FTX crash made regulators hungry.

Calls for harsher regulations around cryptocurrencies and digital assets will likely grow louder in the aftermath of FTX’s collapse — something former United States presidential candidate Andrew Yang said isn’t conducive to making America a hotbed for blockchain innovation.

Speaking at the Texas Blockchain Summit in Austin on Nov. 18, Yang acknowledged that the bankruptcy of FTX and sister company Alameda Research would make common sense crypto regulation“I've always been in the camp that some intelligent regulation is a good thing. I think it would help the industry mature and make it more mainstream.

Yang acknowledged that the path to regulatory clarity on digital assets is more difficult because of the hyper-politicization of the two-party system. As such, the FTX fiasco will only emboldento try and squash the industry. Yang said he’s working with the Bipartisan Policy Center, a Washington, D.C.-based think tank, to educate congresspeople about blockchain technology and its value proposition:

“[W]e e work with the Bipartisan Policy Center to liaise with members of Congress or their offices or their policy teams and just educate them about what these tools are and what they can do and the problems they can solve and why their constituents actually care and value them. We work with the American Conference of Mayors to have various mayors stand up and say, look, the blockchain is a good thing.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

The FTX contagion: Which companies were affected by the FTX collapse?Some of the firms affected include Genesis, Sequoia Capital, Galaxy Digital, and Galois Capital.

The FTX contagion: Which companies were affected by the FTX collapse?Some of the firms affected include Genesis, Sequoia Capital, Galaxy Digital, and Galois Capital.

Read more »

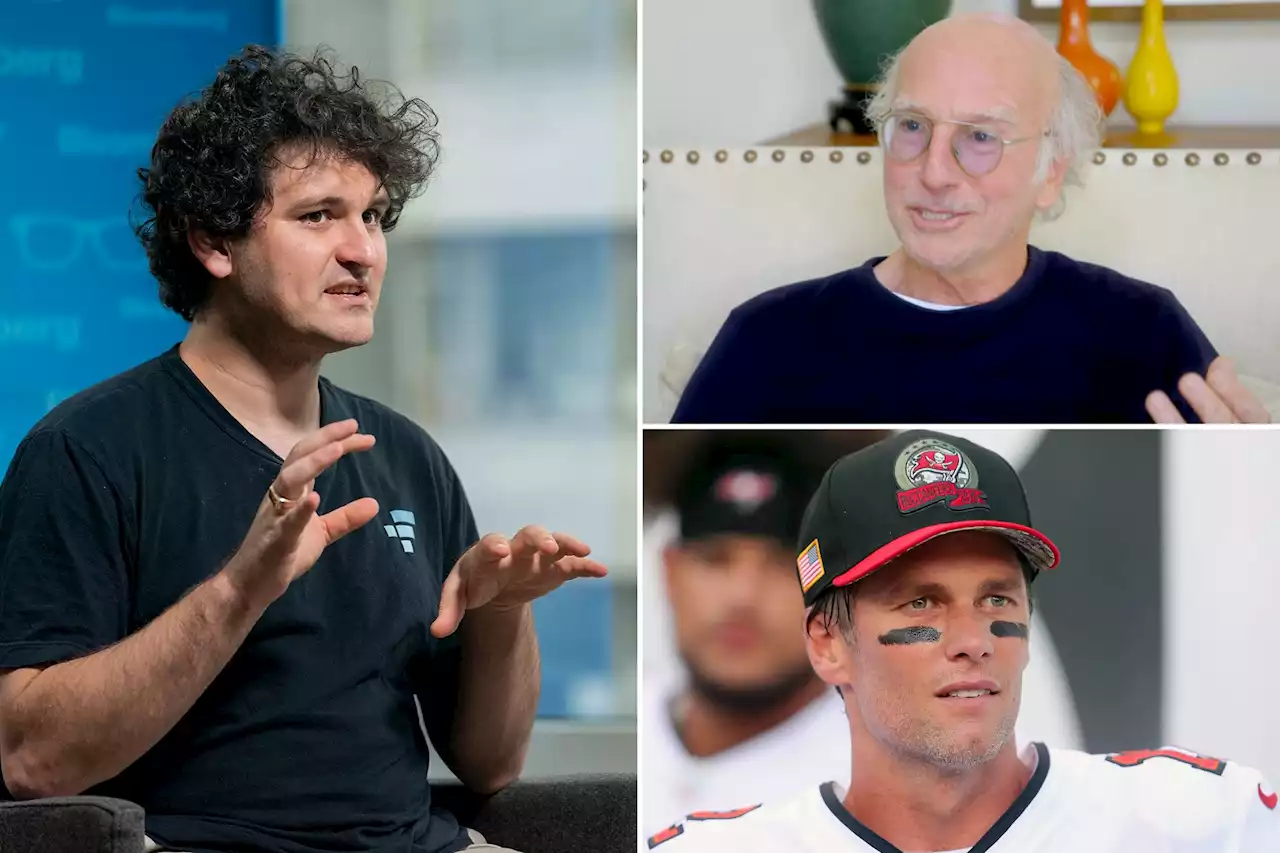

Sam Bankman-Fried, FTX, Alameda Were Accused of Conspiracy, Racketeering, and Market Manipulation 3 Years Before FTX Collapsed – Bitcoin NewsFTX and Alameda faced a lawsuit in 2019, that accused the companies and executives of engaging in racketeering practices and crypto market manipulation.

Sam Bankman-Fried, FTX, Alameda Were Accused of Conspiracy, Racketeering, and Market Manipulation 3 Years Before FTX Collapsed – Bitcoin NewsFTX and Alameda faced a lawsuit in 2019, that accused the companies and executives of engaging in racketeering practices and crypto market manipulation.

Read more »

Tom Brady, Gisele Bündchen, Larry David sued by crypto investors after FTX collapseTom Brady, ex-wife Gisele Bündchen, Larry David, and sports stars like David Ortiz and Steph Curry were named in the lawsuit.

Tom Brady, Gisele Bündchen, Larry David sued by crypto investors after FTX collapseTom Brady, ex-wife Gisele Bündchen, Larry David, and sports stars like David Ortiz and Steph Curry were named in the lawsuit.

Read more »

Exec who cleaned up Enron calls FTX mess 'unprecedented'The new CEO of the collapsed cryptocurrency trading firm FTX, who oversaw Enron's bankruptcy, said he has never seen such a “complete failure” of corporate control.

Exec who cleaned up Enron calls FTX mess 'unprecedented'The new CEO of the collapsed cryptocurrency trading firm FTX, who oversaw Enron's bankruptcy, said he has never seen such a “complete failure” of corporate control.

Read more »

Let’s enjoy this FTX bankruptcy filing togetherThe Enron cleanup guy says FTX is worse than Enron.

Let’s enjoy this FTX bankruptcy filing togetherThe Enron cleanup guy says FTX is worse than Enron.

Read more »