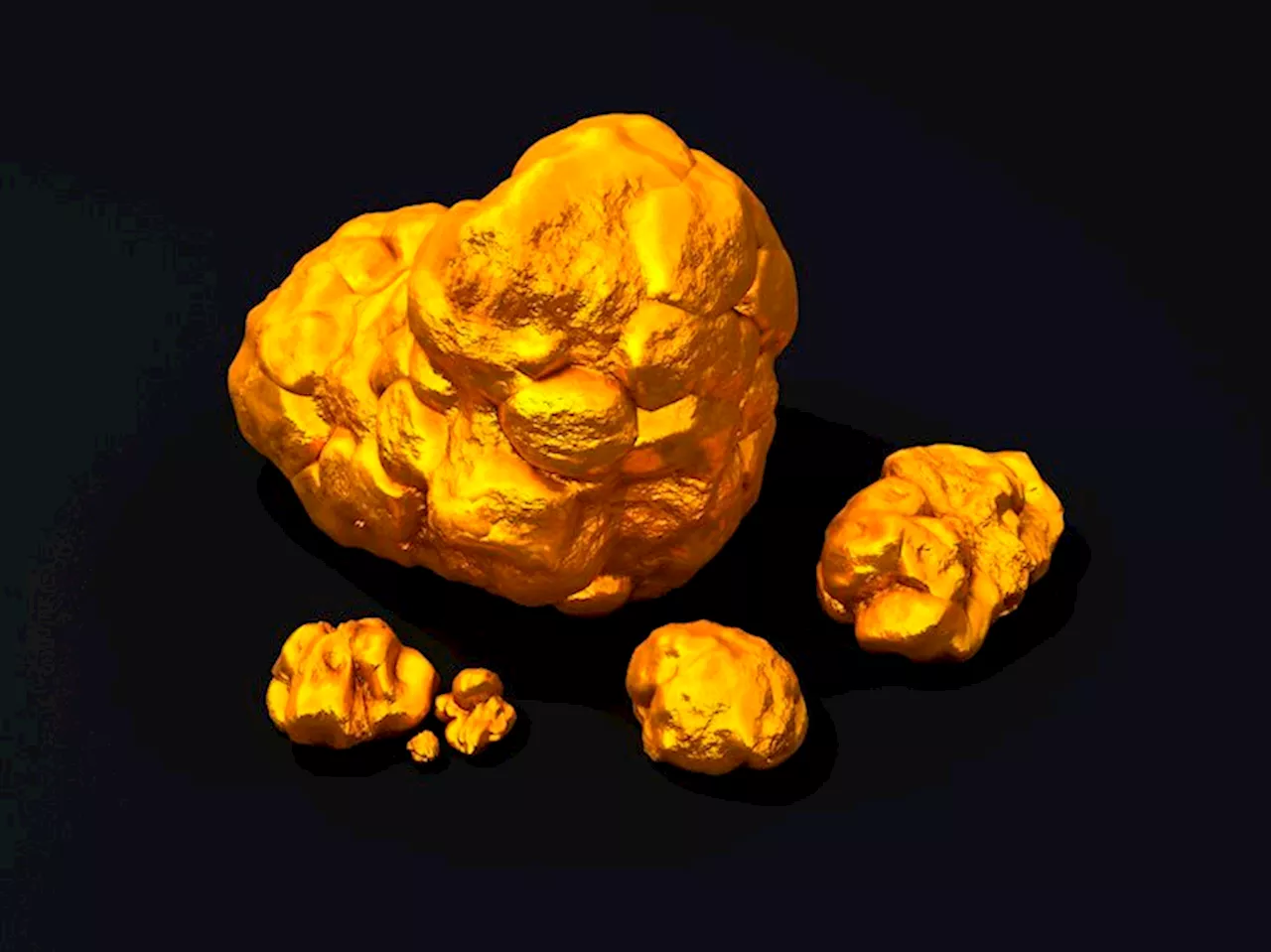

Gold price exceeded the $2,000 mark again for the first time in five months and a half on Friday.

Economists at Commerzbank analyze the yellow metal’s outlook. Gold to lose momentum if the tailwind lent by buying by speculative investors abates The increase in the Gold price is likely to lose momentum if the tailwind lent by buying by speculative investors abates. Furthermore, it is possible that the Fed might have to raise its key rate again after all, contrary to what the market currently expects.

At the press conference following the Fed meeting, Fed Chair Powell will probably leave the door open to another rate hike in December. What is more, it remains to be seen whether Friday’s data will indicate the cooling that is hoped for in the US labour market. If this fails to materialise yet again, a Fed rate hike in December could become more likely again.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Gold Price Forecast: XAU/USD buyers recapture $2,000, what’s next?Gold price has entered a phase of consolidation at the start of a new week, following a massive surge to a fresh five-month high of $2,009 set last Fr

Gold Price Forecast: XAU/USD buyers recapture $2,000, what’s next?Gold price has entered a phase of consolidation at the start of a new week, following a massive surge to a fresh five-month high of $2,009 set last Fr

Read more »

Gold Price Forecast: XAU/USD to soar on a regional escalation of the Middle East conflictGold should remain a good hedge, despite worries that rates will remain higher for longer, economists at UBS report.

Gold Price Forecast: XAU/USD to soar on a regional escalation of the Middle East conflictGold should remain a good hedge, despite worries that rates will remain higher for longer, economists at UBS report.

Read more »

Gold Price Forecast: XAU/USD dips below $2000 as Middle East conflict fears easeGold price (XAU/USD) fell below the $2000 mark late in the New York session, registering losses of 0.

Gold Price Forecast: XAU/USD dips below $2000 as Middle East conflict fears easeGold price (XAU/USD) fell below the $2000 mark late in the New York session, registering losses of 0.

Read more »

Gold Price Forecast: XAU/USD remains capped below the $2,000 barrier, Chinese PMI data loomsGold price (XAU/USD) consolidates below the $2,000 psychological mark during the early Asian session on Monday.

Gold Price Forecast: XAU/USD remains capped below the $2,000 barrier, Chinese PMI data loomsGold price (XAU/USD) consolidates below the $2,000 psychological mark during the early Asian session on Monday.

Read more »

Gold Price Forecast: XAU/USD bullish potential remains intact, focus shifts to FedGold price Is catching a breather below $2000 early Tuesday, having corrected sharply from near five-month highs on Monday.

Gold Price Forecast: XAU/USD bullish potential remains intact, focus shifts to FedGold price Is catching a breather below $2000 early Tuesday, having corrected sharply from near five-month highs on Monday.

Read more »