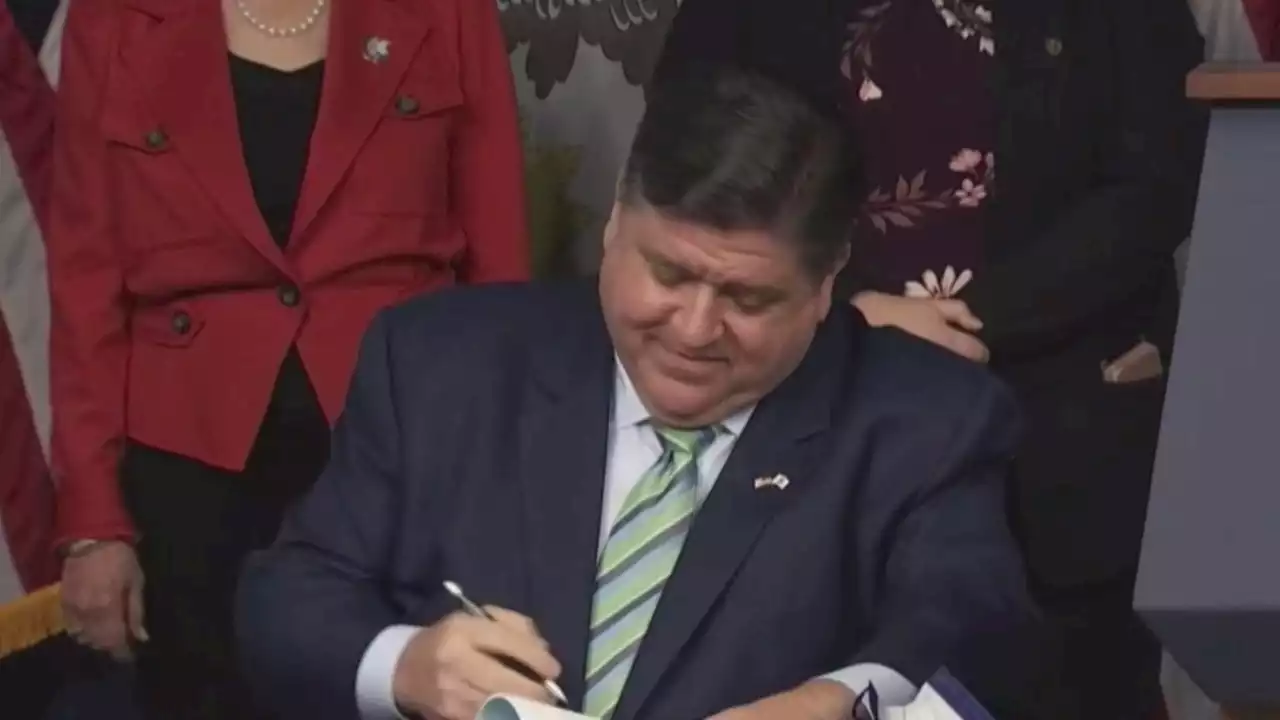

Due to better-than-expected revenue projections, the state of Illinois paused the annual increase in gasoline taxes and its tax on grocery items for a period of time, but both levies will make their return in 2023.

Due to better-than-expected revenue projections and escalating inflation, the state of Illinois paused the annual increase in gasoline taxes and its tax on grocery items for a period of time, but both levies will make their return in 2023.

In fact, the inflation-based gas tax increase could occur twice within a six-month span, according to officials, while the grocery tax will return in the summer.Get Chicago local news, weather forecasts, sports and entertainment stories to your inbox.As part of the state’s 2023 fiscal year budget, a mandatory increase in the gas tax that was tied to inflation was delayed by six months.

That increase was slated to cost motorists 2.2 cents per gallon, but under terms of the legislation, the new percentage was calculated by using the amount the Department of Labor’s Consumer Price Index for All Urban Consumers increased over a 12-month period ending on Sept. 1. That number turned out to be 8.2%, and as a result, Illinois motorists will see a fuel tax increase of roughly 3.2 cents per gallon, bringing the state’s total fuel tax on unleaded gasoline to 42.4 cents per gallon.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

New Driving Laws You Should Know About in Illinois for 2023More than 180 new laws take effect in Illinois at the start of the new year, and among them are a number of traffic-related changes drivers might want to know about.

New Driving Laws You Should Know About in Illinois for 2023More than 180 new laws take effect in Illinois at the start of the new year, and among them are a number of traffic-related changes drivers might want to know about.

Read more »

New Illinois laws that will take effect in 2023There are over 180 new laws passed by the Illinois General Assembly that are set to take effect on Jan. 1, 2023. Here is a list of some of those new laws.

New Illinois laws that will take effect in 2023There are over 180 new laws passed by the Illinois General Assembly that are set to take effect on Jan. 1, 2023. Here is a list of some of those new laws.

Read more »

EXPLAINER: 2023 tax credits for EVs will boost their appealStarting Jan. 1, many Americans will qualify for a tax credit of up to $7,500 for buying an electric vehicle.

EXPLAINER: 2023 tax credits for EVs will boost their appealStarting Jan. 1, many Americans will qualify for a tax credit of up to $7,500 for buying an electric vehicle.

Read more »

New corporate stock buyback tax poised to take effect in 2023: What to knowThe 1% tax on share repurchases passed by Democrats earlier this year begins in January, but many companies say they remain unfazed by the new penalty.

New corporate stock buyback tax poised to take effect in 2023: What to knowThe 1% tax on share repurchases passed by Democrats earlier this year begins in January, but many companies say they remain unfazed by the new penalty.

Read more »

EXPLAINER: 2023 tax credits for EVs will boost their appealStarting Jan. 1, many Americans will qualify for a tax credit of up to $7,500 for buying an electric vehicle. The credit, part of changes enacted in the Inflation Reduction Act, is designed to spur EV sales and reduce greenhouse emissions.

EXPLAINER: 2023 tax credits for EVs will boost their appealStarting Jan. 1, many Americans will qualify for a tax credit of up to $7,500 for buying an electric vehicle. The credit, part of changes enacted in the Inflation Reduction Act, is designed to spur EV sales and reduce greenhouse emissions.

Read more »

2023 tax credits for electric vehicles will boost their appealStarting Jan. 1, many Americans will qualify for a tax credit of up to $7,500 for buying an electric vehicle. The credit, part of changes enacted in the Inflation Reduction Act, is designed to spur EV sales and reduce greenhouse emissions.

2023 tax credits for electric vehicles will boost their appealStarting Jan. 1, many Americans will qualify for a tax credit of up to $7,500 for buying an electric vehicle. The credit, part of changes enacted in the Inflation Reduction Act, is designed to spur EV sales and reduce greenhouse emissions.

Read more »