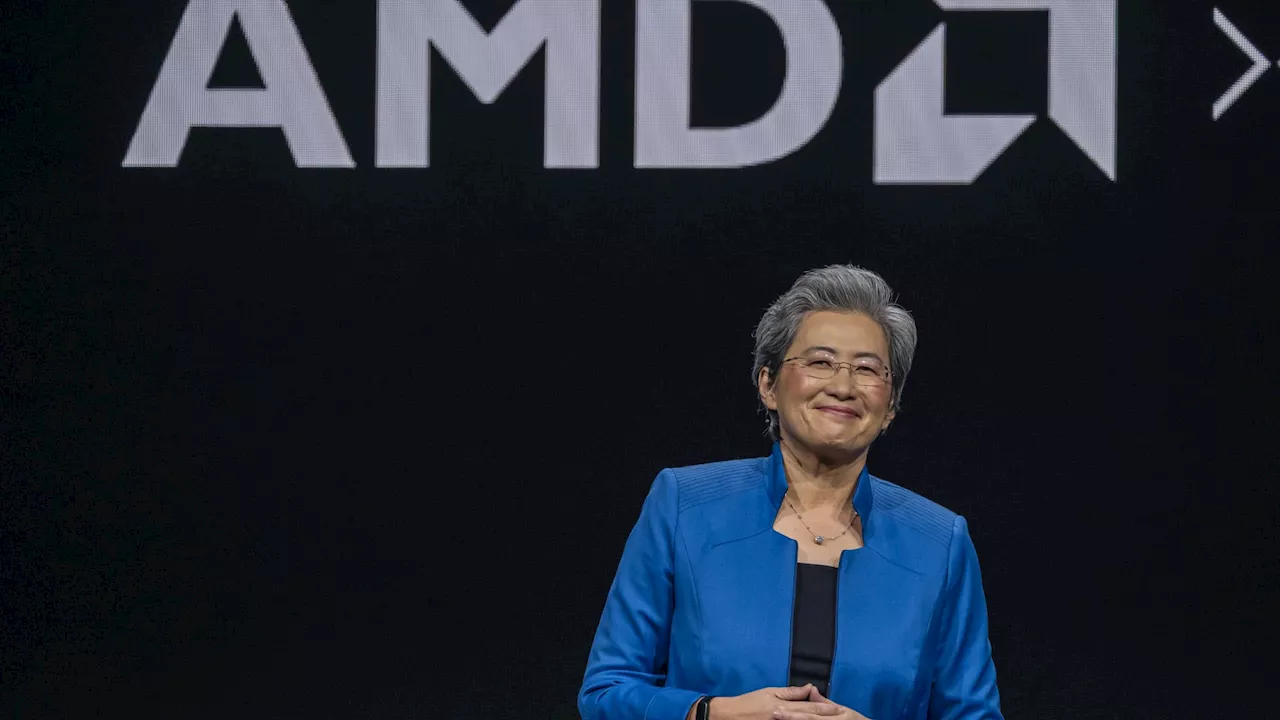

Shares of Advanced Micro Devices will trade range-bound until investors gain renewed optimism about the company's future growth trajectory, Goldman Sachs wrote.

A rising competitive landscape is set to weigh on Advanced Micro Devices down even more, according to Goldman Sachs. The bank downgraded the semiconductor stock to neutral from buy, also cutting its 12-month price target to $129 from $175. This updated forecast represents a less than 6% upside for shares of AMD. Shares of AMD shed 18% in 2024 and have added less than 1% this year.

on Wednesday double downgraded the chipmaker to reduce from buy, also citing strong competition. "We see additional downside as we now believe its AI GPU roadmap is less competitive than we previously thought," analyst Frank Lee wrote. To be sure, most analysts remain bullish on AMD. Of the 54 analysts who cover the stock, 42 rate it as a buy or a strong buy. The average analyst price target implies upside of 47.8%.

Stock Markets Advanced Micro Devices Inc Business News

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Sabrina Carpenter Just Out Sabrina Carpentered Herself Pairing Micro-Micro Shorts and a Leopard BlazerKelsey (she/her) is a freelance fashion editor and writer, specializing in e-commerce and celebrity style content. With more than nine years of experience in digital media, Kelsey has a knack for turning top-performing content into top-selling content.

Sabrina Carpenter Just Out Sabrina Carpentered Herself Pairing Micro-Micro Shorts and a Leopard BlazerKelsey (she/her) is a freelance fashion editor and writer, specializing in e-commerce and celebrity style content. With more than nine years of experience in digital media, Kelsey has a knack for turning top-performing content into top-selling content.

Read more »

Goldman Sachs names Alex Golten as chief risk officerGoldman Sachs names Alex Golten as chief risk officer

Read more »

Investing Club's Q3 Earnings Recap: AI Fuels Growth, Goldman Sachs AddedThe Investing Club reviews the third-quarter earnings season, highlighting the positive impact of AI on company performance and the addition of Goldman Sachs to the portfolio.

Investing Club's Q3 Earnings Recap: AI Fuels Growth, Goldman Sachs AddedThe Investing Club reviews the third-quarter earnings season, highlighting the positive impact of AI on company performance and the addition of Goldman Sachs to the portfolio.

Read more »

Goldman Sachs Forecasts 2.4% US GDP Growth in 2025, Predicts Rate CutsGoldman Sachs economists predict a 2.4% GDP growth for the US in 2025, driven by strong domestic demand and AI-powered business investments. They also anticipate three rate cuts by the Federal Reserve in 2025, citing declining inflation and the impact of potential tariffs.

Goldman Sachs Forecasts 2.4% US GDP Growth in 2025, Predicts Rate CutsGoldman Sachs economists predict a 2.4% GDP growth for the US in 2025, driven by strong domestic demand and AI-powered business investments. They also anticipate three rate cuts by the Federal Reserve in 2025, citing declining inflation and the impact of potential tariffs.

Read more »

Goldman Sachs Doubles Cloudflare Price Target, Sees 'Substantial Gains'Goldman Sachs has doubled its price target for Cloudflare shares to $140 from $77, citing several catalysts that could drive substantial gains for the company over the next several months.

Goldman Sachs Doubles Cloudflare Price Target, Sees 'Substantial Gains'Goldman Sachs has doubled its price target for Cloudflare shares to $140 from $77, citing several catalysts that could drive substantial gains for the company over the next several months.

Read more »

Goldman Sachs Adds Uber to Conviction List, Projects Massive GainsGoldman Sachs has added Uber Technologies to its 'Conviction List – Directors' Cut', projecting massive gains for the stock in the coming years. The firm believes Uber's path to increased profitability, even with the imminent adoption of autonomous vehicles, is strong. Goldman also highlights Norwegian Cruise Line's potential for growth in the cruise industry, driven by investments in private islands.

Goldman Sachs Adds Uber to Conviction List, Projects Massive GainsGoldman Sachs has added Uber Technologies to its 'Conviction List – Directors' Cut', projecting massive gains for the stock in the coming years. The firm believes Uber's path to increased profitability, even with the imminent adoption of autonomous vehicles, is strong. Goldman also highlights Norwegian Cruise Line's potential for growth in the cruise industry, driven by investments in private islands.

Read more »