FTX, a failed cryptocurrency exchange, is preparing to sell billions of digital assets to repay creditors, causing concerns among regulators. The exchange holds around $2.6 billion of solana and bitcoin, along with $1.7 billion in other cryptocurrencies. The transfer of $100+ million worth of solana to major exchanges suggests an upcoming sale.

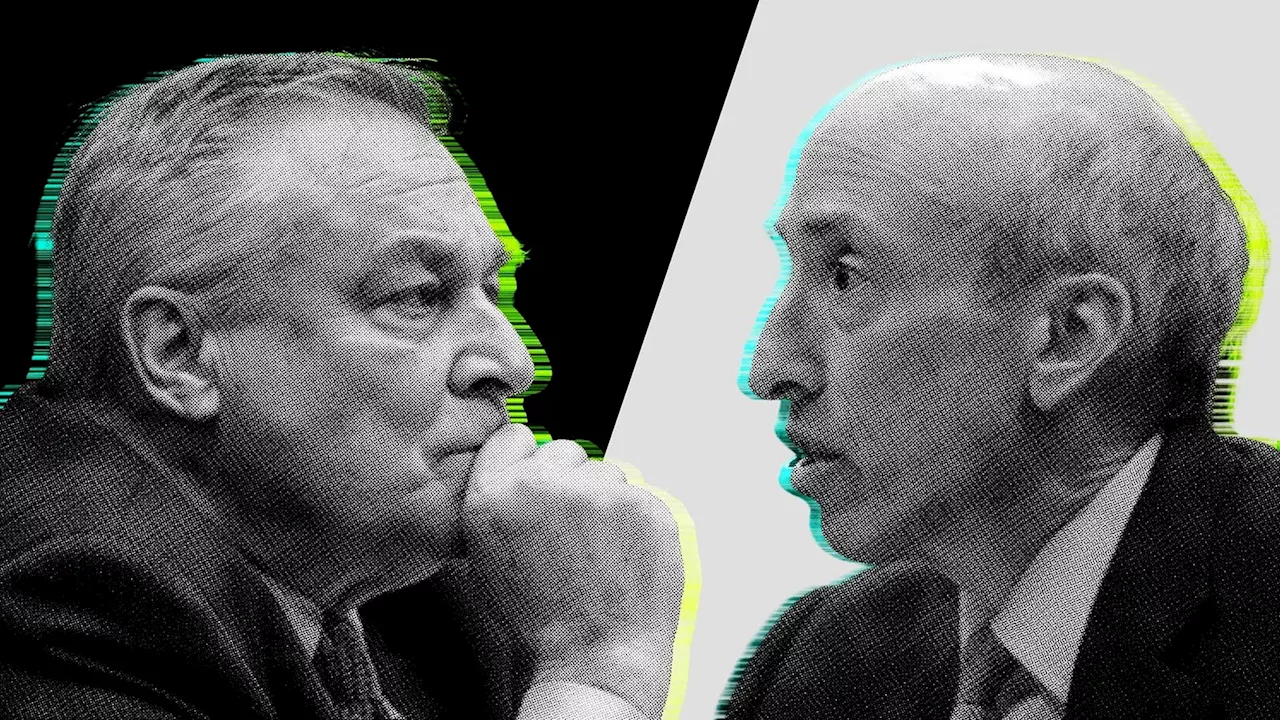

Current FTX CEO John Ray and SEC Chair Gary Gensler could find themselves at odds over FTX ’s plan to sell crypto to repay creditors . With cryptocurrency markets rising, the failed exchange is preparing to sell billions of digital assets held in its coffers. That’s great for customers but problematic for regulators. Its disgraced founder may offer some cold comfort to about a million creditors, but getting some of their money back would be better. FTX is sitting on about $2.

6 billion of solana and bitcoin and another $1.7 billion in other cryptos. It has received judicial approval to start liquidating recovered crypto and has transferred $100+ million worth of solana to major exchanges, indicating a potential sale

FTX Cryptocurrency Exchange Sell Crypto Repay Creditors Regulators Solana Bitcoin Digital Assets

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Calls for Reform in Cryptocurrency Industry Following FTX CollapseThe collapse of FTX and the indictment of Sam Bankman-Fried have prompted calls for reform in the cryptocurrency industry. Linda A. Lacewell, former Superintendent of the New York Department of Financial Services, believes that the California bill, based on New York's bitlicense regime, could provide valuable lessons.

Calls for Reform in Cryptocurrency Industry Following FTX CollapseThe collapse of FTX and the indictment of Sam Bankman-Fried have prompted calls for reform in the cryptocurrency industry. Linda A. Lacewell, former Superintendent of the New York Department of Financial Services, believes that the California bill, based on New York's bitlicense regime, could provide valuable lessons.

Read more »

Crypto's Appeal and the Rejection of Traditional Finance✍️ For her latest piece on hackernoon, CEX•IO’s Head of Communications, Becky Sarwate, waxes on how crypto could restore its foundational promise by looking to its past. 🌱🎓 By making a case for greater community investment from wealthier participants, Becky draws comparisons between educational funding in the U.S., and what crypto can learn from returning to its roots. 📖 Read the piece in full at the link below:

Crypto's Appeal and the Rejection of Traditional Finance✍️ For her latest piece on hackernoon, CEX•IO’s Head of Communications, Becky Sarwate, waxes on how crypto could restore its foundational promise by looking to its past. 🌱🎓 By making a case for greater community investment from wealthier participants, Becky draws comparisons between educational funding in the U.S., and what crypto can learn from returning to its roots. 📖 Read the piece in full at the link below:

Read more »

Oracle Engineer Allegedly Involved in Crypto Management for Cocaine DealersA long-time Oracle engineer was allegedly hiding crypto for imprisoned cocaine dealers who were shifting millions of dollars every month, the DOJ says. One of the dealers protests that the crypto was legitimately acquired.

Oracle Engineer Allegedly Involved in Crypto Management for Cocaine DealersA long-time Oracle engineer was allegedly hiding crypto for imprisoned cocaine dealers who were shifting millions of dollars every month, the DOJ says. One of the dealers protests that the crypto was legitimately acquired.

Read more »

IRS and Treasury officials show flexibility in crypto tax proposalOfficials from the Internal Revenue Service and the U.S. Treasury were interested in how the industry might self-identify assets that have nothing to do with finance and whether stablecoins should be left out of the proposal. After an incredible 124,000 comments have come in on the IRS proposal, the window closes Monday, beginning the final months of the process that could end in the crypto industry's first major crypto regulations in the U.S.

IRS and Treasury officials show flexibility in crypto tax proposalOfficials from the Internal Revenue Service and the U.S. Treasury were interested in how the industry might self-identify assets that have nothing to do with finance and whether stablecoins should be left out of the proposal. After an incredible 124,000 comments have come in on the IRS proposal, the window closes Monday, beginning the final months of the process that could end in the crypto industry's first major crypto regulations in the U.S.

Read more »

Slayyyter: From Googling 'How to sell your soul to the devil' to Pop StardomSlayyyter, a 27-year-old pop star, shares her journey from being bullied by a substitute teacher to becoming one of the most exciting figures in pop music.

Slayyyter: From Googling 'How to sell your soul to the devil' to Pop StardomSlayyyter, a 27-year-old pop star, shares her journey from being bullied by a substitute teacher to becoming one of the most exciting figures in pop music.

Read more »

Bitcoin Rises Over 120% YTD, Crypto Sentiment ImprovesBitcoin has seen a significant increase in price, indicating improved crypto sentiment. Short-term volatility is expected due to upcoming economic data and a government shutdown deadline. Analysts anticipate a rally in Bitcoin in 2024.

Bitcoin Rises Over 120% YTD, Crypto Sentiment ImprovesBitcoin has seen a significant increase in price, indicating improved crypto sentiment. Short-term volatility is expected due to upcoming economic data and a government shutdown deadline. Analysts anticipate a rally in Bitcoin in 2024.

Read more »