Johnson & Johnson (J&J) and Procter & Gamble (P&G) recently reported their quarterly earnings, showcasing resilience in a challenging market. While both exceeded expectations, investor sentiment differed significantly. J&J faced skepticism due to weaker revenue forecasts and legal challenges, while P&G's stability and optimistic projections fueled optimism.

Johnson & Johnson and Procter & Gamble recently reported their quarterly earnings, showcasing their resilience in a challenging economic landscape. Both companies exceeded analyst expectations, delivering stronger-than-anticipated revenue and earnings per share. However, the market reacted differently to each company's performance, highlighting key differences in investor sentiment. While Procter & Gamble (P&G) saw signs of optimism, Johnson & Johnson (J&J) faced renewed skepticism.

\J&J's weaker 2025 revenue forecasts and ongoing legal challenges, such as the patent expiration for its blockbuster drug Stelara and a forthcoming court battle in the talc litigation, cast a shadow over its outlook. In contrast, P&G maintained steady guidance for 2024, projecting 2-4% sales growth and earnings per share between $6.91 and $7.05. This stability fueled investor confidence in P&G, while J&J's less favorable projections triggered a sell-off at the market open. \Despite the divergence, both companies remain attractive for long-term, defensive portfolios, boasting solid dividend payouts. For J&J, the negative reaction to its earnings was anticipated. Its updated 2025 revenue forecast of $89.2-$90 billion fell short of the $91.1 billion consensus, raising concerns about future growth. Furthermore, the impending loss of exclusivity for Stelara opens the door to intensified competition, while the ongoing talc litigation continues to weigh on sentiment. Technically, J&J's shares face a crucial test. Reclaiming the supply gap at $147.75 is the first hurdle for buyers to regain control. However, significant resistance at $151 could cap any short-term recovery, and if bearish momentum persists, a drop towards $141 remains a distinct possibility.Meanwhile, P&G's results ignited optimism among bulls. Despite grappling with elevated supply chain costs, the company's robust growth projections for both sales and earnings have kept sentiment positive. Technically, the $158 support level has proven resilient, acting as a strong buffer against downside risks. For P&G bulls aiming for a return to November highs, breaking through resistance at $170 per share is the next key challenge. However, a failure to hold $158 could signal a more bearish shift in momentum.The contrasting fortunes of these two dividend stalwarts highlight the importance of a balanced investment approach. While J&J faces headwinds that cloud its long-term outlook, P&G's steady performance and optimistic forecasts provide a strong foundation. Investors should consider both near-term results and the broader narratives shaping each company's trajectory. As P&G's ex-dividend date approaches, opportunities may emerge for investors seeking defensive plays. For J&J, however, the path to recovery may depend on clearing legal hurdles and restoring confidence in its growth potential

INVESTING JOHNSON & JOHNSON PROCTER & GAMBLE EARNINGS DIVIDENDS MARKET REACTION LEGAL CHALLENGES STEALARA TALC LITIGATION TECHNICAL ANALYSIS STOCK PERFORMANCE

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Investor Concerns Grow as UK Faces Stagflation RisksThis report highlights investor concerns about the UK potentially facing stagflation, a situation where inflation remains high or increases while economic growth slows. The report also discusses Anthropic's funding round and the impact of the recent ISM report on market expectations.

Investor Concerns Grow as UK Faces Stagflation RisksThis report highlights investor concerns about the UK potentially facing stagflation, a situation where inflation remains high or increases while economic growth slows. The report also discusses Anthropic's funding round and the impact of the recent ISM report on market expectations.

Read more »

USMNT Faces Venezuela in January Friendly: A Chance for New Faces to ShineThe US Men's National Team will play Venezuela in a January friendly, giving players a chance to impress new coach Mauricio Pochettino.

USMNT Faces Venezuela in January Friendly: A Chance for New Faces to ShineThe US Men's National Team will play Venezuela in a January friendly, giving players a chance to impress new coach Mauricio Pochettino.

Read more »

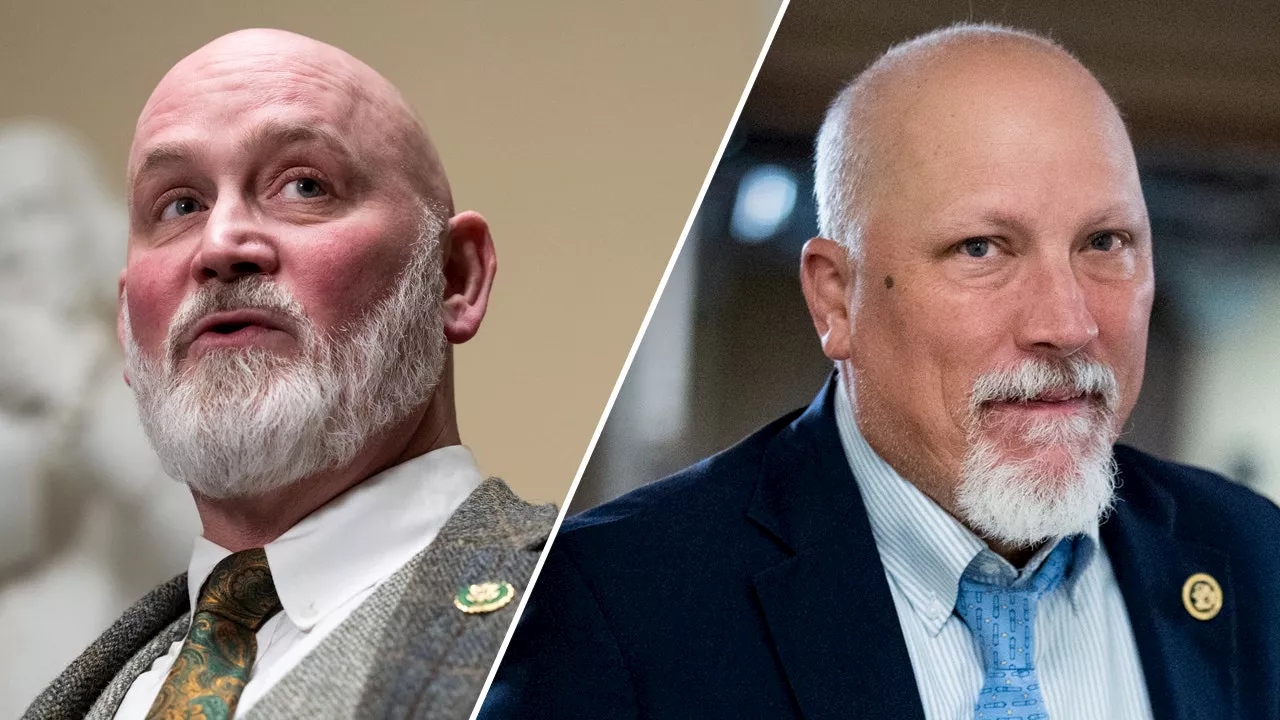

Van Orden Attacks Roy in Speaker Race as Trump Backed Johnson Faces UncertaintyRep. Derrick Van Orden criticizes Rep. Chip Roy for his undecided stance on supporting Rep. Mike Johnson in the House Speaker race. Van Orden emphasizes Trump's endorsement of Johnson and calls for unity behind the 'America First Agenda'. Roy, however, demands change and highlights his opposition to spending bills.

Van Orden Attacks Roy in Speaker Race as Trump Backed Johnson Faces UncertaintyRep. Derrick Van Orden criticizes Rep. Chip Roy for his undecided stance on supporting Rep. Mike Johnson in the House Speaker race. Van Orden emphasizes Trump's endorsement of Johnson and calls for unity behind the 'America First Agenda'. Roy, however, demands change and highlights his opposition to spending bills.

Read more »

House Speaker Mike Johnson Faces Challenges in Securing SupportHouse Speaker Mike Johnson, a Republican from Louisiana, is navigating the complexities of leading a divided House. He requires near-unanimous support from his party to maintain his position, highlighting the ongoing political tensions within the Republican ranks.

House Speaker Mike Johnson Faces Challenges in Securing SupportHouse Speaker Mike Johnson, a Republican from Louisiana, is navigating the complexities of leading a divided House. He requires near-unanimous support from his party to maintain his position, highlighting the ongoing political tensions within the Republican ranks.

Read more »

House Speaker Mike Johnson Faces Challenges in Securing Votes for SpeakershipHouse Speaker Mike Johnson, R-La., faces a challenge in securing enough votes for his continued speakership. While former President Donald Trump's endorsement could sway some, far-right Republicans who have been critical of Johnson's leadership may demand concessions.

House Speaker Mike Johnson Faces Challenges in Securing Votes for SpeakershipHouse Speaker Mike Johnson, R-La., faces a challenge in securing enough votes for his continued speakership. While former President Donald Trump's endorsement could sway some, far-right Republicans who have been critical of Johnson's leadership may demand concessions.

Read more »

Trump's Endorsement for House Speaker Johnson Faces UncertaintyDespite receiving Donald Trump's endorsement, House Speaker Mike Johnson's path to securing the speakership remains uncertain. One GOP member, Rep. Thomas Massie, has publicly declared his opposition, and several others remain undecided. Johnson needs 218 votes to win on the first ballot, raising questions about whether he can garner enough support from his own party.

Trump's Endorsement for House Speaker Johnson Faces UncertaintyDespite receiving Donald Trump's endorsement, House Speaker Mike Johnson's path to securing the speakership remains uncertain. One GOP member, Rep. Thomas Massie, has publicly declared his opposition, and several others remain undecided. Johnson needs 218 votes to win on the first ballot, raising questions about whether he can garner enough support from his own party.

Read more »