McDonald’s Malaysia. The fast-food chain's licensee in Malaysia, Gerbang Alaf Restaurants, issued a legal notice and statement of claim to BDS Malaysia, demanding the cessation of activities that harm McDonald’s reputation. BDS Malaysia is accused of making libellous statements on various online platforms.

Read more »

Sabah Minister questions opposition's silence on tax revenue settlementDOMESTIC Trade and Costs of Living Minister Datuk Armizan Mohd Ali questions why the opposition remained silent when they accepted interim payment for tax revenue settlement. He claims that the new GRS-led State Government saved Sabah by rejecting the agreed sum and demanding a larger amount.

Sabah Minister questions opposition's silence on tax revenue settlementDOMESTIC Trade and Costs of Living Minister Datuk Armizan Mohd Ali questions why the opposition remained silent when they accepted interim payment for tax revenue settlement. He claims that the new GRS-led State Government saved Sabah by rejecting the agreed sum and demanding a larger amount.

Read more »

Implementation of 10% Sales Tax on Low-Value Goods Sold Online to Boost Local BusinessesThe implementation of a 10% sales tax on low-value goods (LVG) costing RM500 and below sold online is expected to allow local businesses to market their products of the same quality at an even selling price, thus boosting consumer demand. The tax which is set to commence on Jan 1, 2024, aims to stabilise prices between imported and local goods, says analyst.

Implementation of 10% Sales Tax on Low-Value Goods Sold Online to Boost Local BusinessesThe implementation of a 10% sales tax on low-value goods (LVG) costing RM500 and below sold online is expected to allow local businesses to market their products of the same quality at an even selling price, thus boosting consumer demand. The tax which is set to commence on Jan 1, 2024, aims to stabilise prices between imported and local goods, says analyst.

Read more »