Financial technology services companies received billions of dollars through taxpayer-funded PPP loan processing fees with little oversight of who was getting the loans, House lawmakers allege.

David Spunt reports on estimated $100 billion in fraud casesissued during the coronavirus pandemic. , shows multiple financial technology companies, or fintechs, were either unable or unwilling to perform checks and balances on loans being issued. The result was the approval of large numbers of fraudulent applications – and untold tens of billions of dollars meant for struggling small businesses stolen.

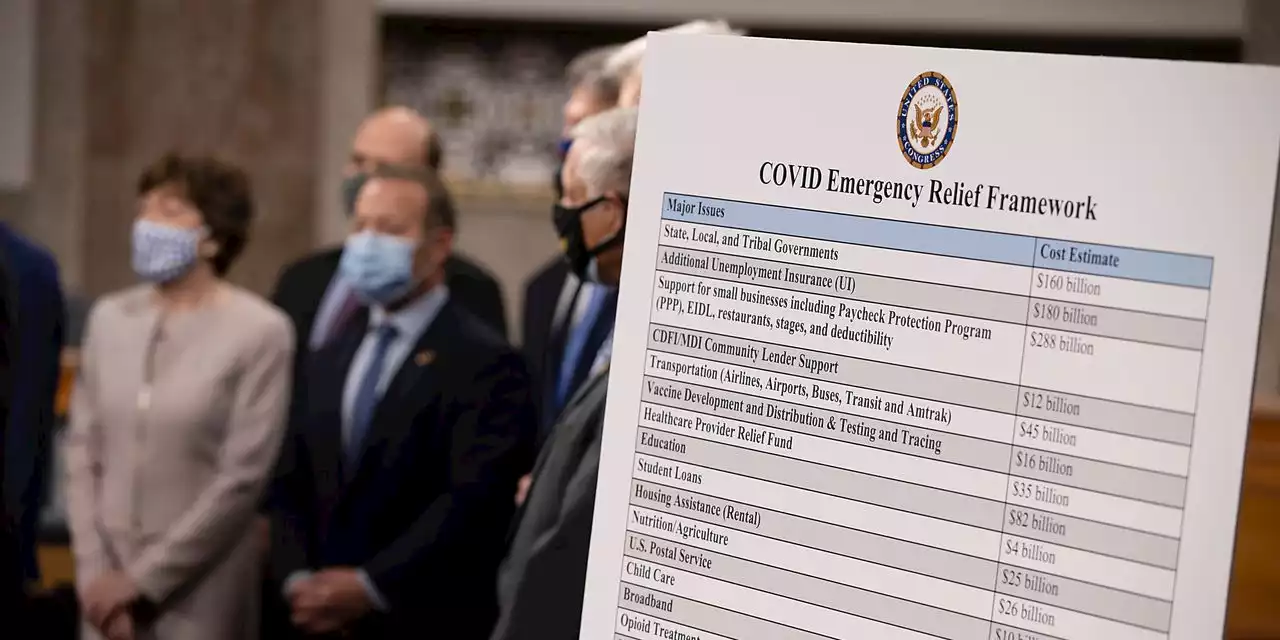

"As today’s report details, many fintechs, while promising to help disburse billions of Paycheck Protection Program [PPP] dollars to struggling small businesses efficiently and expeditiously, refused to take adequate steps to detect and prevent fraud despite their clear responsibility to safeguard taxpayer funds.

Blueacorn, a company founded during the pandemic to help small businesses access PPP loans, received more than $1 billion in taxpayer-funded processing fees but spent less than 1% of its earnings on preventing fraud, investigators found. The company also pressured employees to spend less than 30 seconds reviewing loan applications, instructing workers, "the faster the better."

Companies like Capital Plus, Harvest, and other fintech-partnered PPP lenders admitted to having no formal program to oversee Womply and Blueacorn's activities.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Does a Faint Line on a COVID Test Mean You Have COVID or Are Still Positive?Doctors say there could be a few things going on here.

Does a Faint Line on a COVID Test Mean You Have COVID or Are Still Positive?Doctors say there could be a few things going on here.

Read more »

Illinois Coronavirus Updates: FDA Pulls COVID Antibody Treatment, Long COVIDHere’s what you need to know about the coronavirus pandemic across Illinois today.

Illinois Coronavirus Updates: FDA Pulls COVID Antibody Treatment, Long COVIDHere’s what you need to know about the coronavirus pandemic across Illinois today.

Read more »

Fintech Firms Oversaw Billions in Fraudulent Covid Aid Loans, Report SaysFinancial technology companies oversaw a disproportionately high rate of fraudulent loans through the Paycheck Protection Program, a new congressional report says

Fintech Firms Oversaw Billions in Fraudulent Covid Aid Loans, Report SaysFinancial technology companies oversaw a disproportionately high rate of fraudulent loans through the Paycheck Protection Program, a new congressional report says

Read more »

Princess Cruises ship with 'slightly elevated' COVID-19 cases skips Australia stopA Princess Cruises ship with elevated COVID-19 cases on board skipped a planned stop in Australia this week, the cruise line said.

Princess Cruises ship with 'slightly elevated' COVID-19 cases skips Australia stopA Princess Cruises ship with elevated COVID-19 cases on board skipped a planned stop in Australia this week, the cruise line said.

Read more »

China set to loosen COVID curbs after week of historic protestsChina is set to announce in coming days an easing of its COVID-19 quarantine protocols and a reduction in mass testing, sources told Reuters, a marked shift in policy after anger over the world's toughest curbs fuelled widespread protests.

China set to loosen COVID curbs after week of historic protestsChina is set to announce in coming days an easing of its COVID-19 quarantine protocols and a reduction in mass testing, sources told Reuters, a marked shift in policy after anger over the world's toughest curbs fuelled widespread protests.

Read more »

China softens tone on COVID severity after protestsChina is softening its tone on the severity of COVID-19 and easing some coronavirus restrictions even as its daily case toll hovers near record highs, after anger over the world's toughest curbs fuelled protests across the country.

China softens tone on COVID severity after protestsChina is softening its tone on the severity of COVID-19 and easing some coronavirus restrictions even as its daily case toll hovers near record highs, after anger over the world's toughest curbs fuelled protests across the country.

Read more »