Generation Z is embracing 'micro-retirement,' taking breaks from work in their 20s and 30s. But is this trend a path to happiness or financial ruin?

Generation Z has introduced a new concept called 'micro-retirement,' which involves taking breaks from work while still young, rather than waiting until later in life. Some view it as unemployment or a sabbatical, with proponents arguing it alleviates the pressure to constantly chase promotions and raises. This trend has sparked debate about whether it's a smart move or detrimental to their financial future.

\A 26-year-old named Brittney Foley exemplifies this trend, prioritizing experiences and personal fulfillment over traditional career progression. While appealing, concerns arise considering the staggering national credit card debt and the average young person's financial situation. Brittney's perspective reflects a cynical view of the future, where they doubt their ability to afford a home, comfortable retirement, or reap the benefits of Social Security. This leads to a counterculture where younger generations prioritize living for the moment over long-term financial planning.\Another example involves a 30-year-old former Google employee who, despite earning a substantial income, chose to leave her high-paying job to pursue a four-month stay in Hawaii followed by two months in Bali. This raises questions about whether older generations should have embraced similar choices in their youth. However, experts warn of the potential financial consequences of micro-retirement. For instance, employees need to consider the impact on their 401(k) and retirement savings, especially regarding vesting schedules and potential employer contributions. Additionally, career breaks might affect future earning potential and promotions tied to tenure within a company. The strategy hinges on the assumption that individuals can re-enter the workforce at or above their previous salary, which is not guaranteed.\Another concern is the impact on Social Security benefits. While some Gen Z workers believe they won't receive any Social Security, breaks in income can negatively affect long-term benefits. Finally, the trend's emphasis on travel and luxury experiences raises worries about increasing debt levels among young workers. Whether Gen Z's approach is a sign of weakness or a bold strategy for personal fulfillment remains a subject of debate

Finance Lifestyle MICRO-RETIREMENT GENERATION Z FINANCIAL PLANNING CAREER BREAKS SOCIAL SECURITY DEBT

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Gen Z Are Already Planning Their Dream Retirement TripA survey of employed people in the U.S. found that 63 percent of Gen Zers were planning to travel when they reach retirement age.

Gen Z Are Already Planning Their Dream Retirement TripA survey of employed people in the U.S. found that 63 percent of Gen Zers were planning to travel when they reach retirement age.

Read more »

Gen Xers Are Moving to Retirement Havens Like Florida and TexasGen Xers are relocating to retirement destinations at a higher rate than the overall population, drawn by factors such as a strong stock market, remote work options, and a favorable housing market. Florida and Texas, with many retirement havens, are seeing the most significant influx of Gen Xers.

Gen Xers Are Moving to Retirement Havens Like Florida and TexasGen Xers are relocating to retirement destinations at a higher rate than the overall population, drawn by factors such as a strong stock market, remote work options, and a favorable housing market. Florida and Texas, with many retirement havens, are seeing the most significant influx of Gen Xers.

Read more »

Gen Z Think the Retirement Age Should Be LowerGen Z believe that the retirement age should be around 61 years old, while the current U.S. average is between 64 and 66.

Gen Z Think the Retirement Age Should Be LowerGen Z believe that the retirement age should be around 61 years old, while the current U.S. average is between 64 and 66.

Read more »

Pentagon pulling Gen. Milley's security detail and clearance 'immediately,' may face demotion in retirementRetired Gen. Mark Milley's personal security detail and security clearance is being pulled by Defense Secretary Pete Hegseth, multiple senior administration officials tell Fox News.

Pentagon pulling Gen. Milley's security detail and clearance 'immediately,' may face demotion in retirementRetired Gen. Mark Milley's personal security detail and security clearance is being pulled by Defense Secretary Pete Hegseth, multiple senior administration officials tell Fox News.

Read more »

JetBlue offers some pilots early retirement packages, union saysJetBlue is offering early retirement to pilots nearing retirement age

JetBlue offers some pilots early retirement packages, union saysJetBlue is offering early retirement to pilots nearing retirement age

Read more »

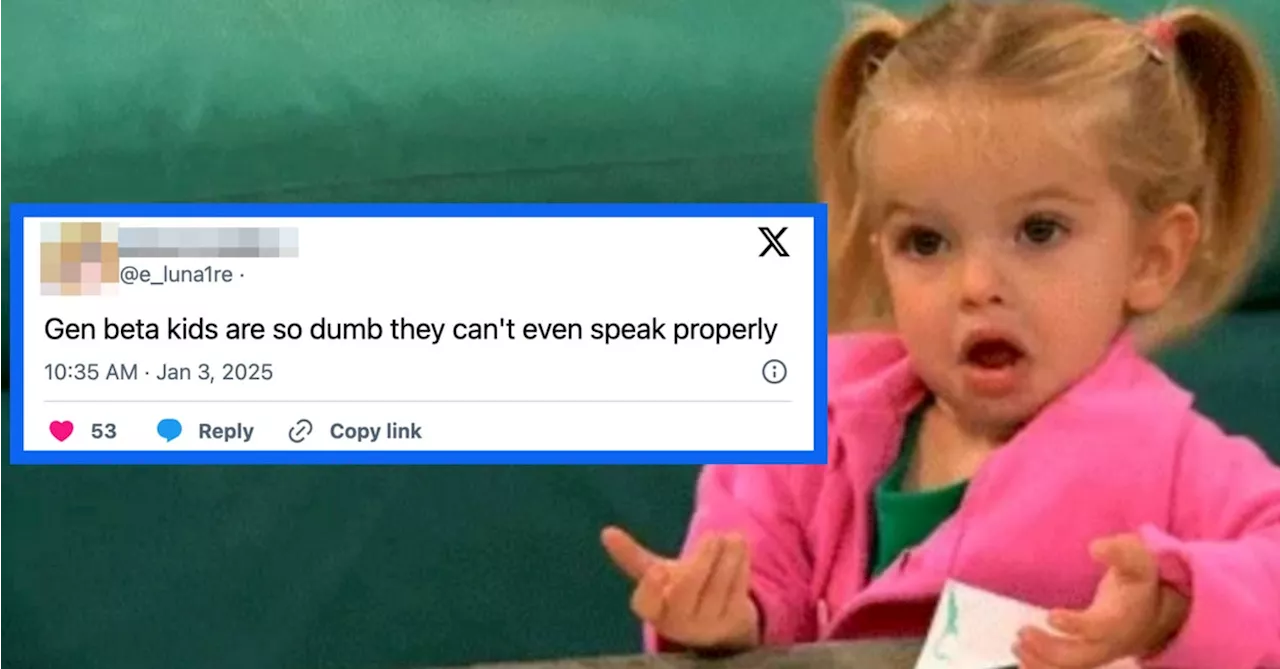

Gen Z Hilariously Roasts the Arrival of Gen BetaWith the official arrival of Generation Beta, born between 2025 and 2039, Gen Z has taken to social media with humorous reactions to being officially two generations old. The article highlights the wit and self-awareness of Gen Z as they grapple with the passage of time and the emergence of a new generation.

Gen Z Hilariously Roasts the Arrival of Gen BetaWith the official arrival of Generation Beta, born between 2025 and 2039, Gen Z has taken to social media with humorous reactions to being officially two generations old. The article highlights the wit and self-awareness of Gen Z as they grapple with the passage of time and the emergence of a new generation.

Read more »