Gold price (XAU/USD) extends its losing streak for the sixth consecutive trading day on Wednesday.

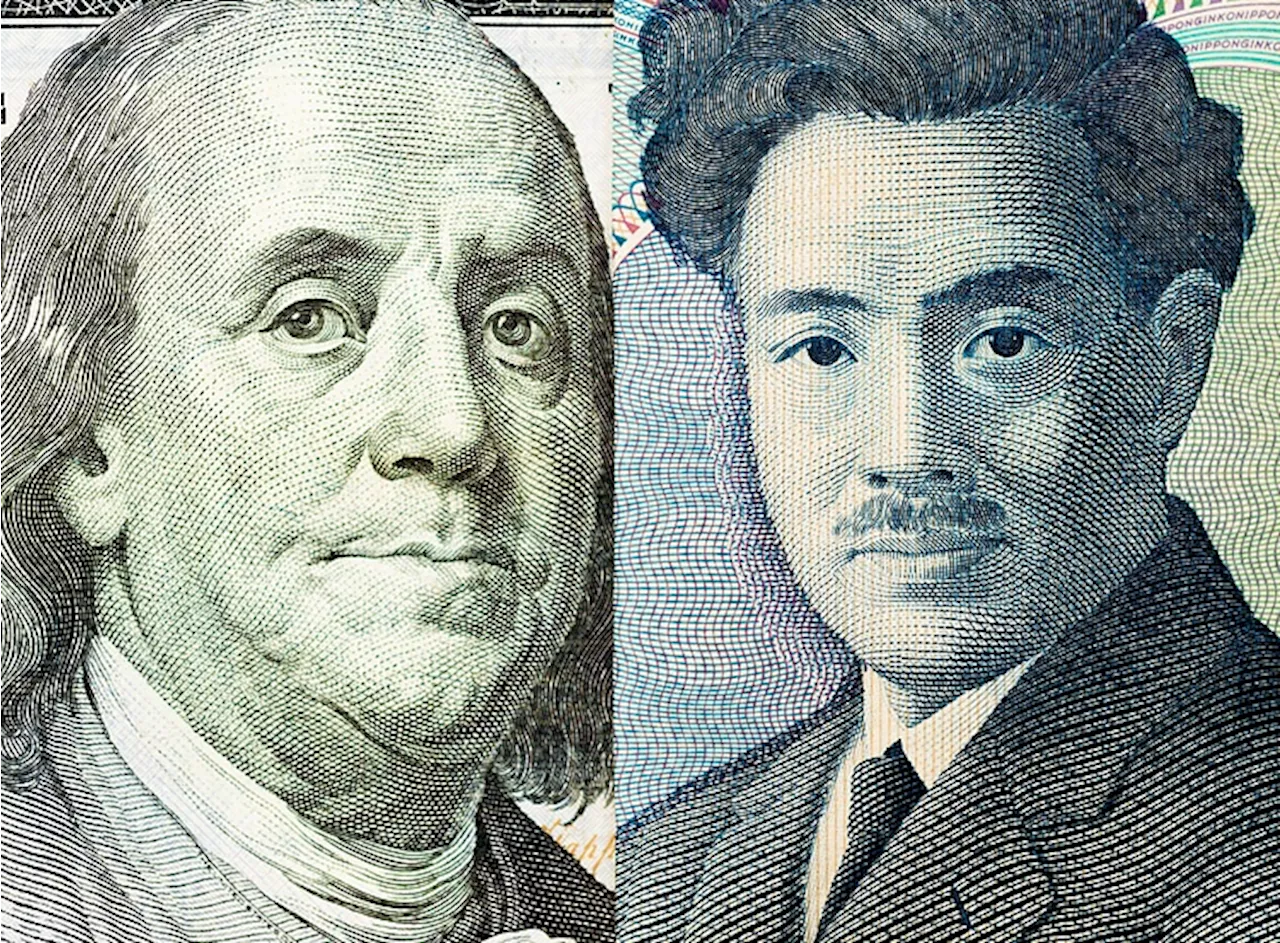

Gold price drops further as fading Fed 50 bps rate cut bets strengthened the US Dollar’s appeal. The downside in Gold price is expected to be limited due to geopolitical tensions. Investors await the FOMC Minutes and the US inflation data for September. Gold price extends its losing streak for the sixth consecutive trading day on Wednesday.

The inflation data will significantly influence market expectations for the Fed’s interest rate outlook for the remainder of the year. According to the CME FedWatch tool, 30-day Federal Fund Futures pricing data shows that there will be a 25-bps interest rate cut in each of the two meetings remaining this year. Technical Analysis: Gold price falls to near $2,610 Gold price extends its correction to near $2,610 from its all-time high of $2,685 as profit-booking remains intact.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Japanese Yen consolidates against USD, looks to FOMC minutes for fresh impetusThe Japanese Yen (JPY) attracted some intraday sellers on Tuesday and assisted the USD/JPY pair to stall its modest pullback from the highest level since August, which was touched the previous day.

Japanese Yen consolidates against USD, looks to FOMC minutes for fresh impetusThe Japanese Yen (JPY) attracted some intraday sellers on Tuesday and assisted the USD/JPY pair to stall its modest pullback from the highest level since August, which was touched the previous day.

Read more »

USD/CAD flat lines below 1.3650, eyes on FOMC MinutesThe USD/CAD pair trades flat around 1.3645 amid the consolidation of the Greenback during the early Asian session on Wednesday.

USD/CAD flat lines below 1.3650, eyes on FOMC MinutesThe USD/CAD pair trades flat around 1.3645 amid the consolidation of the Greenback during the early Asian session on Wednesday.

Read more »

GBP/USD hangs near multi-week low, below 1.3100 as traders await FOMC minutesThe GBP/USD pair struggles to capitalize on the previous day's modest recovery gains and meets with a fresh supply during the Asian session on Wednesday.

GBP/USD hangs near multi-week low, below 1.3100 as traders await FOMC minutesThe GBP/USD pair struggles to capitalize on the previous day's modest recovery gains and meets with a fresh supply during the Asian session on Wednesday.

Read more »

USD/CHF strengthens above 0.8550 ahead of FOMC MinutesThe USD/CHF pair trades on a stronger note to around 0.8575 during the early European session on Wednesday.

USD/CHF strengthens above 0.8550 ahead of FOMC MinutesThe USD/CHF pair trades on a stronger note to around 0.8575 during the early European session on Wednesday.

Read more »

Forex Today: RBNZ opts for a 50 bps cut, FOMC Minutes nextHere is what you need to know on Wednesday, October 9: The action in financial markets remain choppy midweek, with investors' search for the next catalyst continues.

Forex Today: RBNZ opts for a 50 bps cut, FOMC Minutes nextHere is what you need to know on Wednesday, October 9: The action in financial markets remain choppy midweek, with investors' search for the next catalyst continues.

Read more »

USD/CAD advances to 1.3675 area, highest since August 19 ahead of FOMC minutesThe USD/CAD pair scales higher for the sixth successive day on Wednesday and climbs to the 1.3670-1.3675 area, or its highest level since August 19 during the first half of the European session amid renewed US Dollar (USD) buying.

USD/CAD advances to 1.3675 area, highest since August 19 ahead of FOMC minutesThe USD/CAD pair scales higher for the sixth successive day on Wednesday and climbs to the 1.3670-1.3675 area, or its highest level since August 19 during the first half of the European session amid renewed US Dollar (USD) buying.

Read more »