Resilient economic growth and softening inflation will keep stocks supported, says Goldman Sachs, which has a new bullish S&P 500 target.

A baby bull market is poised to keep toddling along, with equity futures indicating the S&P 500 SPX could push beyond 4,300 on Monday. But then much depends on the pivotal Fed meeting and inflation data.

The latest S&P 500 push has done nothing to convince the bearish Mike Wilson of Morgan Stanley who is repeating his view that gains can’t last because the earnings recession isn’t over. He says investors may be making two costly assumptions right now: And while the S&P’s current price/earnings multiple of 19 times is bigger than expected, thanks to a few mega cap stocks, the strategists say “prior episodes of sharply narrowing breadth have been followed by a ‘catch-up’ from a broader valuation re-rating.” Breadth refers to how many stocks are participating in the current rally, with some worried the bear-market exit for the S&P 500 has largely been driven by a few tech stocks.

Kostin and the team say big downside risks to their cheerier S&P 500 view are “an unexpected downturn in growth and stubborn inflation that triggers a hawkish Fed pivot.” A mild recession could knock 10% off S&P EPS, bringing it down to $200 and in line with the historical 13% average fall during recessions, they said.

The buzz A two-day Fed meeting starts Tuesday, with May CPI due the same day. Among other highlights — producer prices for for Wednesday, retail sales and regional manufacturing surveys on Thursday. For Monday, we’ll get an update on the federal budget at 2 p.m. Policy decisions from the European Central Bank and Bank of Japan will come Thursday and Friday, respectively.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Why Are There Over 500 Pubs in the U.K. With the Same Name?There are thousands of pubs across the UK, but hundreds share the same name. We delve into the history of why over 500 pubs call themselves the Red Lion pub.

Why Are There Over 500 Pubs in the U.K. With the Same Name?There are thousands of pubs across the UK, but hundreds share the same name. We delve into the history of why over 500 pubs call themselves the Red Lion pub.

Read more »

9 stocks hedge and mutual funds love: Goldman SachsGoldman Sachs analyzed 1,246 hedge and mutual funds with a combined $4.8 trillion in holdings. Here are the 9 stocks they agree are worth buying.

Read more »

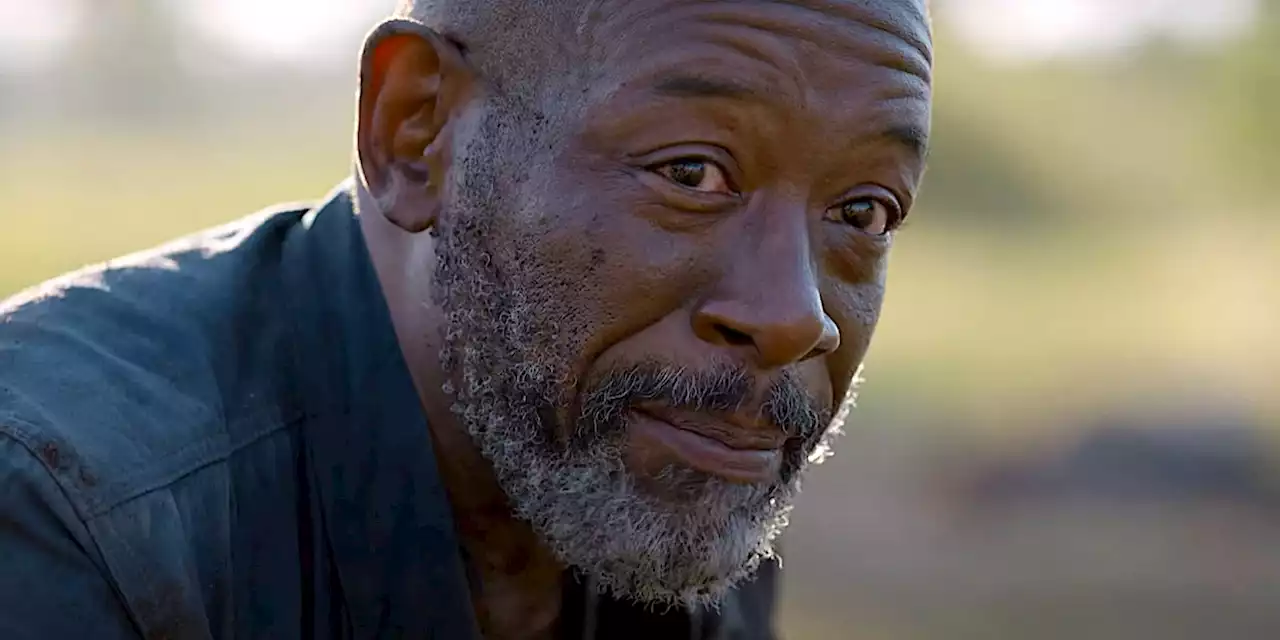

Fear the Walking Dead Season 8, Episode 6 Trailer: Morgan Sees Red AgainA new trailer for Fear the Walking Dead season 8, episode 6 sees Morgan returning to a violent state after major events from the previous episode.

Fear the Walking Dead Season 8, Episode 6 Trailer: Morgan Sees Red AgainA new trailer for Fear the Walking Dead season 8, episode 6 sees Morgan returning to a violent state after major events from the previous episode.

Read more »

China's property sector set to be persistently weak for years -GoldmanChina's property sector is expected to grapple with 'persistent weakness' for years, Goldman Sachs analysts said, adding that its problems would continue to drag on the country's economic growth.

China's property sector set to be persistently weak for years -GoldmanChina's property sector is expected to grapple with 'persistent weakness' for years, Goldman Sachs analysts said, adding that its problems would continue to drag on the country's economic growth.

Read more »

Goldman Sachs slashes oil price forecast by nearly 10% as Russian supply recoversRussia's oil production has remained resilient even in the face of Western sanctions.

Goldman Sachs slashes oil price forecast by nearly 10% as Russian supply recoversRussia's oil production has remained resilient even in the face of Western sanctions.

Read more »

'Breaking Bad' actor Mike Batayeh dead at 52'Breaking Bad' star Mike Batayeh has died at 52.

'Breaking Bad' actor Mike Batayeh dead at 52'Breaking Bad' star Mike Batayeh has died at 52.

Read more »