A macro forex guide exploring how to trade the New Zealand and Australian Dollars – and why they are tied to Chinese growth – through the prism of the Core-Perimeter model.

AUD and NZD Analysis, China Trade Relations With Australia and New Zealand, Understanding the Core-Perimeter Model -TALKING POINTS:MORE MACRO FOREX TRADING GUIDES IN THIS SERIES) both tend to do well when global risk appetite is elevated, and when investors feel good about prospects for global growth. However, while both can and do rise when investors are buoyant, the specific issue of China’s growth tends to be especially important.

In general, they are more vulnerable to external shocks than ones that rely on internal demand to power growth. Under these circumstances, NZD and AUD tend to weaken along with other growth-oriented assets as core demand for exports from the perimeter is anticipated to decline.

Australia and New Zealand are broadly raw-material exporting economies, which makes investors’ global growth assessment as important to their direction as their own domestic dataLeveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Forex trading involves risk. Losses can exceed deposits.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Aussie Dollar Technical Analysis: AUD/USD, AUD/NZD, AUD/JPY Price SetupsThe Aussie dollar is one of the more recent standouts in the FX space, benefitting from a risk off environment and hotter-than-expected inflation. AUD Setups analysed

Aussie Dollar Technical Analysis: AUD/USD, AUD/NZD, AUD/JPY Price SetupsThe Aussie dollar is one of the more recent standouts in the FX space, benefitting from a risk off environment and hotter-than-expected inflation. AUD Setups analysed

Read more »

NZD/JPY Price Analysis: NZD Bulls fuel an upward trend, signs of slowing momentum observedThe NZD/JPY pair, currently trading at 91.57, is recording gains of 0.45%, indicative of a reinforced bullish momentum.

NZD/JPY Price Analysis: NZD Bulls fuel an upward trend, signs of slowing momentum observedThe NZD/JPY pair, currently trading at 91.57, is recording gains of 0.45%, indicative of a reinforced bullish momentum.

Read more »

Australian Dollar Outlook & Sentiment Analysis: AUD/USD, AUD/JPYThis article thoroughly investigates current retail sentiment on the Australian dollar, with a specific focus on the AUD/USD and AUD/JPY. In the piece, we also scrutinize potential market scenarios based on contrarian technical signals.

Australian Dollar Outlook & Sentiment Analysis: AUD/USD, AUD/JPYThis article thoroughly investigates current retail sentiment on the Australian dollar, with a specific focus on the AUD/USD and AUD/JPY. In the piece, we also scrutinize potential market scenarios based on contrarian technical signals.

Read more »

Australian Dollar Outlook – AUD/USD and AUD/JPY Technical and Sentiment AnalysisThe Australian dollar is picking back up against the US dollar and continues to plough ahead against the Yen, for now at least

Australian Dollar Outlook – AUD/USD and AUD/JPY Technical and Sentiment AnalysisThe Australian dollar is picking back up against the US dollar and continues to plough ahead against the Yen, for now at least

Read more »

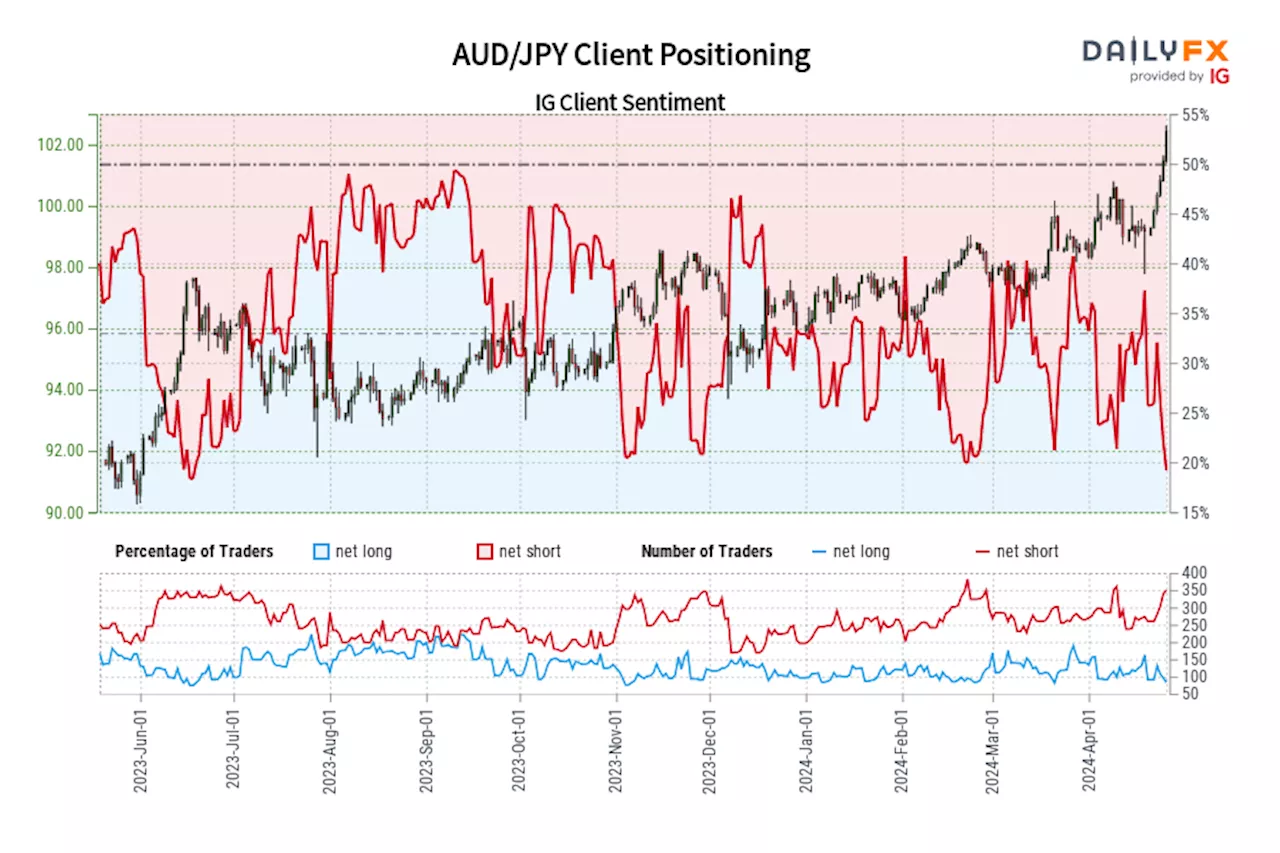

AUD/JPY IG Client Sentiment: Our data shows traders are now at their least net-long AUD/JPY since Jun 19 when AUD/JPY traded near 97.22.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUD/JPY-bullish contrarian trading bias.

AUD/JPY IG Client Sentiment: Our data shows traders are now at their least net-long AUD/JPY since Jun 19 when AUD/JPY traded near 97.22.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUD/JPY-bullish contrarian trading bias.

Read more »

AUD/USD IG Client Sentiment: Our data shows traders are now net-short AUD/USD for the first time since Jan 03, 2024 when AUD/USD traded near 0.67.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUD/USD-bullish contrarian trading bias.

AUD/USD IG Client Sentiment: Our data shows traders are now net-short AUD/USD for the first time since Jan 03, 2024 when AUD/USD traded near 0.67.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUD/USD-bullish contrarian trading bias.

Read more »