The $30 billion bet on First Republic — to prevent it from becoming the third bank to fail in less than a week — was pitched as a bulwark against future bank...

NEW YORK — When 11 of the biggest U.S. banks announced their $30 billion rescue package for First Republic Bank this week, those banks, notably, were coming to the rescue of one of their competitors. When Silicon Valley Bank failed, it was because its closest and most loyal customers, venture capitalists and startups, fled the bank at the first sign of trouble.

“We are deploying our financial strength and liquidity into the larger system, where it is needed the most,” the banks said. Context: From SVB’s sudden collapse to Credit Suisse’s fallout: 8 charts show turbulence in financial marketsAnd: California House Democrats demand investigation into Goldman Sachs’ relationship with Silicon Valley Bank

The rescue package brought back memories of the 2008 financial crisis, when banks collectively came to the aid of weaker banks in the early days of the crisis. Banks then bought others in hurried deals in order to keep the crisis from spreading.The $30 billion in uninsured deposits is seen as a vote of confidence in First Republic, whose banking franchise before the past week was the envy of much of the industry.

“The actions of America’s largest banks reflect their confidence in the country’s banking system,” the banks said in a statement.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

![]() How First Republic rescue, Silicon Valley Bank could cost Main Street AmericaIn wake of recent issues with First Republic and Silicon Valley Bank, community bank leaders tell FOX Business that sharing the financial burden with larger institutions is unfair.

How First Republic rescue, Silicon Valley Bank could cost Main Street AmericaIn wake of recent issues with First Republic and Silicon Valley Bank, community bank leaders tell FOX Business that sharing the financial burden with larger institutions is unfair.

Read more »

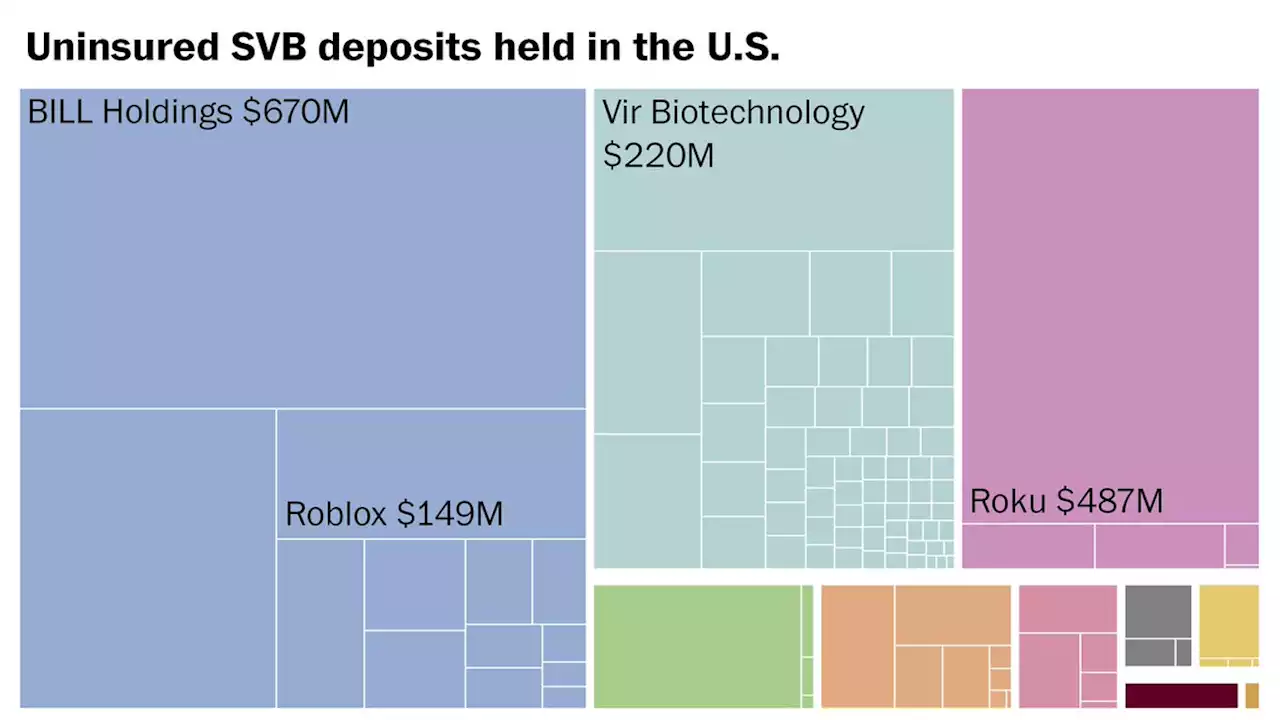

These companies had billions of dollars at risk in Silicon Valley BankSee the billions of dollars of unprotected deposits and other holdings that companies had at Silicon Valley Bank, before federal financial regulators stepped in to secure the deposits likely averting a meltdown in the U.S. banking sector.

These companies had billions of dollars at risk in Silicon Valley BankSee the billions of dollars of unprotected deposits and other holdings that companies had at Silicon Valley Bank, before federal financial regulators stepped in to secure the deposits likely averting a meltdown in the U.S. banking sector.

Read more »

![]() Biden's claim that Silicon Valley Bank bailout wouldn't cost taxpayers contradicts fiscal reality: economistThe Biden administration has insisted taxpayers will not be on the hook for the recent bailout of SVB, but a Heritage economist says that 'doesn't pass the smell test.'

Biden's claim that Silicon Valley Bank bailout wouldn't cost taxpayers contradicts fiscal reality: economistThe Biden administration has insisted taxpayers will not be on the hook for the recent bailout of SVB, but a Heritage economist says that 'doesn't pass the smell test.'

Read more »

Bankers put focus on woke causes; Clinton, Pelosi campaign donors filled Silicon Valley board seatsThe woke philosophy of Silicon Valley Bank didn’t directly cause the cash crunch that led to its rapid failure, but analysts say the bank’s management paid more attention to its climate and social justice mission than its financial health.

Bankers put focus on woke causes; Clinton, Pelosi campaign donors filled Silicon Valley board seatsThe woke philosophy of Silicon Valley Bank didn’t directly cause the cash crunch that led to its rapid failure, but analysts say the bank’s management paid more attention to its climate and social justice mission than its financial health.

Read more »

Yellen tells Congress that U.S. banking system still ‘sound’ after collapse of Silicon Valley BankTreasury Secretary Janet Yellen told lawmakers Thursday that the nation’s banking system “remains sound” and that Americans shouldn’t worry about their deposits, a week after the second-largest bank collapse in U.S. history.

Yellen tells Congress that U.S. banking system still ‘sound’ after collapse of Silicon Valley BankTreasury Secretary Janet Yellen told lawmakers Thursday that the nation’s banking system “remains sound” and that Americans shouldn’t worry about their deposits, a week after the second-largest bank collapse in U.S. history.

Read more »

![]() Silicon Valley Bank’s implosion leaves a gaping hole for start-upsThe tech world relied on Silicon Valley Bank for everything from mortgages to credit cards. Its implosion has left them reeling.

Silicon Valley Bank’s implosion leaves a gaping hole for start-upsThe tech world relied on Silicon Valley Bank for everything from mortgages to credit cards. Its implosion has left them reeling.

Read more »