Goldman Sachs, JPM see the S&P 500 hitting new highs in coming months

U.S. equities could rally over the coming four weeks, Goldman Sachs strategists said Monday, citing positive technical equity dynamics and a tailwind from corporate buybacks.

The analysis predicts that in a stable or rising market, approximately $27 billion could flow into US stocks, while a declining market could still see about $22.9 billion in inflows. However, there is a cautionary note regarding the period after September 16, as historically, the second half of September has historically been the worst two-week trading period of the year.In a similar vein, recent economic data and earnings reports have reinforced JPMorgan Chase & Co.'s confidence in a continued rally for US stocks through the end of the year.

JPMorgan's analysis points to an average 4.2% return for the US stock benchmark in the final quarter of the year, based on data from this century.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Goldman Sachs, JPM see the S&P 500 hitting new highs in coming monthsGoldman Sachs, JPM see the S&P 500 hitting new highs in coming months

Goldman Sachs, JPM see the S&P 500 hitting new highs in coming monthsGoldman Sachs, JPM see the S&P 500 hitting new highs in coming months

Read more »

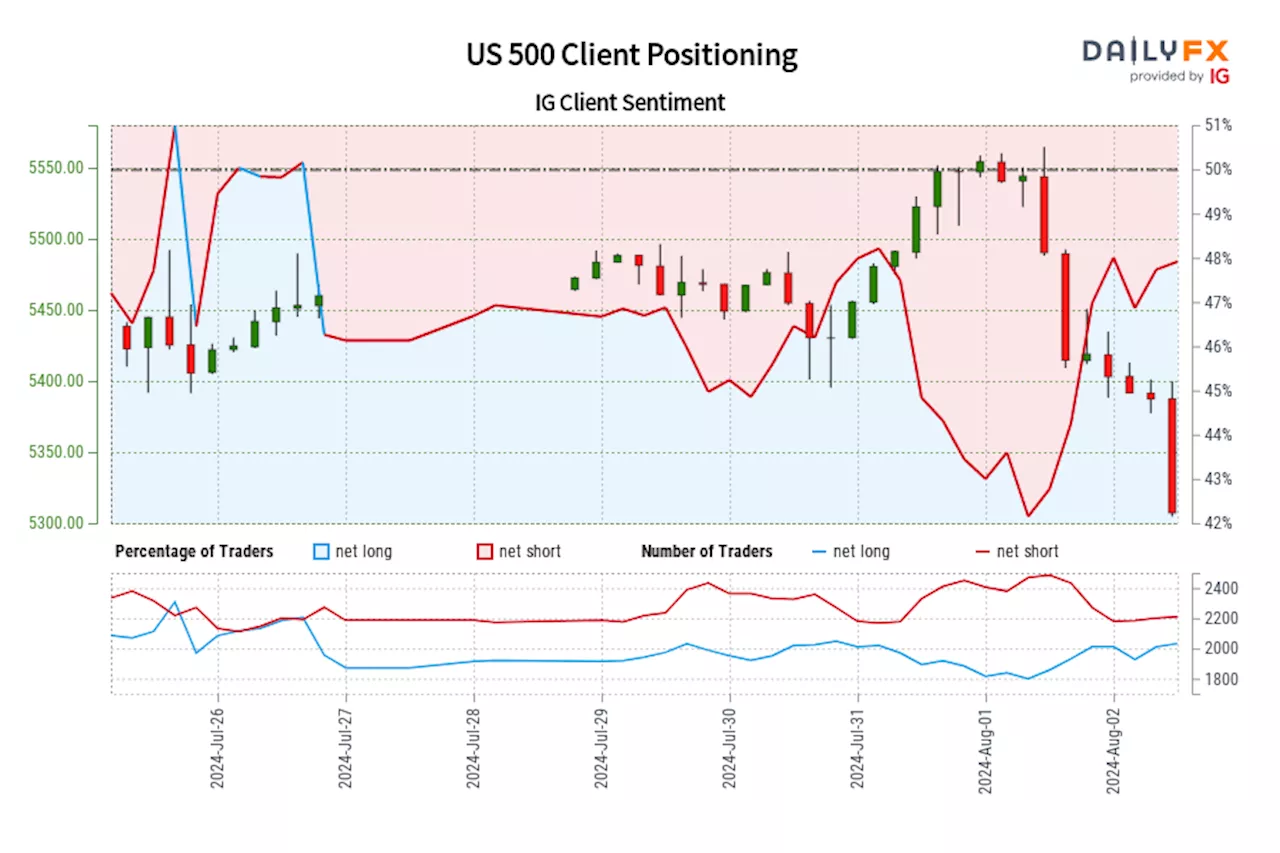

US 500 IG Client Sentiment: Our data shows traders are now net-long US 500 for the first time since Jul 26, 2024 16:00 GMT when US 500 traded near 5,459.96.Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed US 500 trading bias.

US 500 IG Client Sentiment: Our data shows traders are now net-long US 500 for the first time since Jul 26, 2024 16:00 GMT when US 500 traded near 5,459.96.Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed US 500 trading bias.

Read more »

US 500 IG Client Sentiment: Our data shows traders are now net-long US 500 for the first time since Apr 25, 2024 when US 500 traded near 5,091.12.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger US 500-bearish contrarian trading bias.

US 500 IG Client Sentiment: Our data shows traders are now net-long US 500 for the first time since Apr 25, 2024 when US 500 traded near 5,091.12.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger US 500-bearish contrarian trading bias.

Read more »

US recession risk easing, 'confident' Fed will cut by 25bps in Sept: Goldman SachsUS recession risk easing, 'confident' Fed will cut by 25bps in Sept: Goldman Sachs

US recession risk easing, 'confident' Fed will cut by 25bps in Sept: Goldman SachsUS recession risk easing, 'confident' Fed will cut by 25bps in Sept: Goldman Sachs

Read more »

Goldman Sachs lowers odds of US recession to 20% from 25%Goldman Sachs lowers odds of US recession to 20% from 25%

Goldman Sachs lowers odds of US recession to 20% from 25%Goldman Sachs lowers odds of US recession to 20% from 25%

Read more »

Labor market, AI key themes in US earnings calls: Goldman SachsLabor market, AI key themes in US earnings calls: Goldman Sachs

Labor market, AI key themes in US earnings calls: Goldman SachsLabor market, AI key themes in US earnings calls: Goldman Sachs

Read more »