If there ever was a time for interest rate-hedge bond funds to prove their value, this year is it. They appear to have won the battle but lost the war, columnist MktwHulbert writes.

I’m referring to funds that hedge against rising interest rates. I’ve written about such funds before, when the prospect of higher rates—and the value of rate-hedged bond funds—was mostly theoretical. I concluded that such funds could be attractive to extremely risk-averse fixed-income investors.

To assess how they did, I will focus on the iShares Interest Rate Hedged Corporate Bond ETF LQDH, +0.51%. We know exactly how this ETF’s hedges impacted performance because an unhedged version also exists: The iShares iBoxx $ Investment Grade Corporate Bond ETF LQD, +0.64%. The other reason is that hedging isn’t costless; its expenses approach an annualized percentage point. So even when hedging works as designed, you nevertheless should expect to forfeit a good amount of interest income. Currently, for example, the LQD’s SEC yield is 3.80%, in contrast to 2.67% for the LQDH.

If you’re willing to hold a bond ladder for long enough, its total return almost certainly will be close to or equal its initial yield. The required length of time, according to the bond analysts who derived the formula, is one year less than twice the bond ladder’s duration. With a duration of 9.3 years, according to Morningstar, you therefore would need to own this ETF for 17.6 years in order that your return will match its initial yield.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Stocks and Bonds Are Falling in Lockstep at Pace Unseen in DecadesBonds have long been advertised as offering strong returns and hedging against the expected swings in stocks. That hedge has evaporated this year.

Stocks and Bonds Are Falling in Lockstep at Pace Unseen in DecadesBonds have long been advertised as offering strong returns and hedging against the expected swings in stocks. That hedge has evaporated this year.

Read more »

Market has gone 'too far' at pricing in Fed rate hikes, says Mohamed El-ErianMohamed El-Erian, Allianz and Gramercy advisor and president of Queens' College, Cambridge, joins CNBC's 'Squawk Box' to discuss the Federal Reserve's upcoming interest rate decision, markets and more.

Market has gone 'too far' at pricing in Fed rate hikes, says Mohamed El-ErianMohamed El-Erian, Allianz and Gramercy advisor and president of Queens' College, Cambridge, joins CNBC's 'Squawk Box' to discuss the Federal Reserve's upcoming interest rate decision, markets and more.

Read more »

Review: “Old Friends” ,including Judi Dench,Imelda Staunton, Bernadette Peters and Damian Lewis, Knock It Out Of The Park For Stephen Sondheim.Cameron Mackintosh ,the London theatre owner and impresario, nixed the idea of having a host introduce artists performing at Tuesday’s one-night only Old Friends tribute show ,honoring the legacy o…

Review: “Old Friends” ,including Judi Dench,Imelda Staunton, Bernadette Peters and Damian Lewis, Knock It Out Of The Park For Stephen Sondheim.Cameron Mackintosh ,the London theatre owner and impresario, nixed the idea of having a host introduce artists performing at Tuesday’s one-night only Old Friends tribute show ,honoring the legacy o…

Read more »

Weekend of violence leaves 7 dead, raises total to 50 homicides this year in JacksonvilleA violent weekend shoved Jacksonville's homicide rate to 50 on Sunday; behind last year's 4-month rate, but 'terribly violent,' says community leader.

Weekend of violence leaves 7 dead, raises total to 50 homicides this year in JacksonvilleA violent weekend shoved Jacksonville's homicide rate to 50 on Sunday; behind last year's 4-month rate, but 'terribly violent,' says community leader.

Read more »

Apparently, Four-Year-Old Megan Fox 'Manifested' Machine Gun KellyIf the thread is traced back far enough, it might be fair to say that Fox’s devout manifestations years and years ago may have saved pop-punk.

Apparently, Four-Year-Old Megan Fox 'Manifested' Machine Gun KellyIf the thread is traced back far enough, it might be fair to say that Fox’s devout manifestations years and years ago may have saved pop-punk.

Read more »

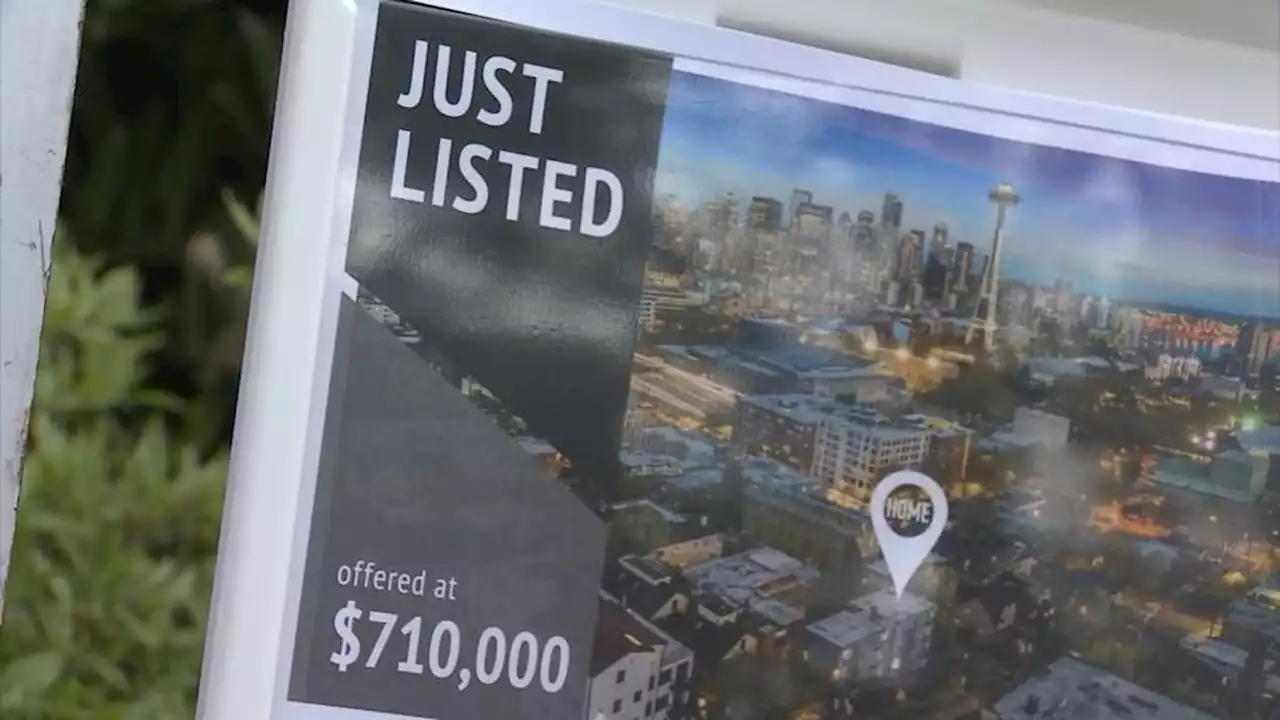

More inventory presents opportunities for homebuyers amid rising interest ratesInterest rates have jumped more than 2% since the start of the year – the biggest quarterly increase in 28 years.

More inventory presents opportunities for homebuyers amid rising interest ratesInterest rates have jumped more than 2% since the start of the year – the biggest quarterly increase in 28 years.

Read more »