Klaviyo Inc. is reportedly raising the target of its upcoming initial public offering to more than $550 million.

Bloomberg News reported late Sunday that Klaviyo has decided to raise the target range for its shares to $27 to $29, up from its previously stated range of $25 to $27 a share. At the top of that new range, the IPO would raise $557 million, with the company valued at about $8.7 billion, according to Bloomberg.The Boston-based digital marketing software-as-a-service platform is scheduled to go public Tuesday on the New York Stock Exchange under the ticker symbol “KVYO.

The move comes after Instacart, which is also primed to go public this week, raised its price range Friday to $28 to $30 a share, from $26 to $28 previously, following the success of Arm Holdings’ ARM, -4.47% successful IPO last week. Also see: Instacart IPO: 5 things to know about the app that’s looking to ride a ‘massive digital transformation’ in grocery shopping

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Instacart IPO Is an Expensive Lesson for Venture FirmsThe grocery-delivery company is set to deliver significant paper losses to many of the private investors who piled on late.

Instacart IPO Is an Expensive Lesson for Venture FirmsThe grocery-delivery company is set to deliver significant paper losses to many of the private investors who piled on late.

Read more »

SoftBank seeks OpenAI tie-up as Son plans deal spree after Arm IPO -FT By ReutersSoftBank seeks OpenAI tie-up as Son plans deal spree after Arm IPO -FT

SoftBank seeks OpenAI tie-up as Son plans deal spree after Arm IPO -FT By ReutersSoftBank seeks OpenAI tie-up as Son plans deal spree after Arm IPO -FT

Read more »

SoftBank's Son plans AI deal spree after Arm IPOSoftBank's Son plans AI deal spree after Arm IPO - FT

SoftBank's Son plans AI deal spree after Arm IPOSoftBank's Son plans AI deal spree after Arm IPO - FT

Read more »

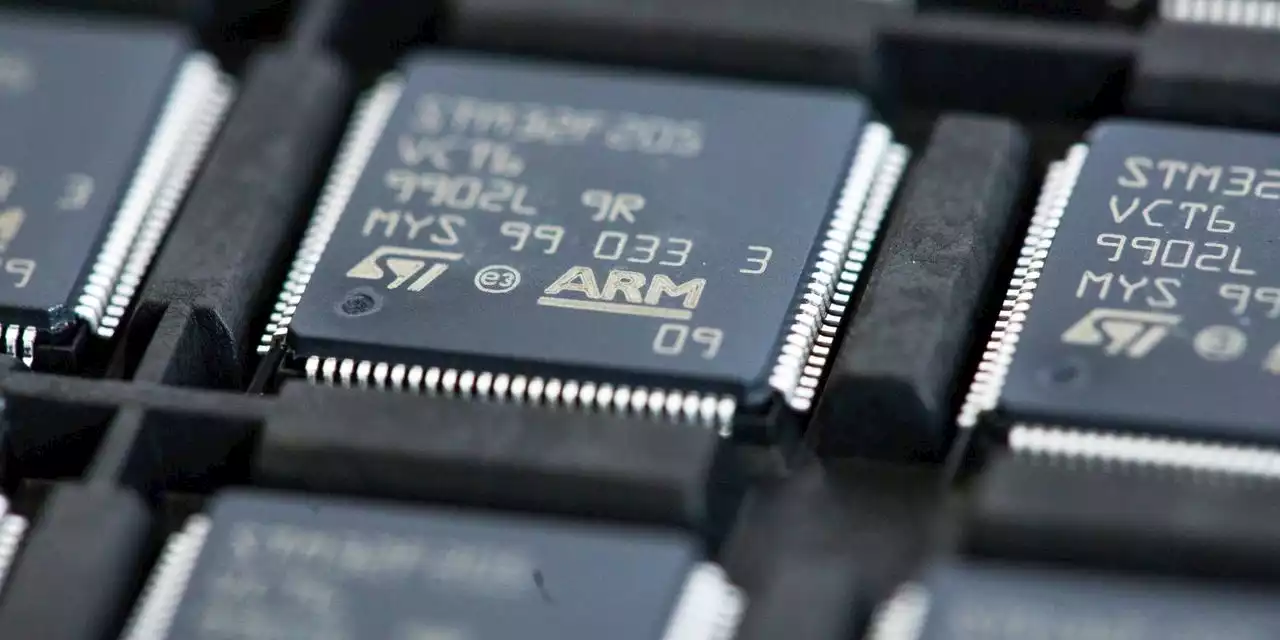

Arm IPO Excites Wall Street, but Challenges LoomBritish supplier of designs for chips, long seen as the industry’s Switzerland, is challenged with growing beyond its dominance in mobile phones without upsetting existing customers.

Arm IPO Excites Wall Street, but Challenges LoomBritish supplier of designs for chips, long seen as the industry’s Switzerland, is challenged with growing beyond its dominance in mobile phones without upsetting existing customers.

Read more »

Fed decision, Instacart IPO and UAW strike top week aheadInvestors will be closely watching the Federal Reserve's decision on interest rates, as well as the ongoing UAW strike against Ford, GM and Stellantis in the coming week.

Fed decision, Instacart IPO and UAW strike top week aheadInvestors will be closely watching the Federal Reserve's decision on interest rates, as well as the ongoing UAW strike against Ford, GM and Stellantis in the coming week.

Read more »

Fed Meeting, Instacart IPO, and More to Watch This WeekThe FOMC is expected to hold interest rates steady on Wednesday. Plus Instacart will IPO on Tuesday and earnings from FedEx, Darden, and more.

Fed Meeting, Instacart IPO, and More to Watch This WeekThe FOMC is expected to hold interest rates steady on Wednesday. Plus Instacart will IPO on Tuesday and earnings from FedEx, Darden, and more.

Read more »