The Pound Sterling slumps in the mid-North American session, as robust US economic data could dent the Federal Reserve’s intentions to cut rates.

GBP/USD declines as strong US manufacturing activity and pricing pressures fuel speculation of a persistent Fed policy. The resilience of the US economy, evidenced by ISM data, contrasts with quiet European markets due to holiday closures. Upcoming UK PMI data releases could weigh the GBP/USD as market participants expect further deterioration. That underpinned the Greenback while US Treasury yields skyrocketed, a headwind for Cable. The GBP/USD trades at 1.2587, down 0.57%.

9%, according to data from the CME FedWatch Tool. Last week, Fed Chair Jerome Powell commented in a speech at the San Francisco Fed that the US central bank is in no rush to cut rates. Even though last week’s Core Personal Consumption Expenditure price index came to a touch softer, the Consumer Price Index remains above the 3% threshold. That would keep Fed officials with their hands tied and adhere to the higher for longer mantra.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

GBP/USD hovers around 1.2530 after paring gains, focus on US ISM Manufacturing PMIGBP/USD trims intraday gains, remaining higher around 1.2530 during the Asian hours on Monday.

GBP/USD hovers around 1.2530 after paring gains, focus on US ISM Manufacturing PMIGBP/USD trims intraday gains, remaining higher around 1.2530 during the Asian hours on Monday.

Read more »

US ISM Manufacturing PMI improves to 50.3 in March vs. 48.4 expectedBusiness activity in the US manufacturing sector expanded at a modest pace in March, with the ISM Manufacturing PMI rising to 50.3 from 47.8 in February.

US ISM Manufacturing PMI improves to 50.3 in March vs. 48.4 expectedBusiness activity in the US manufacturing sector expanded at a modest pace in March, with the ISM Manufacturing PMI rising to 50.3 from 47.8 in February.

Read more »

China NBS Manufacturing PMI improves to 50.8 in March, Services PMI climbs to 53.0China’s official Manufacturing Purchasing Managers' Index (PMI) improved to 50.8 in March from the previous reading of 49.1, the latest data published by the country’s National Bureau of Statistics (NBS) showed on Sunday.

China NBS Manufacturing PMI improves to 50.8 in March, Services PMI climbs to 53.0China’s official Manufacturing Purchasing Managers' Index (PMI) improved to 50.8 in March from the previous reading of 49.1, the latest data published by the country’s National Bureau of Statistics (NBS) showed on Sunday.

Read more »

Australia's Judo Bank PMIs come in mixed as Services PMI rises, Manufacturing PMI easesAustralia's Judo Bank Purchasing Managers Index (PMI) came in mixed in the early Thursday market session, with a lift in the Services component mixing with an easing in the Manufacturing PMI.

Australia's Judo Bank PMIs come in mixed as Services PMI rises, Manufacturing PMI easesAustralia's Judo Bank Purchasing Managers Index (PMI) came in mixed in the early Thursday market session, with a lift in the Services component mixing with an easing in the Manufacturing PMI.

Read more »

US S&P Global manufacturing PMI improves to 52.5, Services PMI declines to 51.7 in MarchBusiness activity in the US private sector continued to expand at a healthy pace in early March, with the S&P Global Composite PMI coming in at 52.2.

US S&P Global manufacturing PMI improves to 52.5, Services PMI declines to 51.7 in MarchBusiness activity in the US private sector continued to expand at a healthy pace in early March, with the S&P Global Composite PMI coming in at 52.2.

Read more »

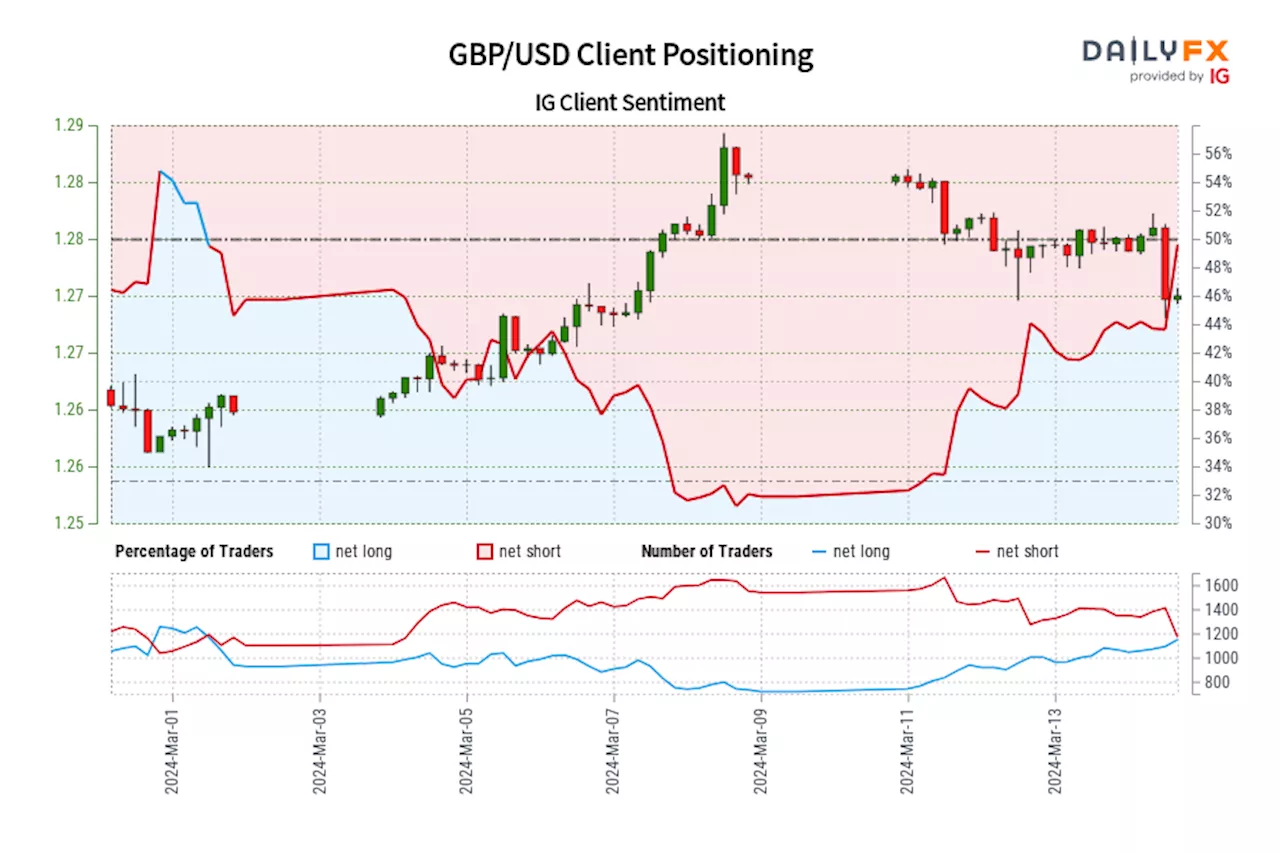

GBP/USD IG Client Sentiment: Our data shows traders are now net-long GBP/USD for the first time since Mar 01, 2024 when GBP/USD traded near 1.26.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bearish contrarian trading bias.

GBP/USD IG Client Sentiment: Our data shows traders are now net-long GBP/USD for the first time since Mar 01, 2024 when GBP/USD traded near 1.26.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bearish contrarian trading bias.

Read more »