Investors are hopeful that the Federal Reserve can bring down consumer prices without hurting the economy, creating a Goldilocks environment that benefits stocks and bonds. Inflation data released on Tuesday showed that consumer prices were unchanged in October, signaling a turning point.

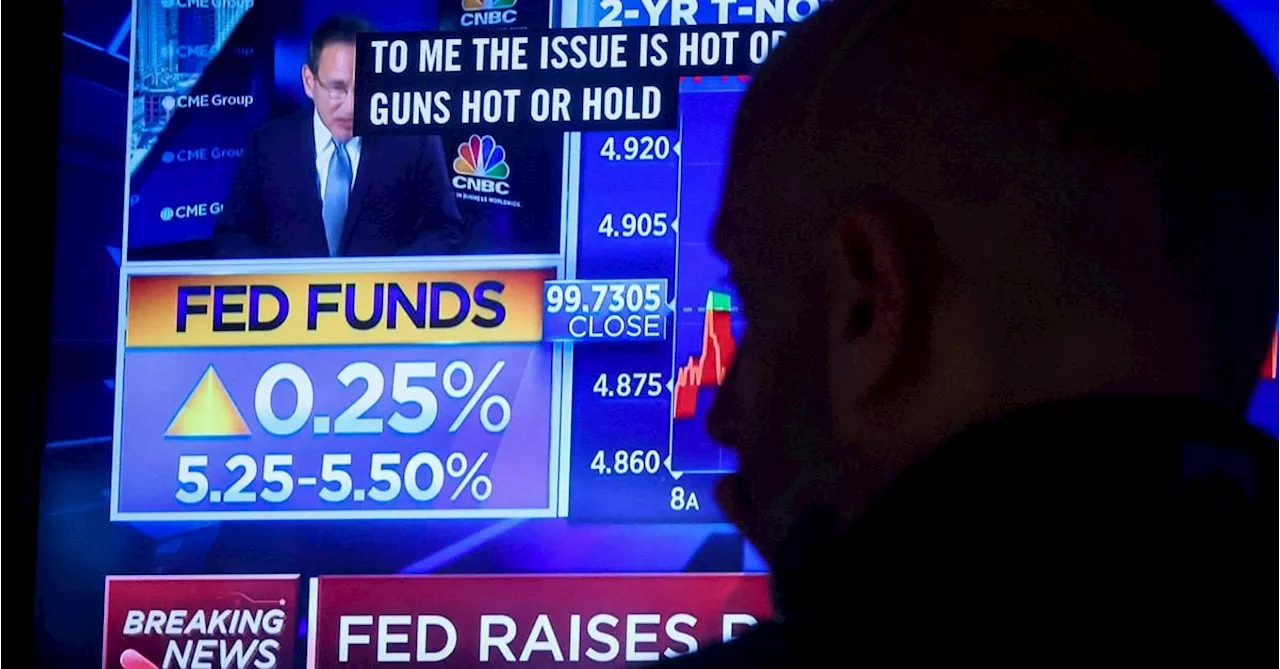

A trader reacts as a screen displays the Fed rate announcement on the floor of the New York Stock Exchange (NYSE) in New York City, U.S., July 26, 2023. REUTERS/Brendan McDermid/File Photoreport is bolstering hopes that the Federal Reserve can bring down consumer prices without hurting the economy, a so-called Goldilocks environment that investors believe will benefit stocks and bonds.

Both asset classes have ripped higher in November following a months-long wobble, fueled by hopes that the Fed was unlikely to deliver any more of theInflation data released on Tuesday supported the view that a turning point is near: consumer prices were unchanged on a monthly basis for October, the first such reading in more than a year and a softer figure than analysts were expecting.“The broader market has been challenged with this consensus negative view about both a recession and inflation," said Eric Kuby, chief investment officer at North Star Investment Management Corp. "Reality is telling a different story. This does feel like a Goldilocks moment for the entire marke

Goldilocks Federal Reserve Consumer Prices Economy Stocks Bonds Inflation Data

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Wind power industry in moment of reckoning as stocks fall and earnings crumbleRenewable energy firms are mostly suffering a dire earnings season as struggling supply chains, manufacturing faults and rising production costs eat into profits.

Wind power industry in moment of reckoning as stocks fall and earnings crumbleRenewable energy firms are mostly suffering a dire earnings season as struggling supply chains, manufacturing faults and rising production costs eat into profits.

Read more »

Stocks Are Poised to FallThis week includes a race on Capitol Hill to pass a temporary government funding bill and the release of the latest consumer price index data.

Stocks Are Poised to FallThis week includes a race on Capitol Hill to pass a temporary government funding bill and the release of the latest consumer price index data.

Read more »

GBP/USD extends gains near 1.2230, focus on UK, US inflation dataGBP/USD extends its gains for the second consecutive day, trading higher around 1.2230 during the Asian session on Monday.

GBP/USD extends gains near 1.2230, focus on UK, US inflation dataGBP/USD extends its gains for the second consecutive day, trading higher around 1.2230 during the Asian session on Monday.

Read more »

This week's October inflation data looms large on Washington's economic radarHere’s what will have the markets’ attention this week

This week's October inflation data looms large on Washington's economic radarHere’s what will have the markets’ attention this week

Read more »

Week ahead: Inflation numbers in the spotlightFollowing a subdued (somewhat monotonous) week, the economic calendar will give us more to get our teeth into this week.

Week ahead: Inflation numbers in the spotlightFollowing a subdued (somewhat monotonous) week, the economic calendar will give us more to get our teeth into this week.

Read more »

Walking Dead Just Teased The Show's Darkest Protagonist Moment In 13 YearsThe Walking Dead has been to some dark places over the past 13 years, but one episode teases a moment that would have surpassed them all.

Walking Dead Just Teased The Show's Darkest Protagonist Moment In 13 YearsThe Walking Dead has been to some dark places over the past 13 years, but one episode teases a moment that would have surpassed them all.

Read more »