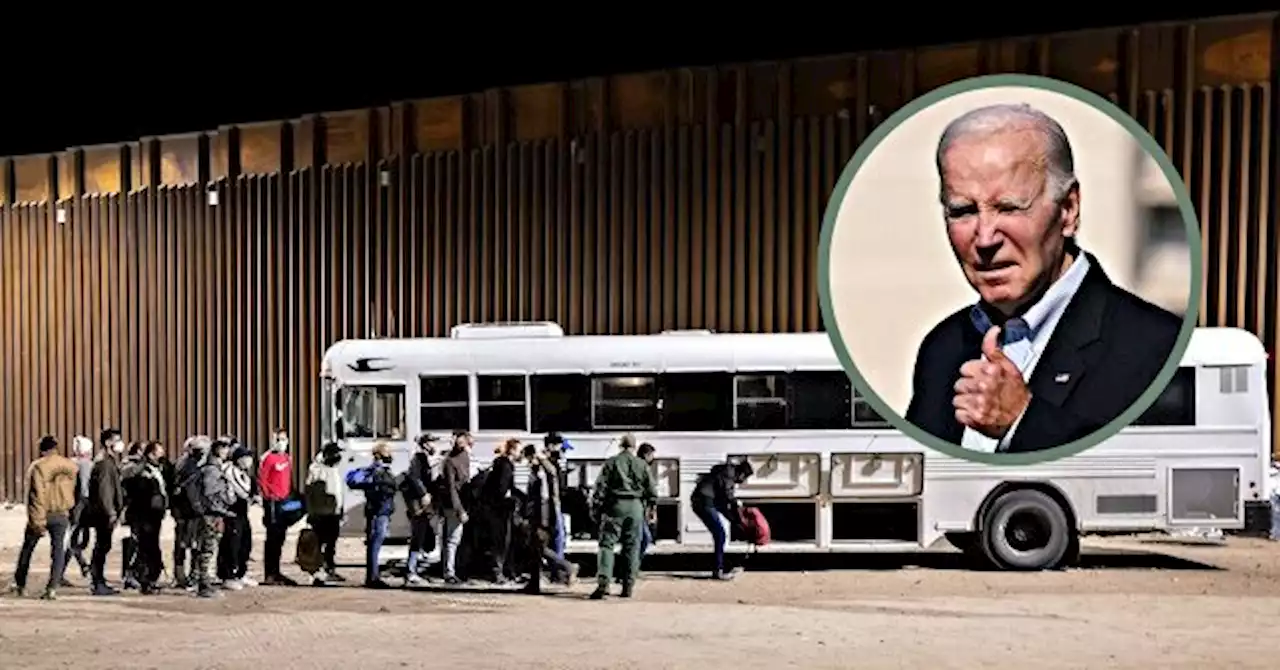

House Republicans are looking to dismantle Biden's expansive Catch and Release network through a Continuing Resolution.

House Republicans are looking to dismantle President Joe Biden’s expansive Catch and Release network at the United States-Mexico border through a Continuing Resolution that would help avoid a government shutdown come October 1.

RJ Hauman, president of the National Immigration Center for Enforcement and visiting advisor at the Heritage Foundation, told Breitbart News that the CR gives House Republicans a straightforward path to defunding Biden’s border policies. The bill comes as Department of Homeland Security Inspector General Joseph Cuffari revealed this month that Biden’s Catch and Release network is releasingThis is the equivalent of adding a foreign population the size of New Orleans, Louisiana to the U.S. every six months or a foreign population the size of Seattle, Washington every year.

“America’s workforce cannot flourish with the unchecked, unfettered illegal immigration that is Biden’s border invasion,” Rep. Bob Good , chairman of the subcommittee, said at the hearing.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Ninth House: Release Date Prediction & Everything We Know About The Prime Video AdaptationThe next adaptation from the Shadow and Bone's author.

Ninth House: Release Date Prediction & Everything We Know About The Prime Video AdaptationThe next adaptation from the Shadow and Bone's author.

Read more »

House Republicans release short-term bill to avert government shutdown until Oct. 31The legislation, brokered between GOP factions, would include spending cuts and a conservative border measure, making it unlikely to pass the Democratic-led Senate.

House Republicans release short-term bill to avert government shutdown until Oct. 31The legislation, brokered between GOP factions, would include spending cuts and a conservative border measure, making it unlikely to pass the Democratic-led Senate.

Read more »

Hunter Biden sues IRS over release of his tax recordsAmong other things, Biden is seeking $1,000 for each unauthorized disclosure and attorneys fees.

Hunter Biden sues IRS over release of his tax recordsAmong other things, Biden is seeking $1,000 for each unauthorized disclosure and attorneys fees.

Read more »

Biden's son Hunter sues IRS, alleges unlawful release of his taxesPresident Joe Biden's son Hunter Biden sued the U.S. Internal Revenue Service on Monday, alleging unlawful disclosure of his taxes by whistleblowers who work for the U.S. tax agency.

Biden's son Hunter sues IRS, alleges unlawful release of his taxesPresident Joe Biden's son Hunter Biden sued the U.S. Internal Revenue Service on Monday, alleging unlawful disclosure of his taxes by whistleblowers who work for the U.S. tax agency.

Read more »