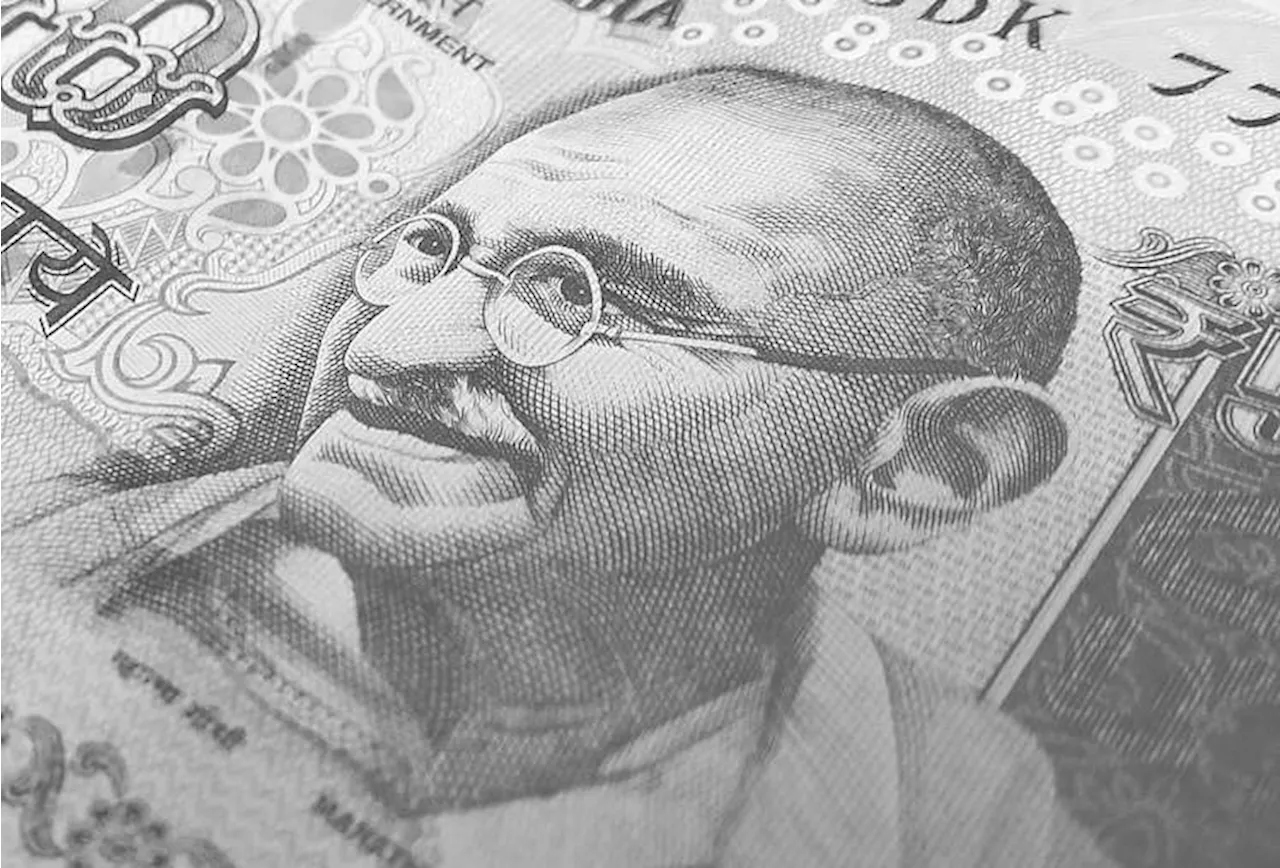

The Indian Rupee (INR) weakened against the US Dollar (USD) on Monday, reaching a record low. Contributing factors include a stronger USD, uncertainties surrounding Donald Trump's trade policies, and India's economic slowdown and widening trade deficit. The Reserve Bank of India (RBI) may intervene to limit further depreciation, but market volatility is expected to persist.

The Indian Rupee (INR) experienced a decline in Monday's Asian trading session, falling to a historic low of 81.00 in the previous session. This depreciation is attributed to several factors, including a stronger US Dollar (USD) driven by month-end demand, uncertainties surrounding the incoming Donald Trump administration, and concerns about India's slowing economic growth and widening trade deficit.

While the Reserve Bank of India (RBI) may intervene by selling USD to mitigate the INR's losses, the markets are expected to remain relatively subdued as the year-end approaches, keeping the currency pair within a defined range. Later on Monday, traders will closely monitor India's Fiscal Deficit figures. On Tuesday, the Indian Trade Deficit for the third quarter (Q3) and Infrastructure Output data for November will be released. Currency experts anticipate increased volatility in the USD/INR pair moving forward. They also note that the RBI's recent intervention signals a commitment to stabilizing the INR. India's economic growth is projected to be around 6.5% in fiscal year 2024/25, closer to the lower end of the government's 6.5%-7% estimate. Deloitte Sunday predicts India's economy to expand at 6.5-6.8% this fiscal year and slightly higher between 6.7-7.3% in FY2026, driven by domestic consumption. The USD/INR pair's bullish outlook remains intact, as indicated by its position above the 100-day Exponential Moving Average (EMA)

Indian Rupee US Dollar Donald Trump Trade Policies Economic Growth

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Indian Rupee Holds Steady Despite USD Demand and Fed Rate CutThe Indian Rupee (INR) remained relatively stable in Thursday's Asian session, despite persistent demand for US dollars (USD) and a cautious outlook from Federal Reserve (Fed) officials. The INR faced pressure from renewed USD demand from importers, foreign banks, and foreign fund outflows, as well as a subdued trend in domestic equities.

Indian Rupee Holds Steady Despite USD Demand and Fed Rate CutThe Indian Rupee (INR) remained relatively stable in Thursday's Asian session, despite persistent demand for US dollars (USD) and a cautious outlook from Federal Reserve (Fed) officials. The INR faced pressure from renewed USD demand from importers, foreign banks, and foreign fund outflows, as well as a subdued trend in domestic equities.

Read more »

Forex Trading Update: EUR/USD, GBP/USD, and USD/JPYThis article provides a snapshot of current forex market movements. EUR/USD hovers around 1.0450, GBP/USD weakens below 1.2600 due to revised UK GDP data, and USD/JPY remains under pressure despite Friday's recovery.

Forex Trading Update: EUR/USD, GBP/USD, and USD/JPYThis article provides a snapshot of current forex market movements. EUR/USD hovers around 1.0450, GBP/USD weakens below 1.2600 due to revised UK GDP data, and USD/JPY remains under pressure despite Friday's recovery.

Read more »

Indian Rupee Holds Steady Ahead of Fed Rate DecisionThe Indian Rupee remains stable despite hitting a record low, influenced by global trade trends and the upcoming Fed announcement.

Indian Rupee Holds Steady Ahead of Fed Rate DecisionThe Indian Rupee remains stable despite hitting a record low, influenced by global trade trends and the upcoming Fed announcement.

Read more »

Indian Rupee Rebounds Despite Global HeadwindsThe Indian Rupee (INR) sees a rebound on Friday after hitting an all-time low. Lower crude oil prices and potential RBI intervention may support the INR, but a hawkish Fed stance could cap its gains. Traders await key US economic data, including the Core PCE Price Index and Michigan Consumer Sentiment Index.

Indian Rupee Rebounds Despite Global HeadwindsThe Indian Rupee (INR) sees a rebound on Friday after hitting an all-time low. Lower crude oil prices and potential RBI intervention may support the INR, but a hawkish Fed stance could cap its gains. Traders await key US economic data, including the Core PCE Price Index and Michigan Consumer Sentiment Index.

Read more »

Indian Rupee Weakens on Global CuesThe Indian Rupee (INR) continues to decline on Tuesday, following its record low in the previous session. A weak Chinese Yuan, strong US Dollar (USD) demand, and higher crude oil prices contribute to the INR's depreciation. However, the Reserve Bank of India (RBI) is expected to intervene to limit further losses. The RBI has been actively selling USD to support the INR and manage its impact on foreign exchange reserves.

Indian Rupee Weakens on Global CuesThe Indian Rupee (INR) continues to decline on Tuesday, following its record low in the previous session. A weak Chinese Yuan, strong US Dollar (USD) demand, and higher crude oil prices contribute to the INR's depreciation. However, the Reserve Bank of India (RBI) is expected to intervene to limit further losses. The RBI has been actively selling USD to support the INR and manage its impact on foreign exchange reserves.

Read more »

USD/CAD climbs back closer to mid-1.4000s on stronger USD, trade war fearsThe USD/CAD pair regains strong positive traction at the start of a new week and climbs to the 1.4040 area during the Asian session, snapping a three-day losing streak amid a goodish pickup in the US Dollar (USD) demand.

USD/CAD climbs back closer to mid-1.4000s on stronger USD, trade war fearsThe USD/CAD pair regains strong positive traction at the start of a new week and climbs to the 1.4040 area during the Asian session, snapping a three-day losing streak amid a goodish pickup in the US Dollar (USD) demand.

Read more »