Bank of America, Wells Fargo, Chase among banks affected by processing issue.

Several major U.S. banks on Friday experienced outages caused by a processing issue that led to deposit delays for customers.

“All Federal Reserve Financial Services are operating normally,” the Federal Reserve said in the afternoon. The Clearing House runs EPN, the payments network that the Federal Reserve pointed to as having experienced the issue. The EPN “handles essentially half the U.S. commercial ACH volume,” according to its website.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

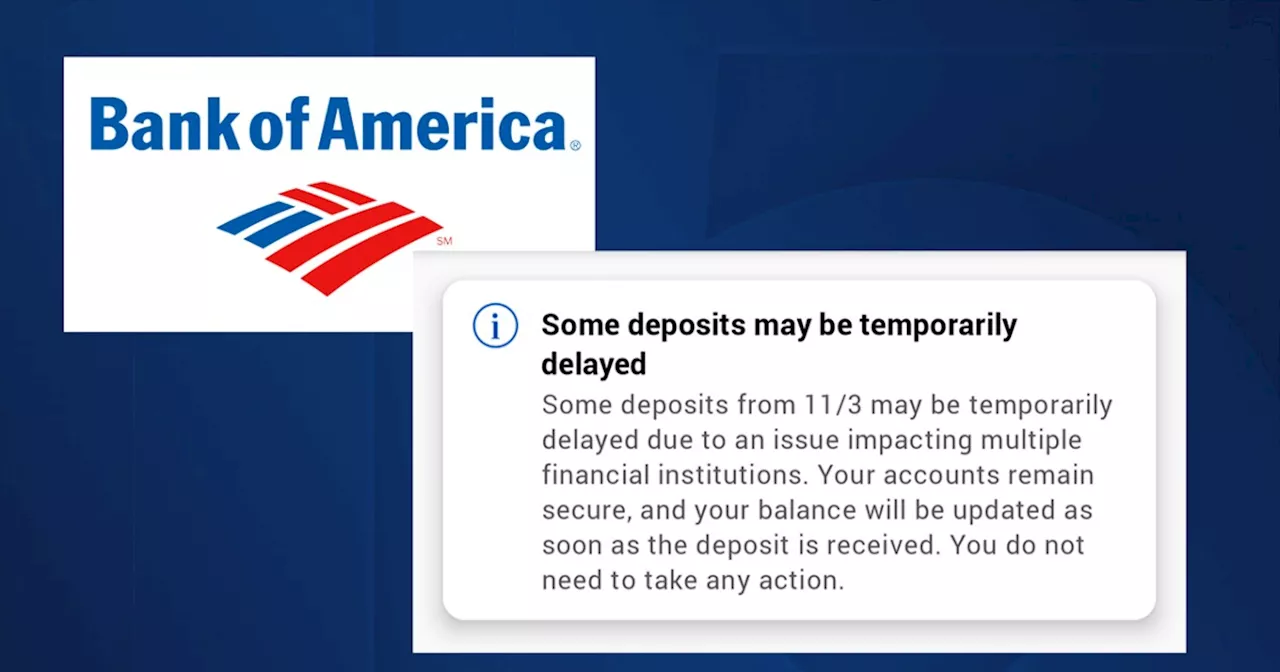

Deposits are delayed at multiple banks, Bank of America saysThe company assured customers their accounts are secure and balances will be updated as soon as deposits are received.

Deposits are delayed at multiple banks, Bank of America saysThe company assured customers their accounts are secure and balances will be updated as soon as deposits are received.

Read more »

Bank of America warns of deposit delays impacting multiple banksCustomers at Bank of America, Chase, U.S. Bank, Truist and Wells Fargo have complained of issues with their direct deposits on Friday.

Bank of America warns of deposit delays impacting multiple banksCustomers at Bank of America, Chase, U.S. Bank, Truist and Wells Fargo have complained of issues with their direct deposits on Friday.

Read more »

'Deposits may be temporarily delayed' notice goes out to Bank of America customersSome Bank of America customers reported that their expected deposits on Friday were not made or arrived late.

'Deposits may be temporarily delayed' notice goes out to Bank of America customersSome Bank of America customers reported that their expected deposits on Friday were not made or arrived late.

Read more »

Bank of America informs customers some deposits may be delayedRooted in fact-based, transparent reporting, Newsy is an award-winning opinion-free network owned by the E.W. Scripps Company that is relentlessly focused on “the why” of every story and seeks to enable a more intimate and immersive understanding of the issues that matter.

Bank of America informs customers some deposits may be delayedRooted in fact-based, transparent reporting, Newsy is an award-winning opinion-free network owned by the E.W. Scripps Company that is relentlessly focused on “the why” of every story and seeks to enable a more intimate and immersive understanding of the issues that matter.

Read more »

Bank of America warns of banking industry deposit delays FridayBank of America alerted customers on Friday that their deposits may be delayed due to a problem impacting multiple banks.

Bank of America warns of banking industry deposit delays FridayBank of America alerted customers on Friday that their deposits may be delayed due to a problem impacting multiple banks.

Read more »

Issue that caused deposit delays for some Bank of America customers, resolved, Fed saysBank of America said account information remained secure and balances would be updated as soon as the deposits were received.

Issue that caused deposit delays for some Bank of America customers, resolved, Fed saysBank of America said account information remained secure and balances would be updated as soon as the deposits were received.

Read more »