You may have heard about the simple “Buy the Dip” Strategy in stock trading.

Unlike trading forex pairs, which can go either way on your price action charts, stocks and indices are encouraged by investors to go up. So, buying the dip is a real strategy for some investors. On the Dow Jones Industrial Average and the S&P, price action fell to intersect the lower trend line, investors bought the dip and prices rose. However, the NASDAQ seems to be in a downtrend compared to the other US Indices.

So we see, for example, shares in Goldman Sachs and Bank of America rising dramatically and having a positive influence on the S&P 500 and the DJIA. This, of course, does not have an effect on the NASDAQ but the fall in shares of Apple and other tech companies does. So, keep an eye on the NASDAQ to see if we get a bounce of the lower trend line. We are seeing a steady rise in the price of WTI crude oil but price action is forming a rising wedge which is often a bearish sign.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Dow Jones Industrial Average lurches into even higher highs, taps 39,880 on ThursdayThe Dow Jones Industrial Average (DJIA) tore into its second all-time high this week, climbing eight-tenths of a percent and tapping a fresh record peak of 39,889.05 as US equities broadly gain ground.

Dow Jones Industrial Average lurches into even higher highs, taps 39,880 on ThursdayThe Dow Jones Industrial Average (DJIA) tore into its second all-time high this week, climbing eight-tenths of a percent and tapping a fresh record peak of 39,889.05 as US equities broadly gain ground.

Read more »

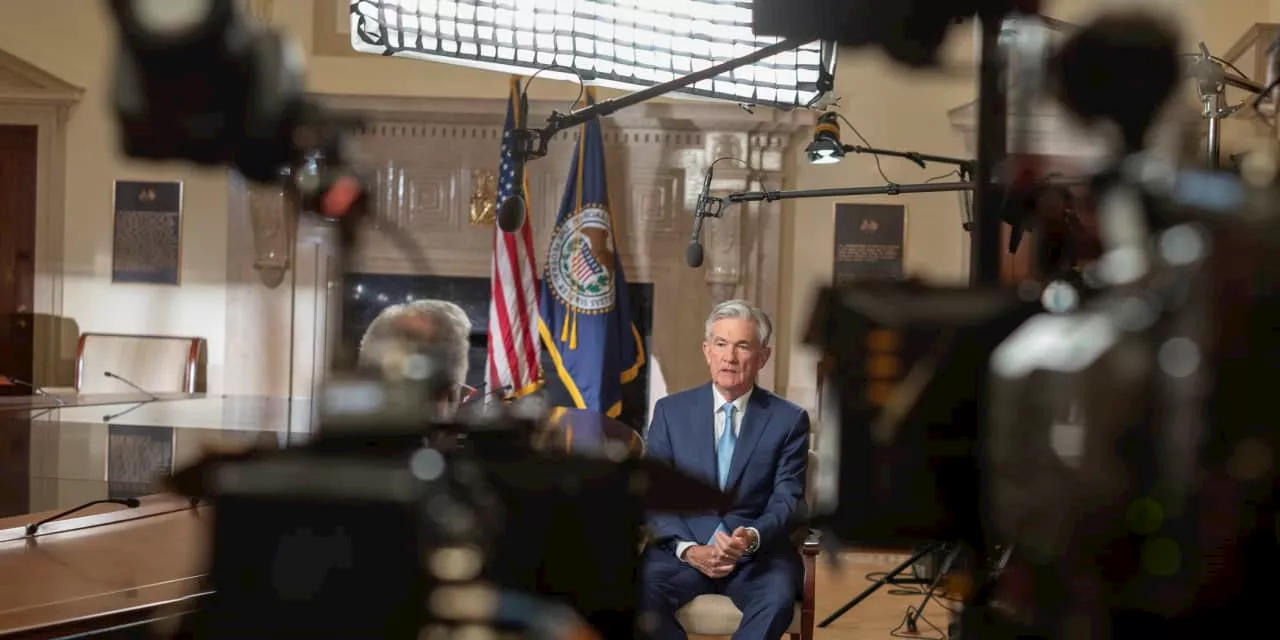

Dow Jones Industrial Average flatlines ahead of FedThe Dow Jones Industrial Average (DJIA) is churning at the day’s opening prices as investors brace for the latest Federal Reserve (Fed) rate call as well as a much-anticipated update to the Federal Open Market Committee’s (FOMC) Interest Rate Outlook.

Dow Jones Industrial Average flatlines ahead of FedThe Dow Jones Industrial Average (DJIA) is churning at the day’s opening prices as investors brace for the latest Federal Reserve (Fed) rate call as well as a much-anticipated update to the Federal Open Market Committee’s (FOMC) Interest Rate Outlook.

Read more »

Fed meeting: Dow Jones steady ahead of rate decision, Powell press conference, dot plotFollow all the latest on the Fed meeting and U.S. market action for Wednesday here.

Fed meeting: Dow Jones steady ahead of rate decision, Powell press conference, dot plotFollow all the latest on the Fed meeting and U.S. market action for Wednesday here.

Read more »

Dow Jones Industrial Average gains on quiet Monday but lags telecomms reboundThe Dow Jones Industrial Average (DJIA) climbed on Monday as investors returned to risk bids to kick off a hectic central bank-themed trading week.

Dow Jones Industrial Average gains on quiet Monday but lags telecomms reboundThe Dow Jones Industrial Average (DJIA) climbed on Monday as investors returned to risk bids to kick off a hectic central bank-themed trading week.

Read more »

Dow Jones Industrial Average finds the green on Wednesday, pushes over 39,000.00The Dow Jones Industrial Average (DJIA) found topside momentum on Wednesday, tapping into an intraday high of 39,200.00 as the index outperforms its peers in the S&P 500 and the NASDAQ Composite.

Dow Jones Industrial Average finds the green on Wednesday, pushes over 39,000.00The Dow Jones Industrial Average (DJIA) found topside momentum on Wednesday, tapping into an intraday high of 39,200.00 as the index outperforms its peers in the S&P 500 and the NASDAQ Composite.

Read more »

Dow Jones ends Monday in the green, bolstered above 38,500.00The Dow Jones Industrial Average (DJIA) is up on thin margins for Monday, trading on the high side of 38,500.00 as its counterpart indexes are slightly softer on the day.

Dow Jones ends Monday in the green, bolstered above 38,500.00The Dow Jones Industrial Average (DJIA) is up on thin margins for Monday, trading on the high side of 38,500.00 as its counterpart indexes are slightly softer on the day.

Read more »