This op-ed explores the benefits of establishing a Roth individual retirement account (IRA) for children as early as possible. The author, a financial advisor and mother of three, highlights how even small contributions can grow significantly over time thanks to compound interest. She emphasizes that while kids might not grasp the concept of retirement now, starting early teaches valuable lessons about saving and prioritizing financial goals.

Establishing a Roth individual retirement account for youngsters is a powerful way to set them on the path to financial security.There's no minimum age requirement for contributing to a Roth IRA; if a child can earn money, they can have a Roth IRA.

While the child needs to have earned income to qualify for contributions, the money used to fund the Roth IRA can be contributed from someone else. This means the child can keep their earnings for immediate spending, while the Roth IRA is funded separately, helping them build a financial foundation without dipping into their own pockets.There's no minimum age requirement for contributing to a Roth IRA; if a child can earn money, they can have a Roth IRA.

Even if the child is not required to file an income tax return, the parent or other custodian must still keep careful records of the earnings that are used to contribute to the Roth. Self-employment income might be subject to additional taxes such as Medicare and Social Security. It's wise to consult a tax professional to ensure compliance and maximize benefits.

There are other advantages as well. Contributions are made with after-tax dollars, so withdrawals during retirement can be tax-free, provided certain conditions are met. This is particularly advantageous for children, who are likely in a low or zero tax bracket now, which allows them to grow their investments without the burden of taxes.

Roth IRA Child Savings Financial Literacy Retirement Planning Compound Interest

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

How high earners can funnel money to a Roth IRA, the ‘gold standard' of retirement accountsHigh earners may find it tricky to access tax breaks in individual retirement accounts. A workaround may help.

How high earners can funnel money to a Roth IRA, the ‘gold standard' of retirement accountsHigh earners may find it tricky to access tax breaks in individual retirement accounts. A workaround may help.

Read more »

Jet-Set in Style: Win a 5-Piece Travel Set!Latest Celebrity News, Pictures & Entertainment

Jet-Set in Style: Win a 5-Piece Travel Set!Latest Celebrity News, Pictures & Entertainment

Read more »

Peaky Blinders Movie Cast Adds The Incredible Hulk’s Tim RothThe Incredible Hulk's Tim Roth joins Cillian Murphy, Rebecca Ferguson, and Barry Keoghan in the cast of the Peaky Blinders movie.

Peaky Blinders Movie Cast Adds The Incredible Hulk’s Tim RothThe Incredible Hulk's Tim Roth joins Cillian Murphy, Rebecca Ferguson, and Barry Keoghan in the cast of the Peaky Blinders movie.

Read more »

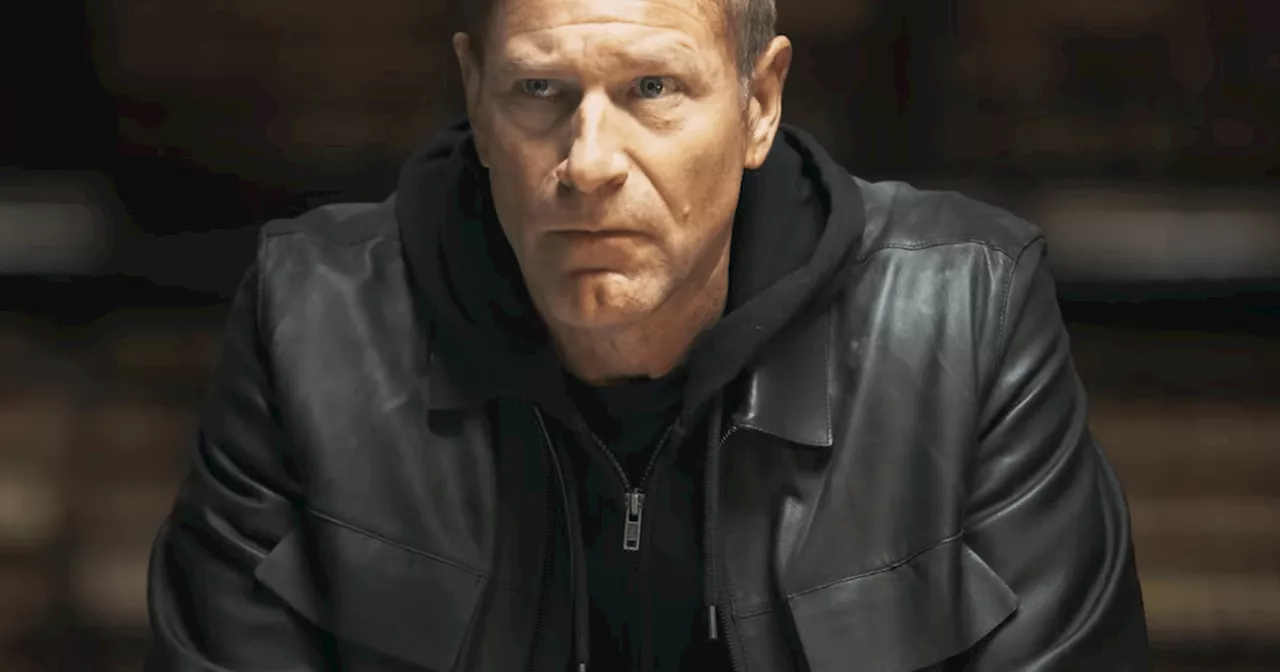

Classified Trailer: Aaron Eckhart, Abigail Breslin, & Tim Roth Star in Hitman ThrillerA new Classified trailer is out, previewing the upcoming action thriller starring Aaron Eckhart and Abigail Breslin.

Classified Trailer: Aaron Eckhart, Abigail Breslin, & Tim Roth Star in Hitman ThrillerA new Classified trailer is out, previewing the upcoming action thriller starring Aaron Eckhart and Abigail Breslin.

Read more »

Peaky Blinders: Tim Roth Joins Cillian Murphy in Undisclosed RoleThe cast for the feature film return of Steven Knight's critically acclaimed series Peaky Blinders continues to impress. First came the word that Cillian Murphy would be reprising his role as Thomas Shelby for the Tom Harper (Heart of Stone, Wild Rose)-directed Netflix film continuation.

Peaky Blinders: Tim Roth Joins Cillian Murphy in Undisclosed RoleThe cast for the feature film return of Steven Knight's critically acclaimed series Peaky Blinders continues to impress. First came the word that Cillian Murphy would be reprising his role as Thomas Shelby for the Tom Harper (Heart of Stone, Wild Rose)-directed Netflix film continuation.

Read more »

Max Roth shares conversation with Americorps CEO on volunteers in UtahMax Roth spoke with Americorps CEO Michael D. Smith as they celebrate their 30th anniversary about the volunteers hard at work in Utah.

Max Roth shares conversation with Americorps CEO on volunteers in UtahMax Roth spoke with Americorps CEO Michael D. Smith as they celebrate their 30th anniversary about the volunteers hard at work in Utah.

Read more »