Commodities Analysis by Michele Schneider covering: XAU/USD, XAG/USD, S&P 500, Gold Futures. Read Michele Schneider's latest article on Investing.com

Hedge funds have turned the most bearish on commodities in over a decade, driven by concerns that a deeper economic slowdown could dampen demand for everything from crude oil to metals and grains, according to Bloomberg.

Hedge funds might have anticipated these moves accurately - assuming they don't face a scramble to cover their shorts in the near future.However, I cannot imagine the Fed is not watching gold and oil as carefully as we are.Hedge funds don't understand the power of this gold bull market.Plus, one has to wonder what $2,500 gold does for miners.Momentum is beginning to grab the 50-DAM.It still has to clear the July 6-month calendar range highs at 38.58.

Regardless, GDX looks like it has a lot of room to go, while the indices remain stuck in warning phases with bearish divergences in momentum.Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.would like to remind you that the data contained in this website is not necessarily real-time nor accurate.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

This ETF Is Forming a Promising Technical PatternStocks Analysis by Michele Schneider covering: S&P 500, VanEck Vietnam ETF. Read Michele Schneider's latest article on Investing.com

This ETF Is Forming a Promising Technical PatternStocks Analysis by Michele Schneider covering: S&P 500, VanEck Vietnam ETF. Read Michele Schneider's latest article on Investing.com

Read more »

Here's Why Small Caps, Retail Stocks Are Set to Lead the Market HigherStocks Analysis by Michele Schneider covering: Nasdaq 100, S&P 500, US Small Cap 2000, SPDR® S&P 500. Read Michele Schneider's latest article on Investing.com

Here's Why Small Caps, Retail Stocks Are Set to Lead the Market HigherStocks Analysis by Michele Schneider covering: Nasdaq 100, S&P 500, US Small Cap 2000, SPDR® S&P 500. Read Michele Schneider's latest article on Investing.com

Read more »

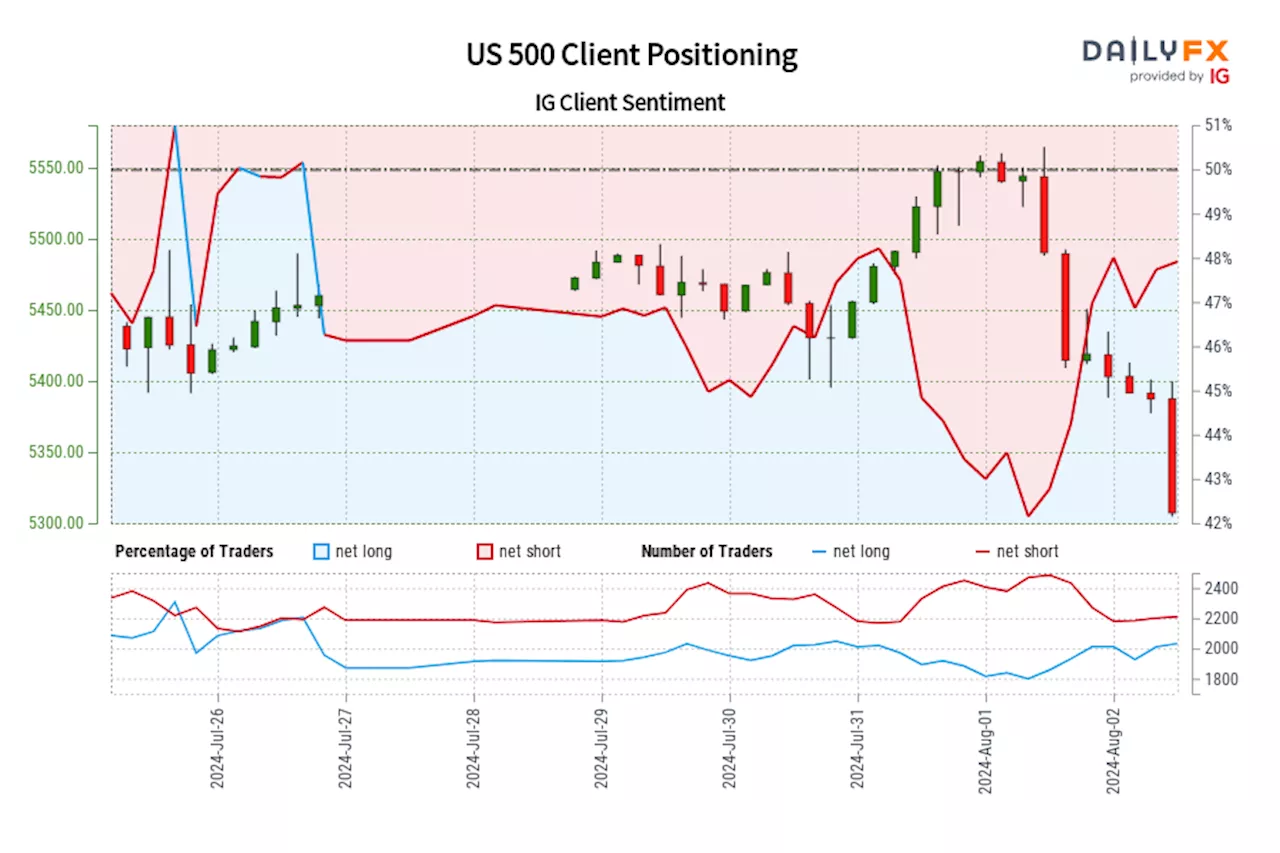

US 500 IG Client Sentiment: Our data shows traders are now net-long US 500 for the first time since Jul 26, 2024 16:00 GMT when US 500 traded near 5,459.96.Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed US 500 trading bias.

US 500 IG Client Sentiment: Our data shows traders are now net-long US 500 for the first time since Jul 26, 2024 16:00 GMT when US 500 traded near 5,459.96.Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed US 500 trading bias.

Read more »

US 500 IG Client Sentiment: Our data shows traders are now net-long US 500 for the first time since Apr 25, 2024 when US 500 traded near 5,091.12.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger US 500-bearish contrarian trading bias.

US 500 IG Client Sentiment: Our data shows traders are now net-long US 500 for the first time since Apr 25, 2024 when US 500 traded near 5,091.12.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger US 500-bearish contrarian trading bias.

Read more »

Is the Market Jumping the Gun on a Trump Win?Market Overview Analysis by Michele Schneider covering: XAU/USD, S&P 500, US Dollar Index Futures, Gold Futures. Read Michele Schneider's latest article on Investing.com

Is the Market Jumping the Gun on a Trump Win?Market Overview Analysis by Michele Schneider covering: XAU/USD, S&P 500, US Dollar Index Futures, Gold Futures. Read Michele Schneider's latest article on Investing.com

Read more »

Rivian Ramps Up Production: Is Wall Street Overlooking the EV Maker's Potential?Stocks Analysis by Michele Schneider covering: Tesla Inc, Rivian Automotive Inc. Read Michele Schneider's latest article on Investing.com

Rivian Ramps Up Production: Is Wall Street Overlooking the EV Maker's Potential?Stocks Analysis by Michele Schneider covering: Tesla Inc, Rivian Automotive Inc. Read Michele Schneider's latest article on Investing.com

Read more »