I am an advisor, investor and educator working on climate technology and investment around the world. I am a co-founder of Riffle Ventures, and the founder of Climate Tech Bootcamp. I was also the lead author of the Climate Tech Opportunity, a global study from the Said Business School at Oxford University.

Funding climate solutions requires an enormous amount of capital - now it feels like common knowledge, but we have to say it anyway. According to McKinsey and Bloomberg NEF, we will needin cumulative financing to power the green transition, a lot of which will go into hard assets , between now and 2050 to hit net zero targets. This is nothing short of the biggest industrial transformation the planet has ever seen.

Imagine this. Let’s say we have a company - GreenCementCo, which is developing a zero carbon cement formula - the cement industry accounts for roughlyof all global CO2 emissions. After 2 years of developing some promising research in university, they raise US $5 million in government grants for a 2-year intensive R&D exercise.

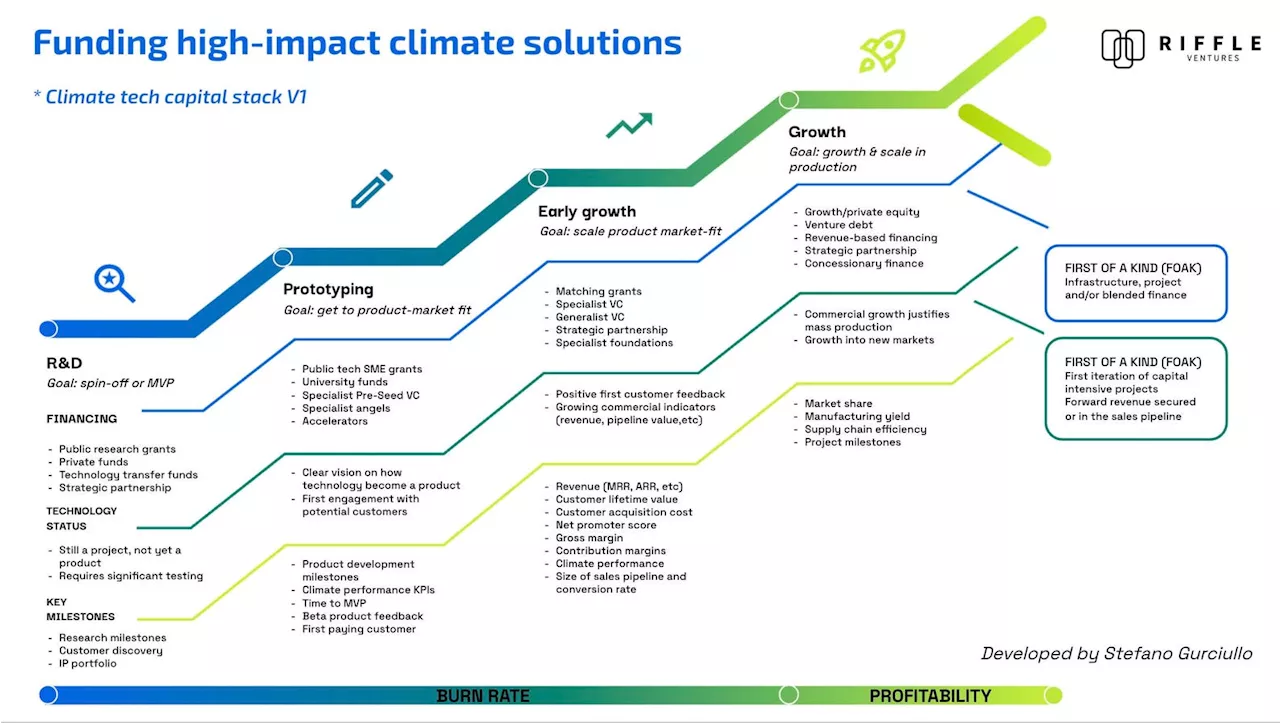

There are a couple of things to note. First, dilutive and non-dilutive funding instruments need to operate in concert. Governments, foundations, family offices, corporations, venture capital funds, angel investors, investment banks, private equity, infrastructure and project finance shops, among others, are all needed, often in parallel to one another. Each of these entities has a different vetting process, risk appetite, return expectation and timeline. Some can take on more risk - e.g.

Stefano Gurciullo, a deep-tech investor and partner at Tau Capital explains it well: “Many climate tech companies require significant upfront capital investments in physical infrastructure, testing and manufacturing facilities, and hardware components. The payback periods for these investments can be much longer than typical VC fund cycles, sometimes spanning decades.

Climate Tech Climate Innovation R&D Venture Capital Climate Entrepreneurship

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Crypto VC Hypersphere opens $130 million liquid fund, seeks $75 million for new VC fundHypersphere Ventures has opened its $130 million liquid fund to outside investors and is raising a new $75 million VC fund.

Crypto VC Hypersphere opens $130 million liquid fund, seeks $75 million for new VC fundHypersphere Ventures has opened its $130 million liquid fund to outside investors and is raising a new $75 million VC fund.

Read more »

California lawmakers advance tax on Big Tech to help fund news industryThe bill would tax Amazon, Meta and Google for the data they take from users and pump the money into news organizations in the form of tax credits.

California lawmakers advance tax on Big Tech to help fund news industryThe bill would tax Amazon, Meta and Google for the data they take from users and pump the money into news organizations in the form of tax credits.

Read more »

EPA awards $4.3 billion to fund projects in 30 states to reduce climate pollutionThe Environmental Protection Agency is awarding $4.3 billion in grants to fund projects in 30 states to reduce climate pollution.

EPA awards $4.3 billion to fund projects in 30 states to reduce climate pollutionThe Environmental Protection Agency is awarding $4.3 billion in grants to fund projects in 30 states to reduce climate pollution.

Read more »

EPA awards $4.3 billion to fund projects in 30 states to reduce climate pollutionSenior EPA leaders Monday will announce nearly $500 million for transportation and freight decarbonization at the ports of Los Angeles and Long Beach.

EPA awards $4.3 billion to fund projects in 30 states to reduce climate pollutionSenior EPA leaders Monday will announce nearly $500 million for transportation and freight decarbonization at the ports of Los Angeles and Long Beach.

Read more »

EPA awards $4.3 billion to fund projects in 30 states to reduce climate pollutionWASHINGTON (AP) — The Environmental Protection Agency is awarding $4.3 billion in grants to fund projects in 30 states to reduce climate pollution. The

EPA awards $4.3 billion to fund projects in 30 states to reduce climate pollutionWASHINGTON (AP) — The Environmental Protection Agency is awarding $4.3 billion in grants to fund projects in 30 states to reduce climate pollution. The

Read more »

EPA awards $4.3 billion to fund projects in 30 states to reduce climate pollutionThe Environmental Protection Agency is awarding $4.3 billion in grants to fund projects in 30 states to reduce climate pollution.

EPA awards $4.3 billion to fund projects in 30 states to reduce climate pollutionThe Environmental Protection Agency is awarding $4.3 billion in grants to fund projects in 30 states to reduce climate pollution.

Read more »