Institutional investors now hold 31% of known Bitcoin, a significant jump from 14% in 2023. This surge is largely attributed to spot Bitcoin ETFs, government acquisitions, and MicroStrategy's expansion of its Bitcoin strategy. Spot Bitcoin ETFs have attracted billions from traditional financial institutions, while MicroStrategy's treasury, holding roughly 2% of Bitcoin's circulating supply, is worth $46.15 billion. Other notable holders include Block.one, Tether, SpaceX, and various governments, with the U.S. leading the pack.

Institutional investors now account for 31% of all known Bitcoin holders, reflecting a sharp increase from 14% in 2023.

The uptick has been largely driven by spot Bitcoin exchange-traded funds , government acquisitions, and MicroStrategy’s ramping up of its BTC strategy, which has seen its stashby CryptoQuant CEO Ki Young Ju, most of the known Bitcoin holdings are in the hands of miners and crypto exchanges. However, MicroStrategy, ETFs, and several governments have eaten into their shares.

Launched earlier in the year, spot BTC ETFs have seen billions of dollars in inflows from traditional financial institutions, with the likes of BlackRock’s iShares recording a staggering $1.4 billion in net weekly inflows as of mid-December. Collectively,MicroStrategy is also a major holder of the number one cryptocurrency. Its treasury, consisting of roughly 2% of BTC’s circulating supply, is worth $46.15 billion.

El Salvador, which became the first country in the world to adopt Bitcoin as legal tender, boasts nearly 6,000 coins, much of itunder President Nayib Bukele’s Bitcoin per day policy. In total, about 2.45% of the cryptocurrency’s circulating supply, valued at $49.36 billion, is controlled by states.What Is Sui Network : The Ultimate Guide in 2024One Weekly Email Can Change Your Crypto Life.Disclaimer: Information found on CryptoPotato is those of writers quoted.

BITCOIN INSTITUTIONAL INVESTORS Etfs MICROSTRATEGY GOVERNMENT HOLDINGS

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Defiance ETFs CEO on MicroStrategy ETFs Straining LimitsMicroStrategy's volatility testing the limits of exposure for prime brokers working with firms like Defiance ETFs. Defiance ETFs CEO and CIO Sylvia Jablonski discusses demand and flows has looked as the price of Bitcoin has gone up. She speaks with Scarlet Fu on 'Bloomberg Markets.

Defiance ETFs CEO on MicroStrategy ETFs Straining LimitsMicroStrategy's volatility testing the limits of exposure for prime brokers working with firms like Defiance ETFs. Defiance ETFs CEO and CIO Sylvia Jablonski discusses demand and flows has looked as the price of Bitcoin has gone up. She speaks with Scarlet Fu on 'Bloomberg Markets.

Read more »

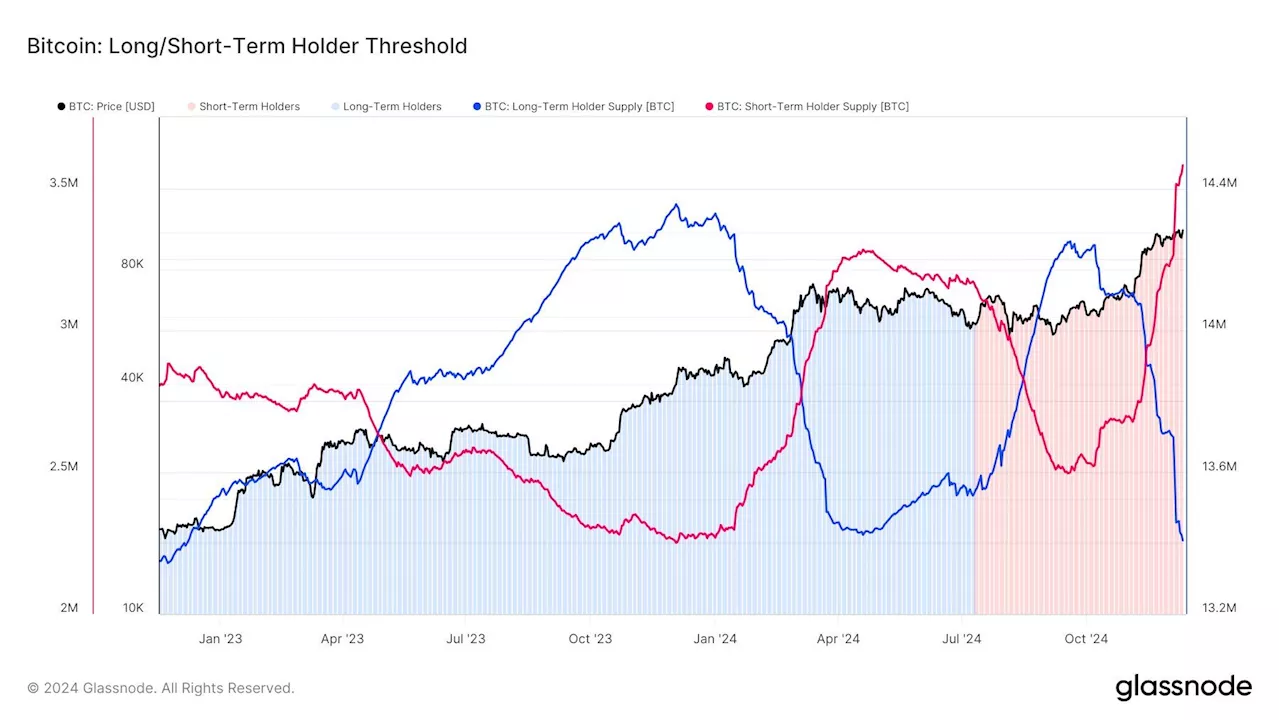

Who Is Currently Dictating the Bitcoin Market? Van StratenSince September, MicroStrategy and U.S.-listed spot ETFs have accumulated approximately 200,000 bitcoin each.

Who Is Currently Dictating the Bitcoin Market? Van StratenSince September, MicroStrategy and U.S.-listed spot ETFs have accumulated approximately 200,000 bitcoin each.

Read more »

Bitcoin ETFs Surge to $121.83 Billion AUM, Outpacing Gold ETFsBitcoin ETFs are attracting significant institutional investment, with assets under management exceeding $121.83 billion and surpassing 88% of the AUM of US-listed Gold ETFs. Bitcoin's price remains stable above $106,000, supported by bullish sentiment from derivatives traders and a steady inflow of capital. Analysts predict a potential rally to $200,000 by mid-2025.

Bitcoin ETFs Surge to $121.83 Billion AUM, Outpacing Gold ETFsBitcoin ETFs are attracting significant institutional investment, with assets under management exceeding $121.83 billion and surpassing 88% of the AUM of US-listed Gold ETFs. Bitcoin's price remains stable above $106,000, supported by bullish sentiment from derivatives traders and a steady inflow of capital. Analysts predict a potential rally to $200,000 by mid-2025.

Read more »

Leveraged MicroStrategy (MSTR) ETFs Are Having a Larger Impact on Market: JPMorganLeveraged MicroStrategy (MSTR) exchange-traded funds (ETFs) are having a larger impact on crypto markets, JPMorgan (JPM) said

Leveraged MicroStrategy (MSTR) ETFs Are Having a Larger Impact on Market: JPMorganLeveraged MicroStrategy (MSTR) exchange-traded funds (ETFs) are having a larger impact on crypto markets, JPMorgan (JPM) said

Read more »

![]() Hiccups in ETFs tracking MicroStrategy occurring as bull market fuels trading boom in single-stock fundsSingle stock ETFs are seeing high trading volumes, and some are showing signs of stress.

Hiccups in ETFs tracking MicroStrategy occurring as bull market fuels trading boom in single-stock fundsSingle stock ETFs are seeing high trading volumes, and some are showing signs of stress.

Read more »

Bitcoin Sees Institutional Surge in 2024 Driven by ETF Success and Balance Sheet IntegrationBitcoin's institutional adoption has significantly increased in 2024, fueled by its integration into public balance sheets as a treasury asset and the success of U.S. spot-listed exchange-traded funds (ETFs). U.S.-listed Bitcoin ETFs have surpassed Gold ETFs in assets under management, exceeding $129 billion. Strong activity on CME, particularly futures open interest approaching new highs, suggests continued momentum towards the end of the year.

Bitcoin Sees Institutional Surge in 2024 Driven by ETF Success and Balance Sheet IntegrationBitcoin's institutional adoption has significantly increased in 2024, fueled by its integration into public balance sheets as a treasury asset and the success of U.S. spot-listed exchange-traded funds (ETFs). U.S.-listed Bitcoin ETFs have surpassed Gold ETFs in assets under management, exceeding $129 billion. Strong activity on CME, particularly futures open interest approaching new highs, suggests continued momentum towards the end of the year.

Read more »