With interest rates finally beginning to fall, experts are advising investors to reconsider their portfolios and prepare for the changing macro environment. The potential impact on equities, fixed income, and cash holdings is discussed.

on Wednesday marked the first time in more than four years it moved to lower the benchmark interest rate. According to VanEck CEO Jan van Eck, investors should start thinking about how the changing macro environment will affect their investments in the year ahead.

But it's not just equity strategies that experts suggest revisiting. Investors may begin to cut back their cash holdings, too. While the average return on the 100 largest money market funds still sits above 5%, according toIncomes spiked over 17% in 1 year for households in this state—it's not Florida, Texas, or New York

Interest Rates Investments Portfolios Fixed Income Equities

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Investors Should Reposition Portfolios as Interest Rates Begin to FallWith the Federal Reserve lowering interest rates for the first time in over four years, investors are advised to rethink their strategies. Experts suggest shifting from cash holdings to equities and fixed income, while also considering potential challenges like the federal deficit.

Investors Should Reposition Portfolios as Interest Rates Begin to FallWith the Federal Reserve lowering interest rates for the first time in over four years, investors are advised to rethink their strategies. Experts suggest shifting from cash holdings to equities and fixed income, while also considering potential challenges like the federal deficit.

Read more »

VanEck CEO: Investors Should Reposition Portfolios as Rates FallAs the Federal Reserve lowers interest rates for the first time in over four years, VanEck CEO Jan van Eck advises investors to rethink their strategies and consider the impact of a changing macro environment. He suggests shifting from cash holdings into small-cap equities and fixed income.

VanEck CEO: Investors Should Reposition Portfolios as Rates FallAs the Federal Reserve lowers interest rates for the first time in over four years, VanEck CEO Jan van Eck advises investors to rethink their strategies and consider the impact of a changing macro environment. He suggests shifting from cash holdings into small-cap equities and fixed income.

Read more »

Investors should diversify portfolios to hedge against risk into election: UBSInvestors should diversify portfolios to hedge against risk into election: UBS

Investors should diversify portfolios to hedge against risk into election: UBSInvestors should diversify portfolios to hedge against risk into election: UBS

Read more »

Investors should diversify portfolios to hedge against risk into election: UBSInvestors should diversify portfolios to hedge against risk into election: UBS

Investors should diversify portfolios to hedge against risk into election: UBSInvestors should diversify portfolios to hedge against risk into election: UBS

Read more »

Positioning credit portfolios for the US electionPositioning credit portfolios for the US election

Positioning credit portfolios for the US electionPositioning credit portfolios for the US election

Read more »

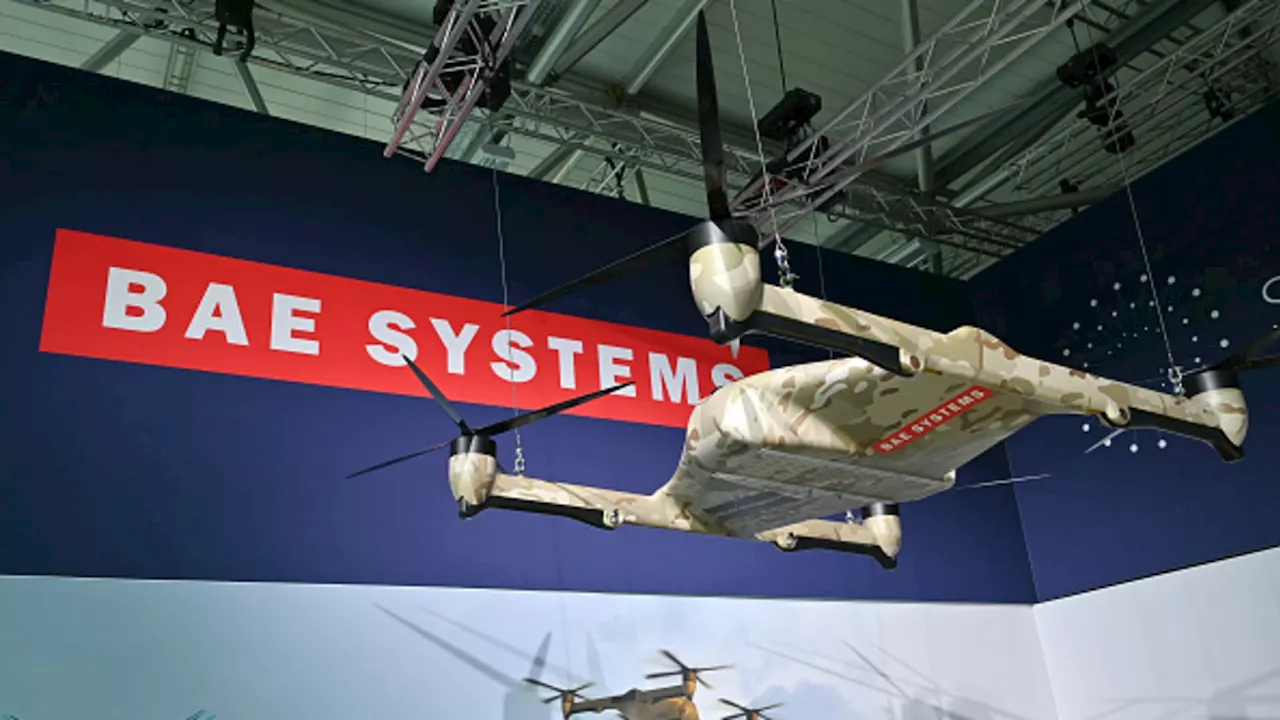

Defense stocks in an ESG portfolio? A profound — and controversial — shift seems to be underwayThe idea of including defense stocks in sustainably-minded portfolios remains controversial.

Defense stocks in an ESG portfolio? A profound — and controversial — shift seems to be underwayThe idea of including defense stocks in sustainably-minded portfolios remains controversial.

Read more »