The GBP/USD pair stages a modest recovery from the 1.2365-1.2360 area, or its lowest level since November 14 touched during the Asian session on Monday and for now, seems to have snapped a two-day losing streak.

GBP/USD attracts some dip-buyers on Monday amid a softer USD, though lacks follow-through. Easing geopolitical tensions boosts investors’ confidence and undermines the safe-haven buck. Reduced Fed rate cut bets should help limit the USD losses and cap any further gains for the pair. The uptick is supported by a modest US Dollar downtick and lift spot prices back closer to the 1.2400 mark in the last hour, though any meaningful upside still seems elusive.

The hawkish outlook remains supportive of elevated US Treasury bond yields and acts as a tailwind for the buck. Apart from this, speculations about more aggressive policy easing by the Bank of England might contribute to keeping a lid on any further appreciating move for the GBP/USD pair. There isn't any relevant market-moving economic data due for release on Monday, either from the UK or the US, leaving spot prices at the mercy of the USD price dynamics.

Riskappetite Fed BOE Currencies

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

GBP/USD retreats from 1.2700 as investors brace for the US CPI releaseSterling’s recovery falters at the 1.6680-1.6700 resistance area.

GBP/USD retreats from 1.2700 as investors brace for the US CPI releaseSterling’s recovery falters at the 1.6680-1.6700 resistance area.

Read more »

US Dollar Outlook & Sentiment Analysis: EUR/USD, GBP/USD, USD/CHFThis article offers a comprehensive review of retail sentiment on the U.S. dollar, focusing on three key popular pairs: EUR/USD, GBP/USD and USD/CHF. Additionally, we assess potential directional outcomes from the vantage point of contrarian signals.

US Dollar Outlook & Sentiment Analysis: EUR/USD, GBP/USD, USD/CHFThis article offers a comprehensive review of retail sentiment on the U.S. dollar, focusing on three key popular pairs: EUR/USD, GBP/USD and USD/CHF. Additionally, we assess potential directional outcomes from the vantage point of contrarian signals.

Read more »

GBP/USD clings to mild losses below 1.2700 ahead of US CPI dataThe GBP/USD pair trades with a mild negative bias near 1.2675 during the early Asian session on Wednesday.

GBP/USD clings to mild losses below 1.2700 ahead of US CPI dataThe GBP/USD pair trades with a mild negative bias near 1.2675 during the early Asian session on Wednesday.

Read more »

GBP/USD plunges on hot US CPI, FOMC minutesThe Pound Sterling collapses late on Wednesday during the North American session, down by more than 1% against the US Dollar, following the release of US inflation data.

GBP/USD plunges on hot US CPI, FOMC minutesThe Pound Sterling collapses late on Wednesday during the North American session, down by more than 1% against the US Dollar, following the release of US inflation data.

Read more »

GBP/USD remains under selling pressure below 1.2550, US PPI data loomsThe GBP/USD pair remains under selling pressure near 1.2540 after bouncing off the 2024 low of 1.2520.

GBP/USD remains under selling pressure below 1.2550, US PPI data loomsThe GBP/USD pair remains under selling pressure near 1.2540 after bouncing off the 2024 low of 1.2520.

Read more »

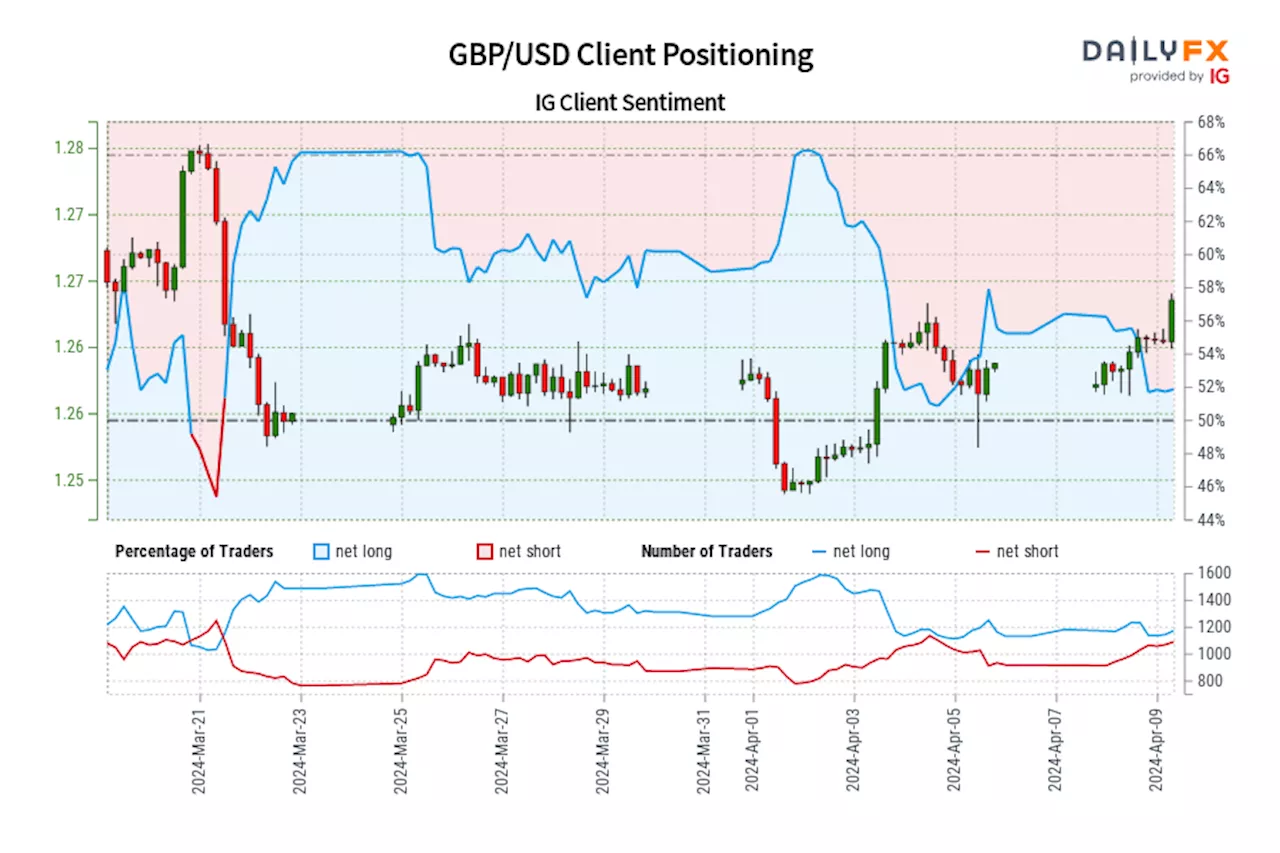

Traders Net-Short GBP/USD for the First Time Since March 21, 2024Our data shows traders are now net-short GBP/USD for the first time since Mar 21, 2024 when GBP/USD traded near 1.27. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bullish contrarian trading bias.

Traders Net-Short GBP/USD for the First Time Since March 21, 2024Our data shows traders are now net-short GBP/USD for the first time since Mar 21, 2024 when GBP/USD traded near 1.27. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bullish contrarian trading bias.

Read more »