Exchange traded funds and stocks tied to China took a big hit in Tuesday's session.

The China trade started showing signs of fading on Tuesday after the country's economic planning body stopped short of announcing any new major stimulus plans. Zheng Shanjie, chairman of China 's National Development and Reform Commission, shared several actions on Tuesday aimed at bolstering the world's second-largest economy. But he did not announce any major new plans for ensuring economic health, leaving investors feeling underwhelmed.

Appaloosa Management founder David Tepper, meanwhile, said his investment plan after the U.S. Federal Reserve began cutting rates last months was to buy "everything" connected to China. Beyond funds, he cited casino stocks Wynn Resorts and Las Vegas Sands — with large operations in Macau — as individual stocks that are leveraged to China. Both retreated in Tuesday's session. Now, market participants are wondering what's next for China's markets and the U.S.

Stock Markets China Ishares China Large-Cap ETF Kraneshares CSI China Internet ETF Exchange-Traded Funds Ishares MSCI China ETF Wynn Resorts Ltd Las Vegas Sands Corp Ray Dalio Business News

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Ethereum ETF and exchange investors step up buying pressure following spike in key metricsEthereum (ETH) was down 1% on Wednesday as investors stepped up their buying pressure via exchange-traded funds (ETF) and exchanges.

Ethereum ETF and exchange investors step up buying pressure following spike in key metricsEthereum (ETH) was down 1% on Wednesday as investors stepped up their buying pressure via exchange-traded funds (ETF) and exchanges.

Read more »

Binance CEO says crypto exchange saw 40% growth this year in institutional, corporate investorsCryptocurrency exchange Binance has seen a 40% increase this year in institutional and corporate investors, CEO Richard Teng told CNBC’s Lin Lin.

Binance CEO says crypto exchange saw 40% growth this year in institutional, corporate investorsCryptocurrency exchange Binance has seen a 40% increase this year in institutional and corporate investors, CEO Richard Teng told CNBC’s Lin Lin.

Read more »

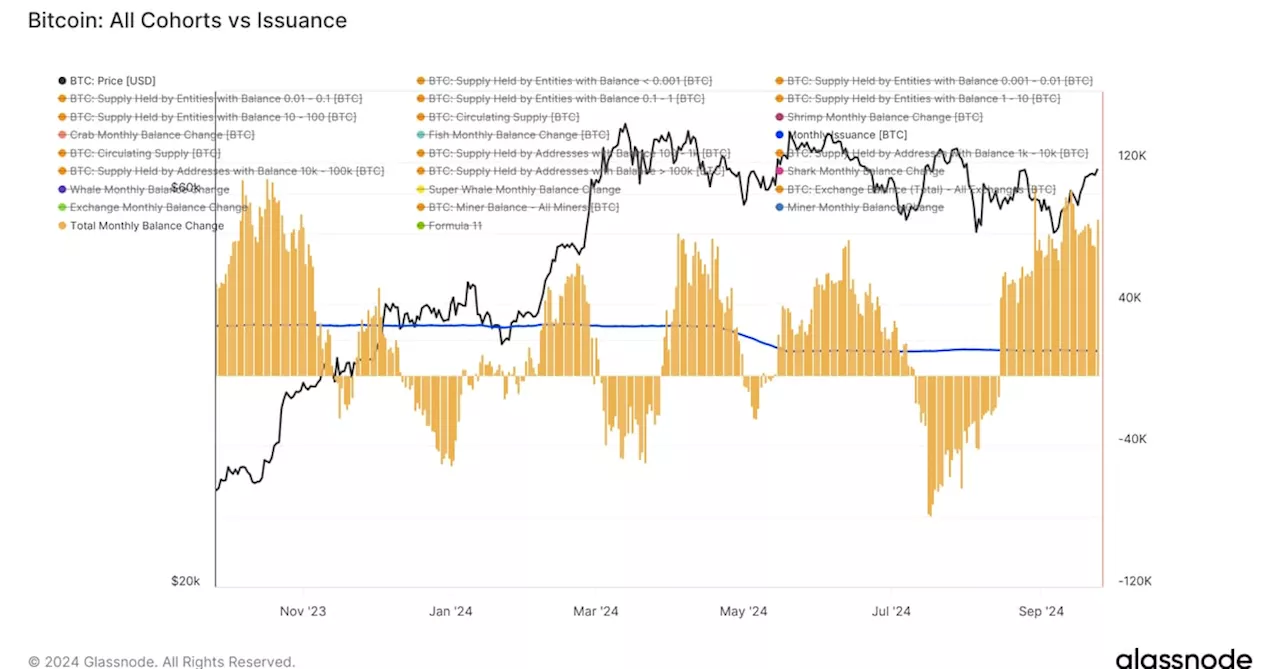

Retail Investors Fuel Bitcoin Accumulation Amidst Exchange OutflowsRecent data reveals a surge in Bitcoin accumulation driven by retail investors, particularly smaller holders. A combined 88,000 BTC has been amassed over the past month, exceeding monthly issuance sevenfold. This trend coincides with significant withdrawals from exchanges, suggesting reduced liquidity and potential for price increases.

Retail Investors Fuel Bitcoin Accumulation Amidst Exchange OutflowsRecent data reveals a surge in Bitcoin accumulation driven by retail investors, particularly smaller holders. A combined 88,000 BTC has been amassed over the past month, exceeding monthly issuance sevenfold. This trend coincides with significant withdrawals from exchanges, suggesting reduced liquidity and potential for price increases.

Read more »

Ethereum investors show bullish bias amid ETF inflows and positive funding rates, exchange reserves pose riskEthereum (ETH) traded around $2,640 on Thursday, up more than 2% following increased bullish bias among investors, as evidenced by ETH ETF net inflows and an uptrend in funding rates.

Ethereum investors show bullish bias amid ETF inflows and positive funding rates, exchange reserves pose riskEthereum (ETH) traded around $2,640 on Thursday, up more than 2% following increased bullish bias among investors, as evidenced by ETH ETF net inflows and an uptrend in funding rates.

Read more »

Asia-Pacific Markets Mostly Fall on Tuesday as Investors Await DataAsia-Pacific markets saw mostly declines on Tuesday, with investors closely monitoring August pay and spending data released from Japan and the return of mainland Chinese markets. While Japan's real household spending fell in August, wages rose, potentially presenting a challenge for the Bank of Japan's inflation goals.

Asia-Pacific Markets Mostly Fall on Tuesday as Investors Await DataAsia-Pacific markets saw mostly declines on Tuesday, with investors closely monitoring August pay and spending data released from Japan and the return of mainland Chinese markets. While Japan's real household spending fell in August, wages rose, potentially presenting a challenge for the Bank of Japan's inflation goals.

Read more »

Asia-Pacific markets mixed as investors digest China trade dataChina's exports grew 8.7% year-on-year in August and imports grew 0.5%, compared to the forecast of 6.5% and 2% in a Reuters poll.

Asia-Pacific markets mixed as investors digest China trade dataChina's exports grew 8.7% year-on-year in August and imports grew 0.5%, compared to the forecast of 6.5% and 2% in a Reuters poll.

Read more »