'I have a generous pension awaiting my retirement. I have significant savings, and several properties. ...I have four nieces and nephews. How do I transfer my wealth to future generations?' The Moneyist weighs in:

I am a second-generation, happily newly divorced, 52-year-old professor without a will. I am incredibly fortunate to be successful in what I do. Because I am a state employee, I have a generous pension awaiting my retirement. I have significant savings, and several properties that followed from moving from one state to another.

Traditional models of distribution would mean my estate would and/or should be apportioned to my extended family. I understand that is how generational wealth works. Families, over time, can build themselves on the success of their forefathers — or, in this case, their “foreuncles” — but I have had some thoughts about what targeting my estate might mean.

First, what are your thoughts about this from a generational perspective? Second, if I choose to set up something like this, how would I find a long-term trustee? Third, is a trust the right way to think about this, and could I use a 529 plan to accomplish this?The three most important things in a young person’s life, in no particular order: education, education, education. Kudos to you for thinking ahead, and putting the money you won’t spend during your lifetime to use.

There are potholes to avoid, or at the very least be aware of. As my colleague Beth Pinsker points out: “Any money from a non-parent given to a student while eligible for aid can count as student income and is assessed at a much higher rate than a parental asset. Say you gave $5,000 to a high-school grad as a present in May 2022.

Duckett is somewhat more optimistic about the impact on economic inequality than other parties, including the authors of this paper for the Center for Economic Policy Research. “This will put younger generations in the driver’s seat and has the potential to reshape our economy.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Axios in Jordan: Growing up in the world's largest Syrian refugee campA new generation is coming of age and having children of its own in the sprawling Syrian refugee camp.

Axios in Jordan: Growing up in the world's largest Syrian refugee campA new generation is coming of age and having children of its own in the sprawling Syrian refugee camp.

Read more »

B.I's 'Love or Loved Part.1' tops iTunes album charts worldwide after release | allkpopOn November 18, B.I made his anticipated comeback with his mini-album 'Love or Loved Part.1'. After its release, the album entered iTunes charts in v…

Read more »

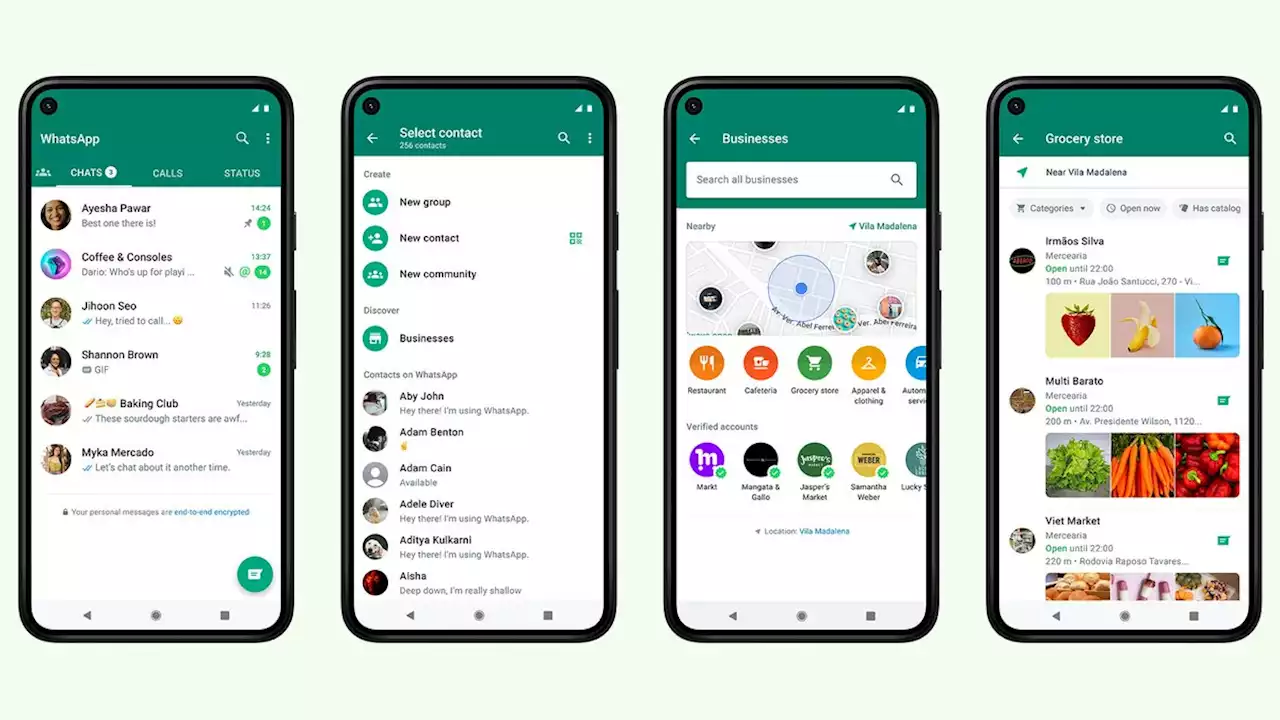

WhatsApp now helps you search for businesses | EngadgetWhatsApp now lets you search for businesses without having to leave the messaging client..

WhatsApp now helps you search for businesses | EngadgetWhatsApp now lets you search for businesses without having to leave the messaging client..

Read more »

Sylvester Stallone Tapped George Cleverley to Create Custom Shoes for His Role as a Mafia Boss in ‘Tulsa King’The London cobbler describes the Hollywood star as having 'a colorful edge' to his personal taste.

Sylvester Stallone Tapped George Cleverley to Create Custom Shoes for His Role as a Mafia Boss in ‘Tulsa King’The London cobbler describes the Hollywood star as having 'a colorful edge' to his personal taste.

Read more »

5 steps to becoming a millionaire, from a millennial who did it in 5 yearsHere are 5 steps to becoming a millionaire, from a millennial who did it in 5 years. (via CNBCMakeIt)

5 steps to becoming a millionaire, from a millennial who did it in 5 yearsHere are 5 steps to becoming a millionaire, from a millennial who did it in 5 years. (via CNBCMakeIt)

Read more »