A growing number of parents are recognizing the importance of teaching their children about financial literacy at an early age. Experts interviewed by CNBC offer valuable insights and practical advice on how to introduce investing concepts to kids, emphasizing age-appropriate approaches, the value of learning from mistakes, and the importance of fostering a long-term investment mindset.

Leaders have been advised to allow their kids to invest in something low-risk at the start and ask them to explain their rationale. Talk to children in their own terms, according to Singapore-based CEO Gregory Van. Ask:'Do you want to spend $100 today on a toy, or have it turn into $200 in 10 years when you are 16?' he said. Entrepreneur Eric Malka had to completely shift his mindset when he sold his company and became an investor.

Since then he's learned many lessons he's now passing to his kids.'When an entrepreneur like me is lucky enough to have a liquidity event, then we're faced … with managing assets without proper training,' he told CNBC by video call. Investors must focus on being patient and on long-term returns, whereas company founders often look at a short-term plan,'almost an opposite' mindset, Malka said.He took courses on wealth management, read books on investing and now has a diversified portfolio of stocks, bonds, private equity and real estate, with about 10% allocated to riskier investments. In 2014 he founded private equity fund Strategic Brand Investments. When it came to educating his children — sons aged 14 and 16 — about money, Malka's attitude has been to help them learn from the ground up. 'One of the challenges I faced with my teenagers early on, is their belief that it's very easy to make money by investing through social media and through what they hear from friends,' he said. His older son thought he could generate a 20% monthly return, which Malka described as'very concerning.' So, Malka let him invest a small portion of his savings, hoping it would provide an opportunity to learn — and his son lost 40% of that investment after trading currency futures.'I hate to set up my child for failure, but sometimes, you know, the lessons learned when you lose are more valuable than the ones when you succeed,' Malka said. It's a point that resonates with Gregory Van, CEO of Singapore-based wealth platform Endowus. He and his wife have children aged eight, six and three. He said he'll be teaching them that it's important to make mistakes when the stakes seem large to them, though may be small in reality.'The emotional muscle, and humility required to be a good investor is something that people need to develop on their own,' he said.For Dayssi Olarte de Kanavos, president and co-founder of real estate company Flag Luxury Group, educating kids early about money is key. She and her husband allocated a'low risk' sum of money to each of their three children in middle school for them to pick companies to invest in.'Our children chose. All but one had terrific runs. As long as they kept their money in the market and continued to be thoughtful in their approach, we added every year to their nest egg,' she told CNBC by email. Olarte de Kanavos said her experience in real estate investing taught her the value of patience.'It influenced my business approach by emphasizing long-term strategy over quick gains,' she said. The mother of three described her own investments in the stock market as'very conservative, in order to best manage the huge risks that we take in our real estate business.' She suggested having children explain why they want to buy certain stocks, because it'can demystify investing and make it an exciting and integral part of their education,' she said. Van said he talks to his young kids about the tradeoffs of investing in their own terms.'I ask them: 'If we invest this $100 and it goes down by $70 next year, how will you feel?' 'Do you want to spend $100 today on a toy, or have it turn into $200 in 10 years when you are 16?',' Van told CNBC via email.'Surprisingly, they are very rational and always go for delayed gratification,' he said. Van and his wife have investment portfolios for each of their kids, mostly made up of gifts they've received during holidays such as Chinese New Year.'Given their long investment horizon, they are in very diversified, multi-manager, low-cost equities portfolios,' Van said, and he shows his children their portfolios' performance — positive or negative — whenever they ask.Age-appropriate advice is very important, Malka said. His focus right now is teaching his children about budgeting, providing them with a fixed allowance per month. 'In the beginning, you know, they would spend in 10 days what they were supposed to spend in 30 days … now I've been doing this for eight months or nine months, now they're really managing it properly, and I think that's a skill they don't realize they're being taught,' he said. He recommended the book'Raising Financially Fit Kids,' by Joline Godfrey, which provides advice by age-group. 'Give them an allowance no later than the first grade,' is Olarte de Kanavos' suggestion.'The purpose of an allowance is to allow them to learn to make their own decisions about money and to manage the repercussions that come with their choices,' she told CNB

INVESTING CHILDREN FINANCIAL LITERACY MONEY MANAGEMENT ALLOWANCE LONG-TERM INVESTING RISK MANAGEMENT INVESTING ADVICE

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Investing in the Future: How Parents Are Teaching Kids About MoneyA growing number of parents are embracing early financial education for their children, encouraging them to invest in low-risk assets and understand the fundamentals of investing. From Singapore-based CEO Gregory Van to entrepreneur Eric Malka and real estate investor Dayssi Olarte de Kanavos, these leaders share their insights and strategies for guiding the next generation towards financial literacy.

Investing in the Future: How Parents Are Teaching Kids About MoneyA growing number of parents are embracing early financial education for their children, encouraging them to invest in low-risk assets and understand the fundamentals of investing. From Singapore-based CEO Gregory Van to entrepreneur Eric Malka and real estate investor Dayssi Olarte de Kanavos, these leaders share their insights and strategies for guiding the next generation towards financial literacy.

Read more »

Letting Kids Struggle: Experts Say This Simple Mistake Raises 'Mentally Weak Children'Psychiatrist Daniel Amen warns against parents overdoing it for their children, stating that excessive involvement can hinder mental resilience. Amen emphasizes the importance of allowing children to face challenges, solve problems independently, and experience the natural consequences of their decisions. He believes that fostering independence and allowing children to learn from their mistakes are crucial for building mental toughness.

Letting Kids Struggle: Experts Say This Simple Mistake Raises 'Mentally Weak Children'Psychiatrist Daniel Amen warns against parents overdoing it for their children, stating that excessive involvement can hinder mental resilience. Amen emphasizes the importance of allowing children to face challenges, solve problems independently, and experience the natural consequences of their decisions. He believes that fostering independence and allowing children to learn from their mistakes are crucial for building mental toughness.

Read more »

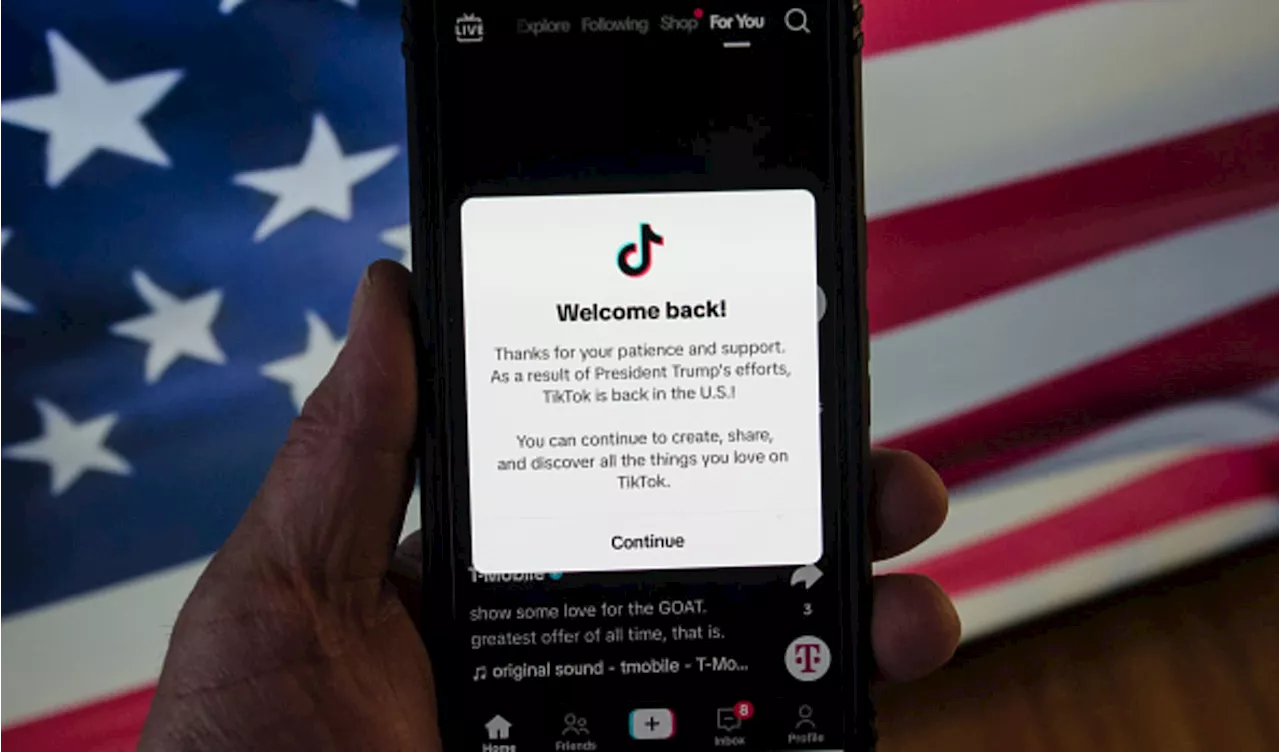

TikTok Ban Could Benefit Kids' Mental Health, Experts SayJonathan Haidt and Tristan Harris, experts in technology and social media, argue that banning TikTok would benefit children's mental health. They cite TikTok's addictive nature, exposure to harmful content, and link to increased anxiety and depression. While acknowledging that banning TikTok alone won't solve the problem, they advocate for broader measures and encourage parents and educators to create alternative spaces and norms for young people.

TikTok Ban Could Benefit Kids' Mental Health, Experts SayJonathan Haidt and Tristan Harris, experts in technology and social media, argue that banning TikTok would benefit children's mental health. They cite TikTok's addictive nature, exposure to harmful content, and link to increased anxiety and depression. While acknowledging that banning TikTok alone won't solve the problem, they advocate for broader measures and encourage parents and educators to create alternative spaces and norms for young people.

Read more »

Experts Advise Limiting Screen Time for Kids, Suggest Phone AlternativesA pediatrician recommends setting screen time limits for children, especially for preschoolers. He suggests considering alternatives to smartphones and setting ground rules if a child does have a phone, including usage frequency, internet access, and social media permissions. Kid-friendly phones and smartwatches with parental controls are also suggested.

Experts Advise Limiting Screen Time for Kids, Suggest Phone AlternativesA pediatrician recommends setting screen time limits for children, especially for preschoolers. He suggests considering alternatives to smartphones and setting ground rules if a child does have a phone, including usage frequency, internet access, and social media permissions. Kid-friendly phones and smartwatches with parental controls are also suggested.

Read more »

Tesla: Road Ahead Could Get Rocky as EV Giant Faces FSD Hurdles Amid NHTSA ProbeStocks Analysis by Investing.com (Damian Nowiszewski) covering: Tesla Inc. Read Investing.com (Damian Nowiszewski)'s latest article on Investing.com

Tesla: Road Ahead Could Get Rocky as EV Giant Faces FSD Hurdles Amid NHTSA ProbeStocks Analysis by Investing.com (Damian Nowiszewski) covering: Tesla Inc. Read Investing.com (Damian Nowiszewski)'s latest article on Investing.com

Read more »

6 S&P 500 Dividend Stocks Offering High Upside Potential in a Volatile MarketStocks Analysis by Investing.com (David Wagner) covering: S&P 500, CVS Health Corp, LyondellBasell Industries NV. Read Investing.com (David Wagner)'s latest article on Investing.com

6 S&P 500 Dividend Stocks Offering High Upside Potential in a Volatile MarketStocks Analysis by Investing.com (David Wagner) covering: S&P 500, CVS Health Corp, LyondellBasell Industries NV. Read Investing.com (David Wagner)'s latest article on Investing.com

Read more »