JPMorgan CEO Jamie Dimon suggests that President Trump's proposed tariffs on trading partners could be beneficial for national security, even if they lead to some inflation. Dimon believes that tariffs can be a useful economic tool if implemented strategically.

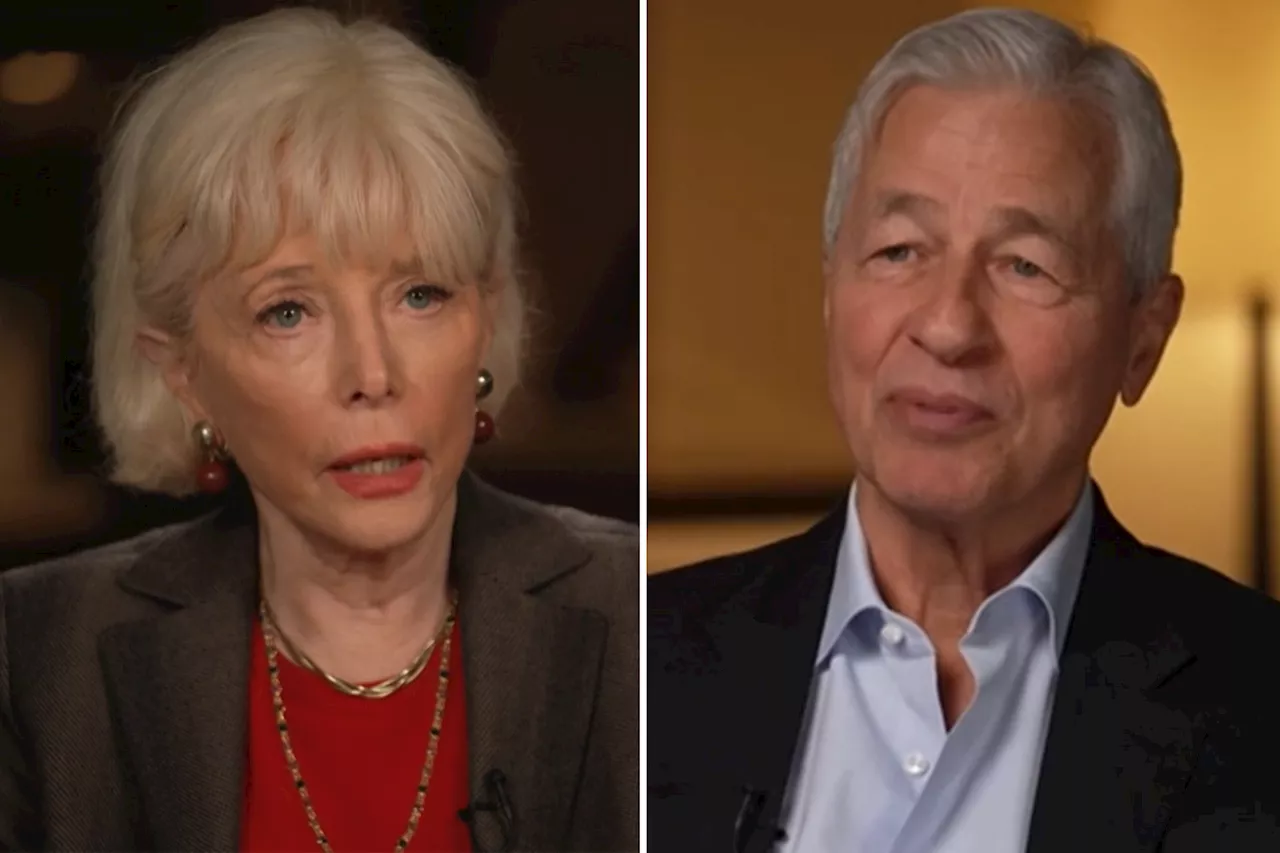

JPMorgan CEO Jamie Dimon expressed a surprisingly positive outlook on the potential tariffs President Donald Trump is expected to impose on U.S. trading partners. During an interview at the World Economic Forum in Davos , Switzerland, Dimon stated that if tariffs lead to a slight increase in inflation but safeguard national security, the consequences are acceptable. He emphasized that national security should take precedence over minor inflation concerns.

'If it's a little inflationary, but it's good for national security, so be it. I mean, get over it,' Dimon told CNBC. 'National security trumps a little bit more inflation.'President Trump has indicated that the European Union treats the U.S. unfairly due to its substantial trade surplus. Among the proposed measures are a 10% tariff on goods from China and 25% tariffs on products from Canada and Mexico. These tariffs are part of a review of the tri-party agreement, the U.S.-Mexico-Canada Agreement (USMCA), which is scheduled for assessment in July 2026. Although Dimon refrained from delving into the specifics of Trump's plans, he stressed that the impact of tariffs hinges on their implementation. Trump has suggested that these tariffs could be implemented as early as February 1st.Dimon characterized tariffs as an economic tool that can be wielded effectively depending on the intended purpose and execution. He acknowledged that tariffs can be inflationary but also asserted that they don't necessarily have to be. During Trump's first term, when he implemented broad-based tariffs, inflation remained below 2.5% annually. Despite the looming threat of tariffs, the U.S. dollar has weakened slightly this week. Other prominent business leaders, such as Goldman Sachs CEO David Solomon, also speaking from Davos, have indicated that companies are preparing for policy shifts, including trade-related changes. Solomon believes that a rebalancing of trade agreements can be beneficial for U.S. growth if handled thoughtfully and strategically. 'This is going to unfold over the course of the year, and we have to watch it closely,' he added

JPMORGAN DIMON TRUMP TARIFFS TRADE WAR INFLATION NATIONAL SECURITY Davos

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

JPMorgan Chase CEO Jamie Dimon Explains Trump's Victory: 'People Were Angry'JPMorgan Chase CEO Jamie Dimon outlines the factors he believes contributed to Donald Trump's electoral victory, attributing it to voter frustration with government policies and the perceived lack of economic opportunity for many Americans. Dimon also addresses concerns about income inequality and advocates for policies that promote economic growth and benefit all citizens.

JPMorgan Chase CEO Jamie Dimon Explains Trump's Victory: 'People Were Angry'JPMorgan Chase CEO Jamie Dimon outlines the factors he believes contributed to Donald Trump's electoral victory, attributing it to voter frustration with government policies and the perceived lack of economic opportunity for many Americans. Dimon also addresses concerns about income inequality and advocates for policies that promote economic growth and benefit all citizens.

Read more »

JPMorgan CEO Jamie Dimon Explains Trump's Victory and Economic ConcernsJPMorgan Chase CEO Jamie Dimon attributes President-elect Donald Trump's victory to voter frustration with government policies and a desire for pro-growth, pro-business approaches. Dimon also highlights concerns about inflation, government bureaucracy, and a disconnect between policy priorities and outcomes in rural communities.

JPMorgan CEO Jamie Dimon Explains Trump's Victory and Economic ConcernsJPMorgan Chase CEO Jamie Dimon attributes President-elect Donald Trump's victory to voter frustration with government policies and a desire for pro-growth, pro-business approaches. Dimon also highlights concerns about inflation, government bureaucracy, and a disconnect between policy priorities and outcomes in rural communities.

Read more »

JPMorgan Chase CEO Jamie Dimon Supports Trump's Tariffs for National SecurityJPMorgan Chase CEO Jamie Dimon has stated that a slight increase in inflation caused by the Trump administration's tariff plans would be acceptable to enhance national security.

JPMorgan Chase CEO Jamie Dimon Supports Trump's Tariffs for National SecurityJPMorgan Chase CEO Jamie Dimon has stated that a slight increase in inflation caused by the Trump administration's tariff plans would be acceptable to enhance national security.

Read more »

JPMorgan's Dimon 'likely' to become chairman once he quits as CEOJamie Dimon, the long-time CEO of JPMorgan Chase, hinted in a recent interview that he is 'likely' to become chairman of the bank after stepping down as CEO. Dimon, 68, has led the financial giant since 2006 and has been a key figure in the US financial industry.

JPMorgan's Dimon 'likely' to become chairman once he quits as CEOJamie Dimon, the long-time CEO of JPMorgan Chase, hinted in a recent interview that he is 'likely' to become chairman of the bank after stepping down as CEO. Dimon, 68, has led the financial giant since 2006 and has been a key figure in the US financial industry.

Read more »

JPMorgan Chase CEO Jamie Dimon Warns of Inflated U.S. Stock MarketJPMorgan Chase CEO Jamie Dimon expressed concerns about the inflated U.S. stock market and a more cautious outlook compared to other business leaders. He cited risks from deficit spending, inflation, and geopolitical instability as reasons for his apprehension. Dimon noted that asset prices, including the stock and bond markets, are at historically high levels, requiring favorable outcomes to justify their valuations. He emphasized the need for pro-growth strategies to support market stability but warned about potential negative surprises.

JPMorgan Chase CEO Jamie Dimon Warns of Inflated U.S. Stock MarketJPMorgan Chase CEO Jamie Dimon expressed concerns about the inflated U.S. stock market and a more cautious outlook compared to other business leaders. He cited risks from deficit spending, inflation, and geopolitical instability as reasons for his apprehension. Dimon noted that asset prices, including the stock and bond markets, are at historically high levels, requiring favorable outcomes to justify their valuations. He emphasized the need for pro-growth strategies to support market stability but warned about potential negative surprises.

Read more »

JPMorgan CEO Jamie Dimon Says Tariffs Could Be 'Good for National Security'Despite fears of a global trade war and domestic inflation, JPMorgan CEO Jamie Dimon told CNBC that tariffs imposed by President Trump could be viewed positively if used strategically to protect American interests and secure better trade deals.

JPMorgan CEO Jamie Dimon Says Tariffs Could Be 'Good for National Security'Despite fears of a global trade war and domestic inflation, JPMorgan CEO Jamie Dimon told CNBC that tariffs imposed by President Trump could be viewed positively if used strategically to protect American interests and secure better trade deals.

Read more »