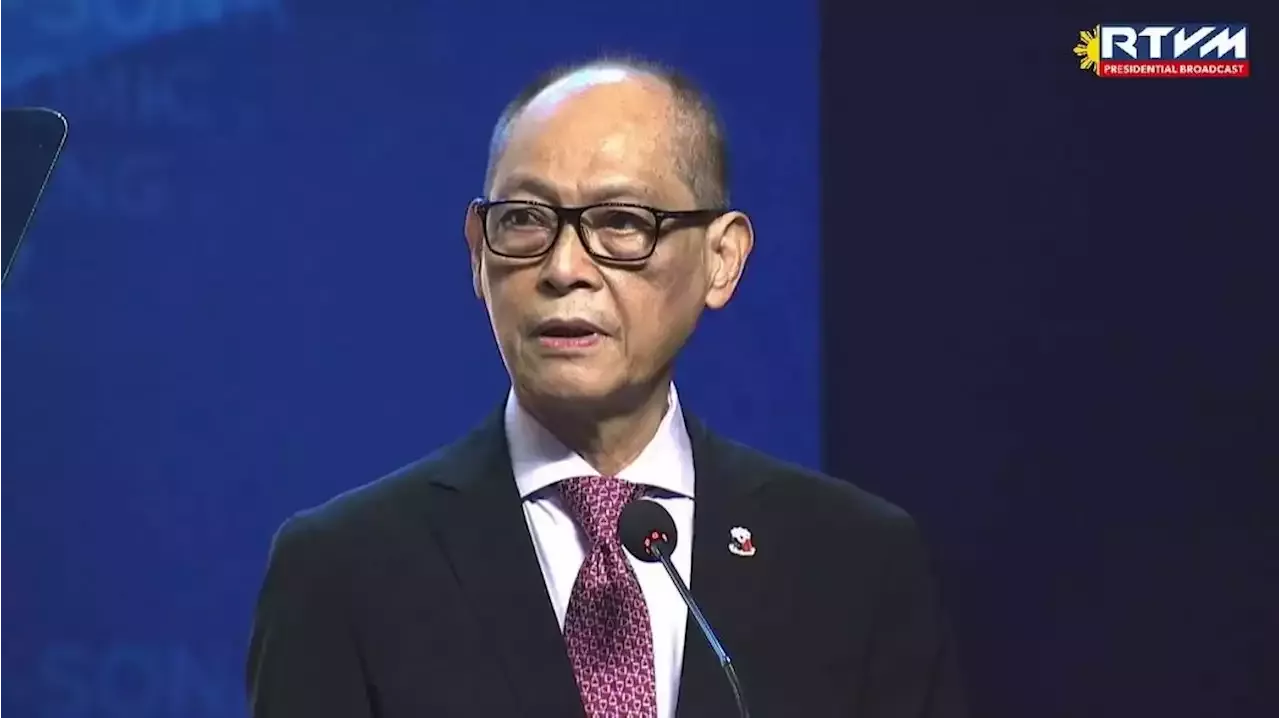

Finance Secretary Benjamin Diokno defended Friday the proposed Maharlika Wealth Fund, saying it has transparency and accountability safeguard to prevent it from suffering the same fate as Malaysia’ corruption-riddled 1Malaysia Development Berhad (1MDB).

Finance Secretary Benjamin Diokno defended Friday the proposed Maharlika Wealth Fund, saying it has transparency and accountability safeguard to prevent it from suffering the same fate as Malaysia’ corruption-riddled 1Malaysia Development Berhad .

“There are many layers of audits, we have an internal auditor, we have an international auditor, and then we have COA ,” the Finance chief said. “We want to make sure that this is on the level, transparent, there’s accountability, there’s a published report, we submit a report to the President. And this will be published so we can be sure that the people would know where that money is going," he said.

"In a situation where high rewards are likely, we also need to manage risks. Ito naman ang dahilan kaya maraming safeguards sa batas. Natuto na tayo sa Malaysia kung saan isa lang ang signatory at sisiguraduhin natin na hindi tayo matutulad sa kanila [This is why we have many safeguards. We've learned from Malaysia which only had one signatory and we will make sure we won't go the same route]," the House leader said.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

DOF's Diokno: SSS, GSIS can still contribute to Maharlika FundState-run pension funds Social Security System (SSS) and Government Service Insurance System (GSIS), which were removed as mandatory contributors to the Maharlika Wealth Fund, can still invest in the proposed sovereign wealth fund should they seek higher yields for their investible funds or assets, Finance Secretary Benjamin Diokno said Friday.

DOF's Diokno: SSS, GSIS can still contribute to Maharlika FundState-run pension funds Social Security System (SSS) and Government Service Insurance System (GSIS), which were removed as mandatory contributors to the Maharlika Wealth Fund, can still invest in the proposed sovereign wealth fund should they seek higher yields for their investible funds or assets, Finance Secretary Benjamin Diokno said Friday.

Read more »

Sovereign Wealth Fund: 'Don't involve BSP in setting up of Maharlika Fund'The proposed Maharlika Wealth Fund (MWF) continues to be saddled with governance “red flags” even after the withdrawal of the Government Service Insurance System (GSIS) and Social Security System (SSS) as chief funders.

Sovereign Wealth Fund: 'Don't involve BSP in setting up of Maharlika Fund'The proposed Maharlika Wealth Fund (MWF) continues to be saddled with governance “red flags” even after the withdrawal of the Government Service Insurance System (GSIS) and Social Security System (SSS) as chief funders.

Read more »

![[ANALYSIS] On the Maharlika Wealth Fund](https://i.headtopics.com/images/2022/12/7/rapplerdotcom/the-reality-is-the-philippines-has-presently-no-su-the-reality-is-the-philippines-has-presently-no-su-1600499140743598085.webp?w=640) [ANALYSIS] On the Maharlika Wealth Fund'The reality is, the Philippines has presently no surplus funds to establish a true sovereign wealth fund.... The MWF is just masquerading as a sovereign wealth fund, which means the Philippines is a poor country pretending to be rich.' Analysis READ:

[ANALYSIS] On the Maharlika Wealth Fund'The reality is, the Philippines has presently no surplus funds to establish a true sovereign wealth fund.... The MWF is just masquerading as a sovereign wealth fund, which means the Philippines is a poor country pretending to be rich.' Analysis READ:

Read more »

Even without SSS, GSIS funds in Maharlika Fund, public must be vigilant — CastroRep. France Castro said that while the SSS and the GSIS have been removed from the proposed Maharlika fund, people must remember that taxpayers’ money is still part of it — or the P25 billion from the national budget. | GabrielLaluINQ

Even without SSS, GSIS funds in Maharlika Fund, public must be vigilant — CastroRep. France Castro said that while the SSS and the GSIS have been removed from the proposed Maharlika fund, people must remember that taxpayers’ money is still part of it — or the P25 billion from the national budget. | GabrielLaluINQ

Read more »

GSIS, SSS dropped as mandatory sources of capital for Maharlika FundAuthors of the proposed Maharlika Wealth Fund (MWF) have dropped state pension fund repositories Government Service Insurance System (GSIS) and Social Security System (SSS) as mandatory contributors to the proposed sovereign wealth fund, House appropriations panel senior vice chairperson Stella Quimbo of Marikina City said Wednesday.

GSIS, SSS dropped as mandatory sources of capital for Maharlika FundAuthors of the proposed Maharlika Wealth Fund (MWF) have dropped state pension fund repositories Government Service Insurance System (GSIS) and Social Security System (SSS) as mandatory contributors to the proposed sovereign wealth fund, House appropriations panel senior vice chairperson Stella Quimbo of Marikina City said Wednesday.

Read more »