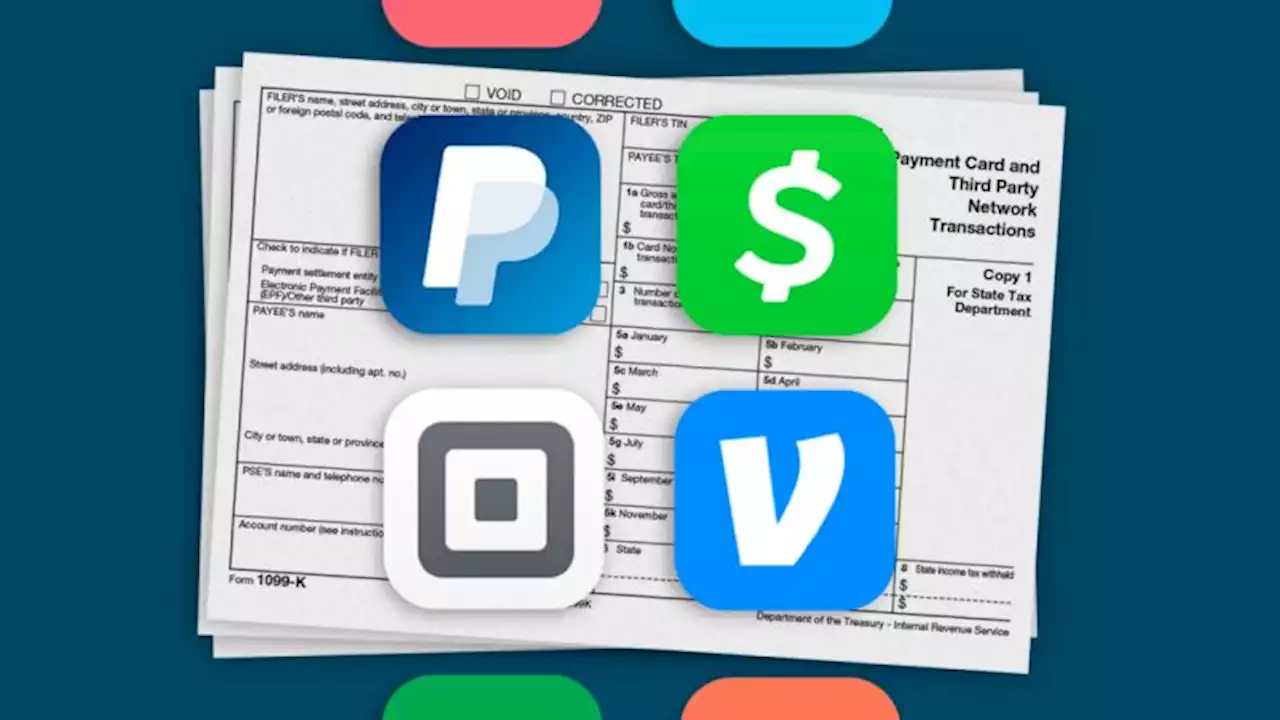

If you get paid through apps like Venmo, PayPal or other third-party platforms, preparing your taxes may be a little more confusing than usual.

A new tax reporting rule requires third-party payment platforms to issue you and the IRS a 1099-K for business transaction payments if they add up to more than $600 over the course of the year. A business transaction that is taxable is defined as a payment for a good or service, including tips. It used to be those platforms only had to issue you a 1099-K if you engaged in more than 200 business transactions for which you received total payments of more than $20,000.

“People are just not going to understand how to take that gross amount and then work off the deductions to get to their taxable amount.” What the new rule doesn’t do The new rule doesn’t impose any additional taxes on anyone. Nor does it change your obligation as a taxpayer to always report to the IRS all of your taxable income from your business activities. But the 1099-K reporting will make it harder for someone to evade the taxes they owe by underreporting their business income.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Be aware of this change when you file taxes in 2023, IRS saysThere’s a change in reporting rules for Form 1099-K, the IRS document used to report payments and transactions from online platforms, apps or payment card processors such as Venmo or PayPal.

Be aware of this change when you file taxes in 2023, IRS saysThere’s a change in reporting rules for Form 1099-K, the IRS document used to report payments and transactions from online platforms, apps or payment card processors such as Venmo or PayPal.

Read more »

You May Get a 1099-K for Venmo and PayPal Payments. Here's How to Prepare — and Shrink Your Tax BillIf you’ve received payments via third-party networks such as Venmo or PayPal, you may get a Form 1099-K. Here’s how to prepare and reduce your tax liability.

You May Get a 1099-K for Venmo and PayPal Payments. Here's How to Prepare — and Shrink Your Tax BillIf you’ve received payments via third-party networks such as Venmo or PayPal, you may get a Form 1099-K. Here’s how to prepare and reduce your tax liability.

Read more »

White Man Shoots Unarmed Black Airbnb Guest in ‘Unprovoked’ Attack, Cops Say66-year-old Mark Waters allegedly opened fire on a 21-year-old unarmed Black man in an “unprovoked attack” the night of Oct. 2, as the unidentified man walked from his Airbnb rental to a local grocery store, according to a news release.

White Man Shoots Unarmed Black Airbnb Guest in ‘Unprovoked’ Attack, Cops Say66-year-old Mark Waters allegedly opened fire on a 21-year-old unarmed Black man in an “unprovoked attack” the night of Oct. 2, as the unidentified man walked from his Airbnb rental to a local grocery store, according to a news release.

Read more »

San Jose homeowner charged in shooting of unarmed Black man renting nearby AirbnbA white San Jose homeowner has been charged with felony assault and may face a hate crime charge in connection with the shooting of an unarmed Black man who was renting a nearby Airbnb, prosecutors said.

San Jose homeowner charged in shooting of unarmed Black man renting nearby AirbnbA white San Jose homeowner has been charged with felony assault and may face a hate crime charge in connection with the shooting of an unarmed Black man who was renting a nearby Airbnb, prosecutors said.

Read more »

Airbnb cracks down on partying just in time for New Year's EveAirbnb takes 'anti-party stance' using stricter technology to block users from hosting New Years Eve house parties

Read more »

White San Jose man accused of unprovoked shooting of unarmed Black manA white homeowner in San Jose has been charged with shooting an unarmed Black man as the victim walked to a grocery store from an Airbnb rental, Santa Clara County prosecutors said.

White San Jose man accused of unprovoked shooting of unarmed Black manA white homeowner in San Jose has been charged with shooting an unarmed Black man as the victim walked to a grocery store from an Airbnb rental, Santa Clara County prosecutors said.

Read more »