The Internal Revenue Service (IRS) will automatically issue stimulus payments of up to $1,400 to approximately 1 million taxpayers who missed claiming the Recovery Rebate Credit on their 2021 tax returns.

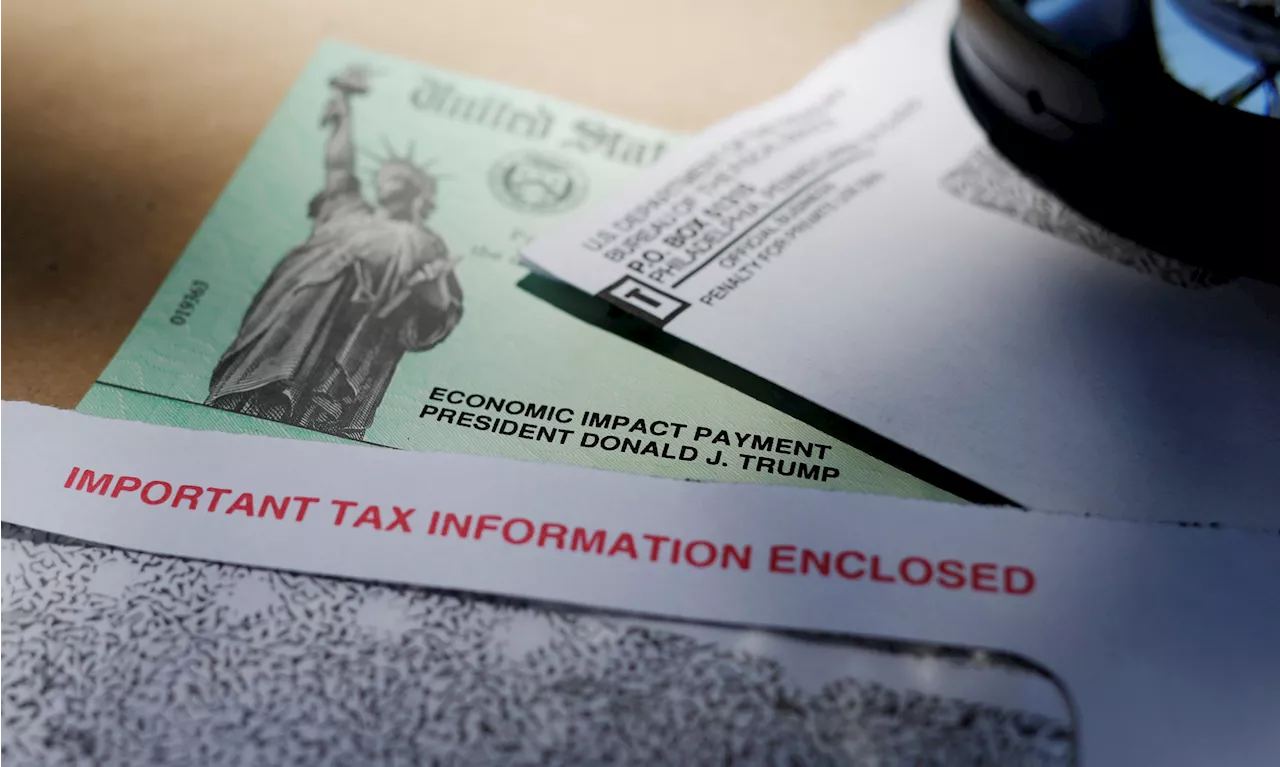

Published: Dec. 23, 2024, 6:31 a.m. FILE - This file photo shows blank checks on an idle press at the Philadelphia Regional Financial Center, which disburses payments on behalf of federal agencies in Philadelphia.Some 1 million people are eligible for refunds of up to $1,400 and, according to the IRS , the money will appear in their accounts without an actions on their part. The money goes to people who did not claim the Recovery Rebate Credit on their 2021 tax returns.

The RRC is a refundable credit for individuals who did not receive one or more Economic Impact Payments – commonly known as stimulus payments – issued amid the COVID-19 pandemic. “Looking at our internal data, we realized that one million taxpayers overlooked claiming this complex credit when they were actually eligible. To minimize headaches and get this money to eligible taxpayers, we’re making these payments automatic, meaning these people will not be required to go through the extensive process of filing an amended return to receive it,”Exact amounts will depend on several factors but maximum amount is $1,400 per individual. In all, the IRS is sending out about $2.4 billion.The payments are only going to taxpayers who were eligible for the credits in 2021 but either left the information blank or filled it out as $0 when they were in fact eligible. Eligible taxpayers don’t have to do anything to receive the payments. They will go out automatically in December and should arrive by late January 2025. They will be automatically deposited if you filed your return electronically and provided banking information. If you didn’t provide direct deposit information, you will receive a paper check.If the bank account tied to the return is closed, the IRS said the direct deposit will be returned by the financial institution and reissued as a paper check to the address on record.People who haven’t filed their 2021 tax returns could be eligible as well, the IRS sai

STIMULUS PAYMENTS IRS TAX REFUNDS ECONOMIC IMPACT PAYMENTS COVID-19

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

IRS to Send $2.4 Billion to Eligible Taxpayers Who Missed Stimulus PaymentsThe IRS is distributing $2.4 billion to eligible taxpayers who missed out on COVID-19 stimulus payments or received less than the full amount. Eligible individuals will receive the payments automatically through direct deposit or check by late January 2025.

IRS to Send $2.4 Billion to Eligible Taxpayers Who Missed Stimulus PaymentsThe IRS is distributing $2.4 billion to eligible taxpayers who missed out on COVID-19 stimulus payments or received less than the full amount. Eligible individuals will receive the payments automatically through direct deposit or check by late January 2025.

Read more »

IRS to Send $1,400 Payments to 1 Million Taxpayers Who Missed Stimulus CreditsApproximately 1 million taxpayers will automatically receive special payments of up to $1,400 from the IRS in the coming weeks. The payments are being sent to people who failed to claim a Recovery Rebate Credit on their 2021 tax returns. Eligible taxpayers don't have to take any action. The payments will be sent by direct deposit or check by late January 2025.

IRS to Send $1,400 Payments to 1 Million Taxpayers Who Missed Stimulus CreditsApproximately 1 million taxpayers will automatically receive special payments of up to $1,400 from the IRS in the coming weeks. The payments are being sent to people who failed to claim a Recovery Rebate Credit on their 2021 tax returns. Eligible taxpayers don't have to take any action. The payments will be sent by direct deposit or check by late January 2025.

Read more »

IRS to Send $2.4 Billion to Taxpayers Who Missed COVID Stimulus PaymentsThe IRS is distributing approximately $2.4 billion to taxpayers who were eligible for but failed to claim the Recovery Rebate Credit on their 2021 tax returns. The payments will be sent automatically to eligible individuals via direct deposit or paper check by late January 2025.

IRS to Send $2.4 Billion to Taxpayers Who Missed COVID Stimulus PaymentsThe IRS is distributing approximately $2.4 billion to taxpayers who were eligible for but failed to claim the Recovery Rebate Credit on their 2021 tax returns. The payments will be sent automatically to eligible individuals via direct deposit or paper check by late January 2025.

Read more »

IRS to Send $2.4 Billion in Stimulus Payments to Eligible TaxpayersThe Internal Revenue Service (IRS) is distributing $2.4 billion in stimulus payments to eligible taxpayers who missed claiming the Recovery Rebate Credit on their 2021 tax returns. These payments will go out automatically this month and should arrive by late January 2025.

IRS to Send $2.4 Billion in Stimulus Payments to Eligible TaxpayersThe Internal Revenue Service (IRS) is distributing $2.4 billion in stimulus payments to eligible taxpayers who missed claiming the Recovery Rebate Credit on their 2021 tax returns. These payments will go out automatically this month and should arrive by late January 2025.

Read more »

IRS to Send Out Missing Stimulus Payments to 1 Million TaxpayersA small number of taxpayers who never claimed or received the full amount of the 2021 Recovery Rebate Credit will be receiving a special payment from the IRS in the coming weeks. The payments, which will vary but with a maximum of $1,400 per individual, will be sent automatically by direct deposit or check by late January 2025.

IRS to Send Out Missing Stimulus Payments to 1 Million TaxpayersA small number of taxpayers who never claimed or received the full amount of the 2021 Recovery Rebate Credit will be receiving a special payment from the IRS in the coming weeks. The payments, which will vary but with a maximum of $1,400 per individual, will be sent automatically by direct deposit or check by late January 2025.

Read more »

IRS to Send $2.4 Billion in Stimulus Checks to Overlooked TaxpayersThe IRS will distribute $2.4 billion in stimulus payments to eligible taxpayers who missed claiming the Recovery Rebate Credit on their 2021 tax returns.

IRS to Send $2.4 Billion in Stimulus Checks to Overlooked TaxpayersThe IRS will distribute $2.4 billion in stimulus payments to eligible taxpayers who missed claiming the Recovery Rebate Credit on their 2021 tax returns.

Read more »