Non-banks’ use of banking lingo, FDIC logo draw scrutiny. Amid bank failures, FDIC sees an increase in false promises of deposit insurance

Mercury, a financial technology company and major beneficiary of recent turmoil in the banking industry, is not a bank–but that key point hasn’t always been clear to consumers, according to California’s financial-services regulator.

“We believe in transparency and seek to be clear in our communications that banking services are provided by our regulated partner banks,” the Mercury spokesperson told MarketWatch. When the California regulator raised its concerns, the spokesperson said, “we acted quickly to settle the matter and update any marketing materials that were ambiguous or needed clarification.”

Amid the scrutiny, the FDIC is seeing an increase in misrepresentations about deposit insurance, the agency said in a February statement announcing that it had sent cease and desist letters to several companies making false and misleading statements about the insurance coverage. “These practices not only harm those who are targeted with the false promise of deposit insurance, but, if left unchecked, could also undermine confidence in the FDIC, FDIC-insured banks, and the U.S.

Many non-bank fintech companies clearly state that they’re not banks and not FDIC insured–but in some cases, there’s still room for confusion, consumer advocates say. The website of fintech company Tellus states in several places that it is not a bank and not FDIC-insured, but it compares the interest earned on a Tellus account with major banks such as Bank of America BAC and Wells Fargo WFC .

If the requirements are not met, only the account itself–and not each consumer–would be insured up to $250,000, the GAO report said. “If this is the case, consumers may not be aware that their deposits are not fully FDIC-insured,” the GAO said.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Treasury Explores Emergency Powers To Expand FDIC Coverage Amid Contagion Concerns, Report SaysThe move to expand FDIC protections to cover all deposits in U.S. banks is likely to face pushback from House Republicans.

Treasury Explores Emergency Powers To Expand FDIC Coverage Amid Contagion Concerns, Report SaysThe move to expand FDIC protections to cover all deposits in U.S. banks is likely to face pushback from House Republicans.

Read more »

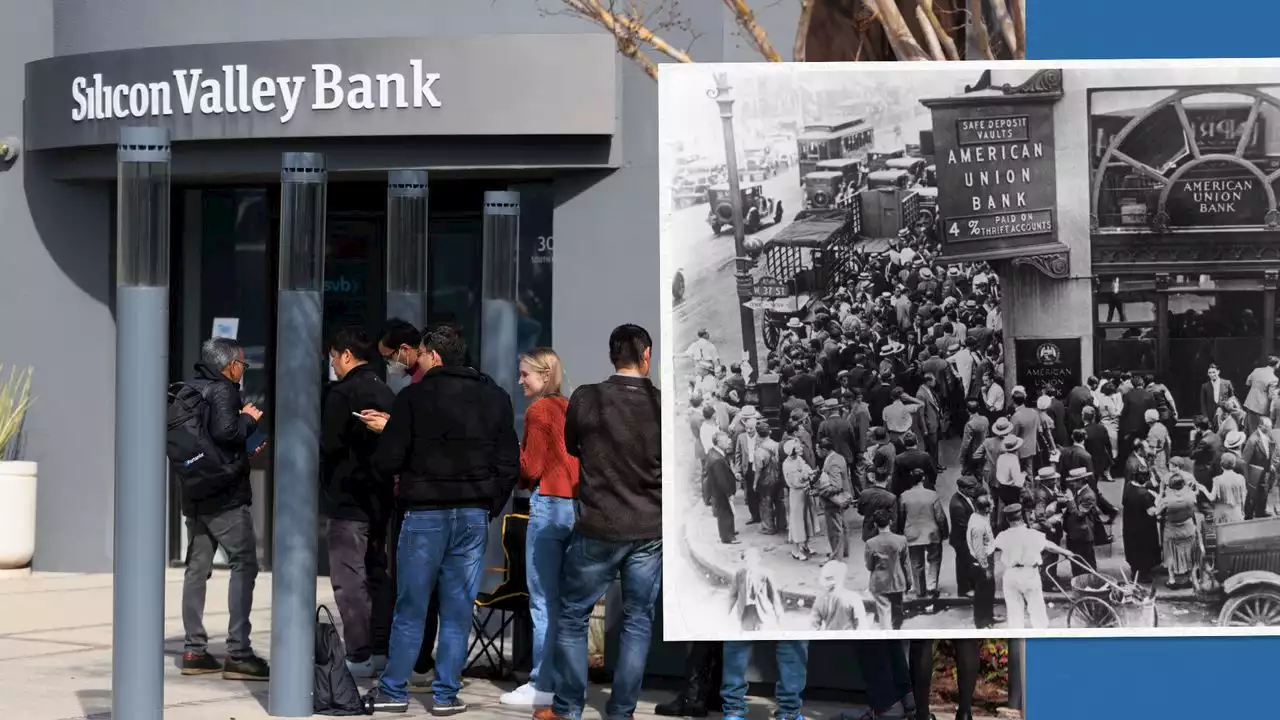

How the FDIC Acts When Banks FailWatch: The Federal Deposit Insurance Corporation was created from the Banking Act of 1933 to prevent the bank runs seen during the Great Depression. Here’s how it’s helping depositors at Silicon Valley Bank and Signature Bank now.

How the FDIC Acts When Banks FailWatch: The Federal Deposit Insurance Corporation was created from the Banking Act of 1933 to prevent the bank runs seen during the Great Depression. Here’s how it’s helping depositors at Silicon Valley Bank and Signature Bank now.

Read more »

Regional and community banks rally to call for FDIC backupMid-sized regional banks and community banks around the country are urging regulators to consider lifting the FDIC's threshold for uninsured deposits after they granted exceptions.

Regional and community banks rally to call for FDIC backupMid-sized regional banks and community banks around the country are urging regulators to consider lifting the FDIC's threshold for uninsured deposits after they granted exceptions.

Read more »

Flagstar Bank to take over most of Signature Bank's deposits, FDIC saysFlagstar Bank, a subsidiary of New York Community Bankcorp Inc., on Sunday agreed to assume most of Signature Bank's deposits and some of its loans.

Flagstar Bank to take over most of Signature Bank's deposits, FDIC saysFlagstar Bank, a subsidiary of New York Community Bankcorp Inc., on Sunday agreed to assume most of Signature Bank's deposits and some of its loans.

Read more »

Signature Bank Deposits to Be Assumed by New York Community Bank Unit: FDICFormer Signature Bank deposits other than those related to the digital banking business will be assumed by a unit of New York Community Bancorp as of Monday, the FDIC said. GregAhl reports

Signature Bank Deposits to Be Assumed by New York Community Bank Unit: FDICFormer Signature Bank deposits other than those related to the digital banking business will be assumed by a unit of New York Community Bancorp as of Monday, the FDIC said. GregAhl reports

Read more »

FDIC announces agreement to sell Signature Bank assets to New York Community BancorpA subsidiary of New York Community Bancorp has entered into an agreement with U.S. regulators to purchase deposits and loans from New York-based Signature Bank , which was closed earlier this month.

FDIC announces agreement to sell Signature Bank assets to New York Community BancorpA subsidiary of New York Community Bancorp has entered into an agreement with U.S. regulators to purchase deposits and loans from New York-based Signature Bank , which was closed earlier this month.

Read more »