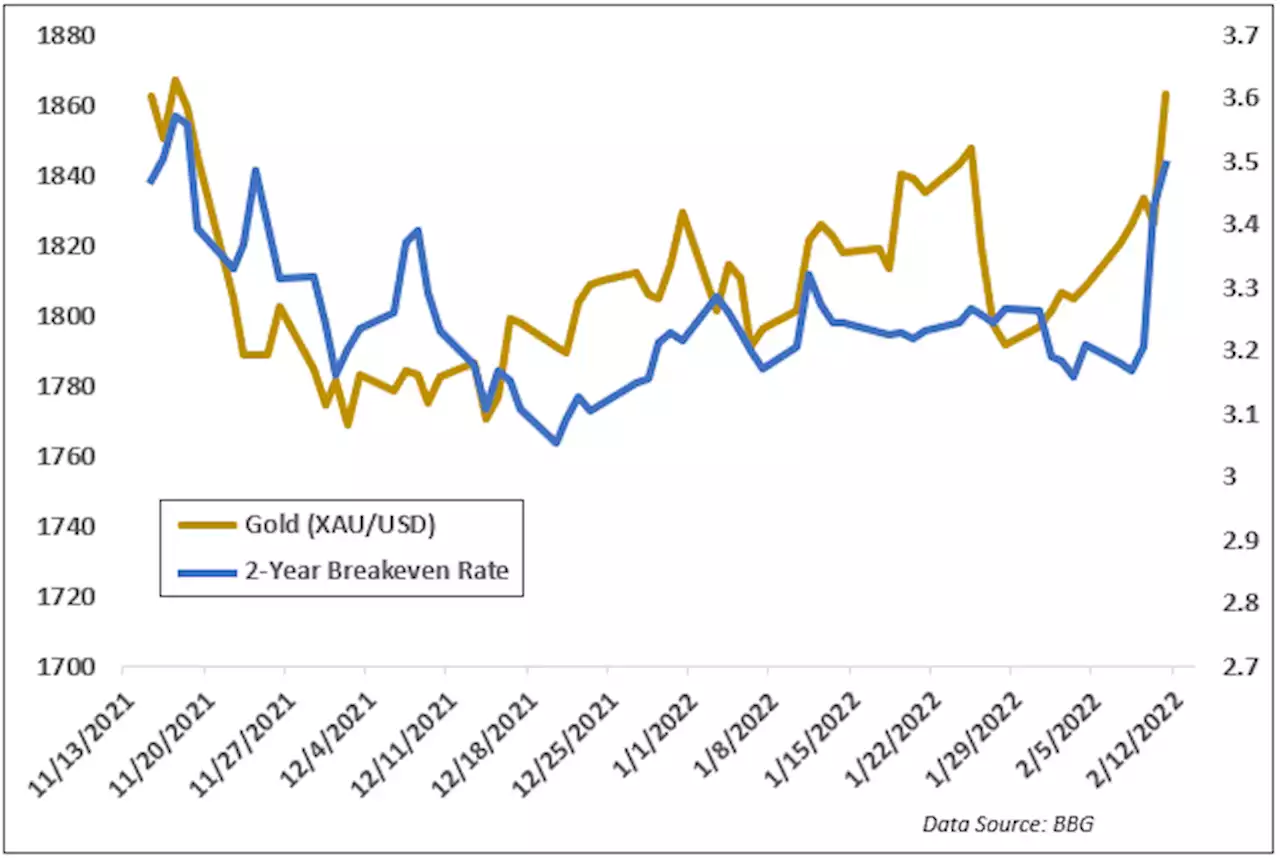

Gold prices rose to the highest level since November last week after a red-hot CPI report pushed up breakeven rates. Bulls followed through on the move as geopolitical tensions in Ukraine rose. Get your weekly gold forecast from FxWestwater here:

Gold shined last week, aided by a late-week rally after geopolitical tensions over an impending Russian invasion into Ukraine intensified. The risk of war has investors flowing into safe-haven assets, pushing gold to its highest level since November 19, as the United States and the United Kingdom warned its citizens to leave the country as soon as possible.

Earlier last week, the US reported its highest rate of inflation in 40 years, causing the yield curve to flatten as traders priced in a more aggressive outlook on monetary tightening. That signals a possible growth slowdown may be on the horizon. US consumer confidence fell too. That is bad news for the economic recovery seeing as how the Fed hasn’t even started to hike rates yet.

The super-charged CPI numbers did bolster the chances for a 50-basis point rate hike at the March FOMC meeting. Some rate traders are speculating over the possibility of an emergency rate hike, fearing that the Federal Reserve has now fallen behind the curve on inflation. That would mark a major shift in the central bank’s calculus from just a few months ago when the Fed removed ‘transitory’ from its verbiage over inflation.

Breakeven rates – a market-based inflation outlook gauge – rose to their highest levels of 2022. That is a tailwind for gold as it suggests markets see higher inflation, which is a boon for gold. Volatility in equity markets should provide XAU with an added tailwind. Traders will watch the upcoming US retail sales print for January and the FOMC minutes to gauge gold’s fundamental situation concerning rate hikes and the broader economic recovery.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Gold Weekly Forecast: Is gold finally regaining its inflation-hedge status?Gold Weekly Forecast: Is gold finally regaining its inflation-hedge status? Gold managed to stay resilient despite surging US Treasury bond yields and closed the second straight week in positive territory.

Gold Weekly Forecast: Is gold finally regaining its inflation-hedge status?Gold Weekly Forecast: Is gold finally regaining its inflation-hedge status? Gold managed to stay resilient despite surging US Treasury bond yields and closed the second straight week in positive territory.

Read more »

Gold Forecast: Gold Markets Cause Massive HeadachesWe lost a lot of the big gains, and now gold seems to be exhausted in trying to figure out what to do next. XAUUSD gold xauusd xauusdgold goldprice goldprediction

Gold Forecast: Gold Markets Cause Massive HeadachesWe lost a lot of the big gains, and now gold seems to be exhausted in trying to figure out what to do next. XAUUSD gold xauusd xauusdgold goldprice goldprediction

Read more »

Gold Price Forecast: XAU/USD climbs back above $1,830 level amid retreating bond yieldsGold attracted some dip-buying near the $1,821 region on Friday and for now, seems to have stalled the previous day's retracement slide from over a tw

Gold Price Forecast: XAU/USD climbs back above $1,830 level amid retreating bond yieldsGold attracted some dip-buying near the $1,821 region on Friday and for now, seems to have stalled the previous day's retracement slide from over a tw

Read more »

Gold Price Forecast: XAU/USD extends rebound from $1820, eyes $1840Gold rose further during the American session and climbed to $1836, reaching a fresh daily high. It remains near the top with a bullish tone. The upsi

Gold Price Forecast: XAU/USD extends rebound from $1820, eyes $1840Gold rose further during the American session and climbed to $1836, reaching a fresh daily high. It remains near the top with a bullish tone. The upsi

Read more »

The Most Dominant Snowboarder of All Time Didn’t Need an Olympic Gold to Prove ItHer triumph was very sweet, but her career before it was so much more than her previous blunders at the Games.

The Most Dominant Snowboarder of All Time Didn’t Need an Olympic Gold to Prove ItHer triumph was very sweet, but her career before it was so much more than her previous blunders at the Games.

Read more »

Snowboarding-US veterans win gold in snowboard cross mixed team eventThe United States won gold in the inaugural snowboard cross mixed team event at the Beijing Games on Saturday, with Lindsey Jacobellis beating Italian Michela Moioli in a nail-biting final race.

Snowboarding-US veterans win gold in snowboard cross mixed team eventThe United States won gold in the inaugural snowboard cross mixed team event at the Beijing Games on Saturday, with Lindsey Jacobellis beating Italian Michela Moioli in a nail-biting final race.

Read more »