Start the year strong by reflecting on your financial progress and adjusting your goals as needed. This article provides practical tips on how to stay on track, overcome challenges, and achieve your financial aspirations.

As January draws to a close, it's time to assess and reflect on the financial goals you set at the beginning of the year. Whether you aimed to increase savings, make wise investments, reduce debt, adhere to a budget, or boost your income in 2025, this is the perfect moment to gauge your progress and ensure you're on track to achieve your objectives.

Staying committed to your financial goals can be challenging, so if you've encountered a few roadblocks this month, it's not too late to adjust your course, refocus your efforts, and set yourself up for success in 2025. The year is young, and the habits you cultivate now will lay the groundwork for long-term financial security.First, take stock of your progress so far. Checking in on your financial standing is crucial because the first month sets the tone for the year ahead. Evaluate how effectively you've been adhering to your plan and make any necessary adjustments early on. Ask yourself some key questions: Have you consistently tracked your income and expenses? Are you on course to meet your savings or investment targets for the month? Did you encounter any unexpected expenses or overspend in certain areas?Use this reflection as an opportunity to learn and improve. Celebrate your small victories; every step forward, no matter how small, builds momentum and contributes to your overall progress. Recognizing obstacles early is vital to preventing larger issues down the road. Whether it's unforeseen expenses, overspending, or a slip-up in budgeting, identifying the root cause allows you to take corrective action promptly. Remember, adjusting your financial goals isn't a sign of failure; it's a smart, proactive strategy that keeps you moving toward your long-term objectives. Small course corrections can make all the difference in staying on track. By embracing adjustments as part of the process, you empower yourself to overcome challenges and continue progressing toward your goals. Reconnect with your 'why'. Your reason for setting these financial goals is the driving force behind your efforts. Staying connected to your 'why' is essential for long-term motivation. Whether your goal is to build a secure retirement, create generational wealth, or achieve financial freedom to spend more time with loved ones, keeping your purpose front and center can help you push through challenges. Remind yourself of the bigger picture by visualizing what success looks like for you. When your motivation dips, revisit your 'why' to reignite your commitment and stay focused on the future you're working to create. If you've veered off track this month, now is the perfect time to realign with your financial goals. Start by reviewing your initial objectives and identifying areas where adjustments might be needed. Realigning isn't about starting over; it's about recalibrating to ensure you're moving in the right direction. Every effort you make to realign brings you closer to your ultimate financial success.Remember, financial success is not about perfection; it's about showing up consistently. Progress doesn't always feel glamorous, but every step you take brings you closer to your goals. Whether you've made significant strides or simply managed to stay mindful of your finances, it all counts. Celebrate your wins and keep moving forward as you build the foundation for lasting financial freedom. The bottom line is that it's vital to have financial goals to give your money a purpose. Without goals, your finances can drift aimlessly. Your financial goals act as a roadmap to guide your financial decisions. Stay focused, stay consistent, and keep working toward the financial freedom you envision. With purpose and persistence, you'll turn your goals into reality.

FINANCIAL GOALS MONEY MANAGEMENT BUDGETING SAVINGS INVESTMENTS PERSONAL FINANCE FINANCIAL FREEDOM

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Financial Resolutions for 2025: Experts Offer Tips for SuccessAs the new year approaches, experts encourage setting financial resolutions to achieve life goals. The advice emphasizes evaluating your current financial situation, setting attainable goals, reframing your money mindset, and using tools to track progress. Remember to attach your financial goals to bigger dreams and forgive past financial mistakes for a motivated start to the new year.

Financial Resolutions for 2025: Experts Offer Tips for SuccessAs the new year approaches, experts encourage setting financial resolutions to achieve life goals. The advice emphasizes evaluating your current financial situation, setting attainable goals, reframing your money mindset, and using tools to track progress. Remember to attach your financial goals to bigger dreams and forgive past financial mistakes for a motivated start to the new year.

Read more »

Chainalysis Acquires Alterya to Expand Financial Fraud DetectionChainalysis, a leading firm tracking illicit cryptocurrency flows, has acquired Alterya, a fraud detection startup, to enhance its capabilities in combating financial fraud. Chainalysis specializes in tracing cryptocurrency movements, while Alterya focuses on identifying and blocking scammer transactions. The acquisition combines Chainalysis' extensive data on crypto scammers with Alterya's comprehensive database of scammer financial infrastructure, enabling more effective fraud detection. This move marks Chainalysis's expansion into broader financial fraud detection, leveraging Alterya's AI-driven fraud models to assist banks and financial institutions.

Chainalysis Acquires Alterya to Expand Financial Fraud DetectionChainalysis, a leading firm tracking illicit cryptocurrency flows, has acquired Alterya, a fraud detection startup, to enhance its capabilities in combating financial fraud. Chainalysis specializes in tracing cryptocurrency movements, while Alterya focuses on identifying and blocking scammer transactions. The acquisition combines Chainalysis' extensive data on crypto scammers with Alterya's comprehensive database of scammer financial infrastructure, enabling more effective fraud detection. This move marks Chainalysis's expansion into broader financial fraud detection, leveraging Alterya's AI-driven fraud models to assist banks and financial institutions.

Read more »

Fact Check Team: DEI initiatives face growing scrutiny amid shifting corporate prioritiesMeta has joined a growing list of companies moving away from diversity, equity, and inclusion (DEI) initiatives.

Fact Check Team: DEI initiatives face growing scrutiny amid shifting corporate prioritiesMeta has joined a growing list of companies moving away from diversity, equity, and inclusion (DEI) initiatives.

Read more »

Fact Check Team: DEI initiatives face growing scrutiny amid shifting corporate prioritiesMeta has joined a growing list of companies moving away from diversity, equity, and inclusion (DEI) initiatives.

Fact Check Team: DEI initiatives face growing scrutiny amid shifting corporate prioritiesMeta has joined a growing list of companies moving away from diversity, equity, and inclusion (DEI) initiatives.

Read more »

Founder of muckraking financial information firm Hindenburg Research calls it quitsThe founder of the muckraking financial research firm Hindenburg Research says he is disbanding the organization after finishing the work it set out to do.

Founder of muckraking financial information firm Hindenburg Research calls it quitsThe founder of the muckraking financial research firm Hindenburg Research says he is disbanding the organization after finishing the work it set out to do.

Read more »

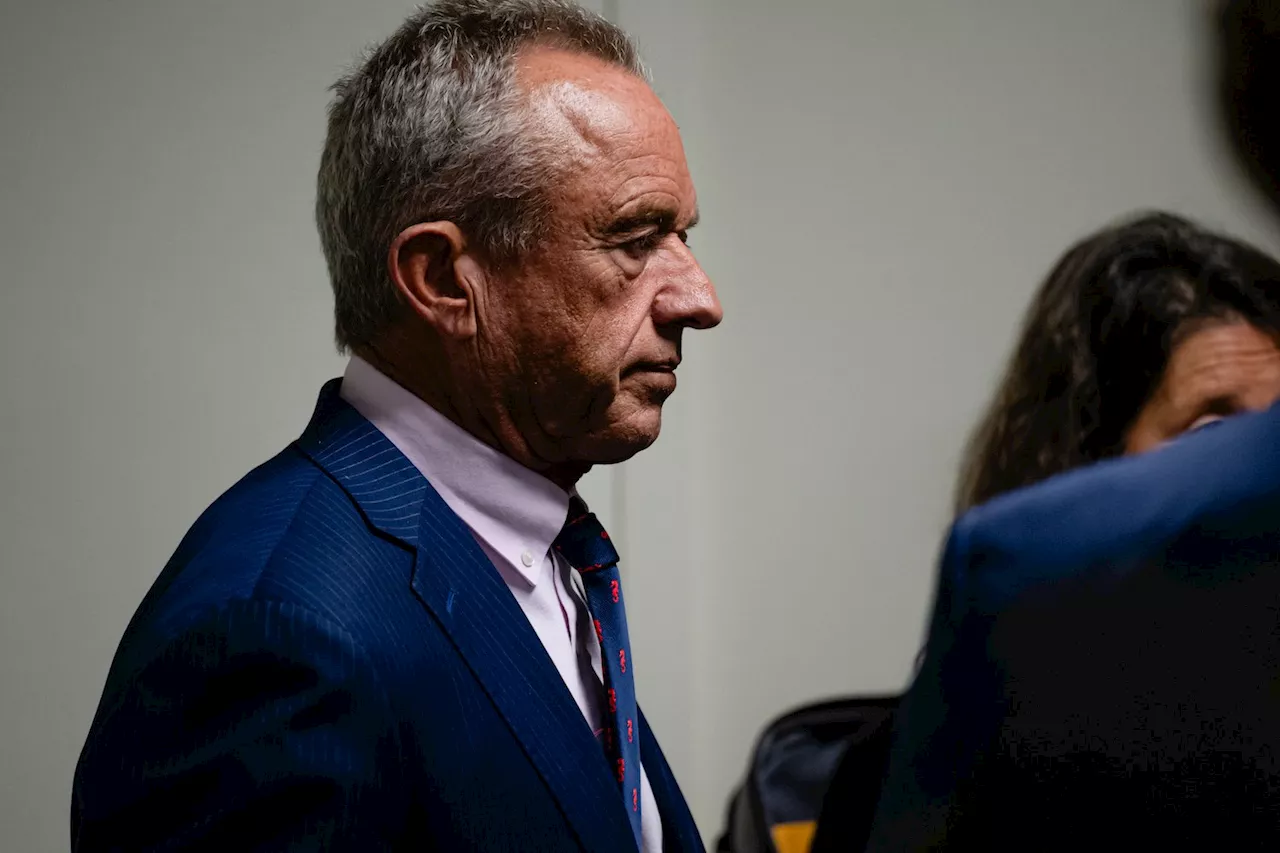

RFK Jr.'s Appointment to HHS Raises Concerns Over His Conspiracy Theories and Financial Disclosure ErrorsRobert F. Kennedy Jr.'s nomination to head the Department of Health and Human Services (HHS) has sparked controversy due to his history of promoting conspiracy theories and his underreporting of income from an anti-vaccine non-profit. Kennedy, known for his views on fringe science, has faced scrutiny over his financial disclosures, which revealed an underreported income of $431,156.72 from Children's Health Defense. While Kennedy attributed the discrepancy to an 'inadvertent error,' the incident has raised questions about his suitability for the HHS position.

RFK Jr.'s Appointment to HHS Raises Concerns Over His Conspiracy Theories and Financial Disclosure ErrorsRobert F. Kennedy Jr.'s nomination to head the Department of Health and Human Services (HHS) has sparked controversy due to his history of promoting conspiracy theories and his underreporting of income from an anti-vaccine non-profit. Kennedy, known for his views on fringe science, has faced scrutiny over his financial disclosures, which revealed an underreported income of $431,156.72 from Children's Health Defense. While Kennedy attributed the discrepancy to an 'inadvertent error,' the incident has raised questions about his suitability for the HHS position.

Read more »