Fed Gov. Christopher Waller pushes back on market euphoria in Sunday comments. Fed Vice Chair Lael Brainard calls for regulation following FTX crisis. Light week for economic data sees Fedspeak come into focus.

Following a wild ride in the markets last week, Federal Reserve speakers are back out in force. After a weaker-than-expected October CPI print, markets rushed to price in a lower Fed terminal rate. The significant loosening of financial conditions may be unwelcomed by Federal Reserve officials, who have already come out and stated that it is “premature” to claim victory over inflation.

In comments made on Sunday, Fed Gov. Christopher Waller indicated that the market should begin to focus on the endpoint of the Fed’s rate hiking cycle, rather than the pace of rate hikes. Following last week’s soft CPI print, risk assets surged as markets rushed to price in a 50 bps rate hike at the December meeting. Waller also stated that the October CPI print was “just one data point” and that more data is needed to indicate a material slowdown in inflation. Waller also described the 7.

Should this be echoed in comments throughout the week by other central bankers, markets may experience yet another repricing of interest rates. The 2-year Treasury yield has moved higher off of the post-CPI lows, currently trading around 4.40%. In the days following last week’s CPI print, market pricing for 50 basis points at the December policy meeting has shifted from 50/50 to 80/20.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

EURUSD grinds lower towards 1.0300 amid recession fears, hawkish Fedspeak ahead of Eurozone GDPEURUSD grinds lower towards 1.0300 amid recession fears, hawkish Fedspeak ahead of Eurozone GDP – by anilpanchal7 EURUSD Fed ECB RiskAppetite GDP

EURUSD grinds lower towards 1.0300 amid recession fears, hawkish Fedspeak ahead of Eurozone GDPEURUSD grinds lower towards 1.0300 amid recession fears, hawkish Fedspeak ahead of Eurozone GDP – by anilpanchal7 EURUSD Fed ECB RiskAppetite GDP

Read more »

Americans see higher inflation ahead: NY FedConsumers are growing more pessimistic as inflation expectations tracked by the Federal Reserve Bank of New York increased across all horizons, while unemployment expectations deteriorated.

Americans see higher inflation ahead: NY FedConsumers are growing more pessimistic as inflation expectations tracked by the Federal Reserve Bank of New York increased across all horizons, while unemployment expectations deteriorated.

Read more »

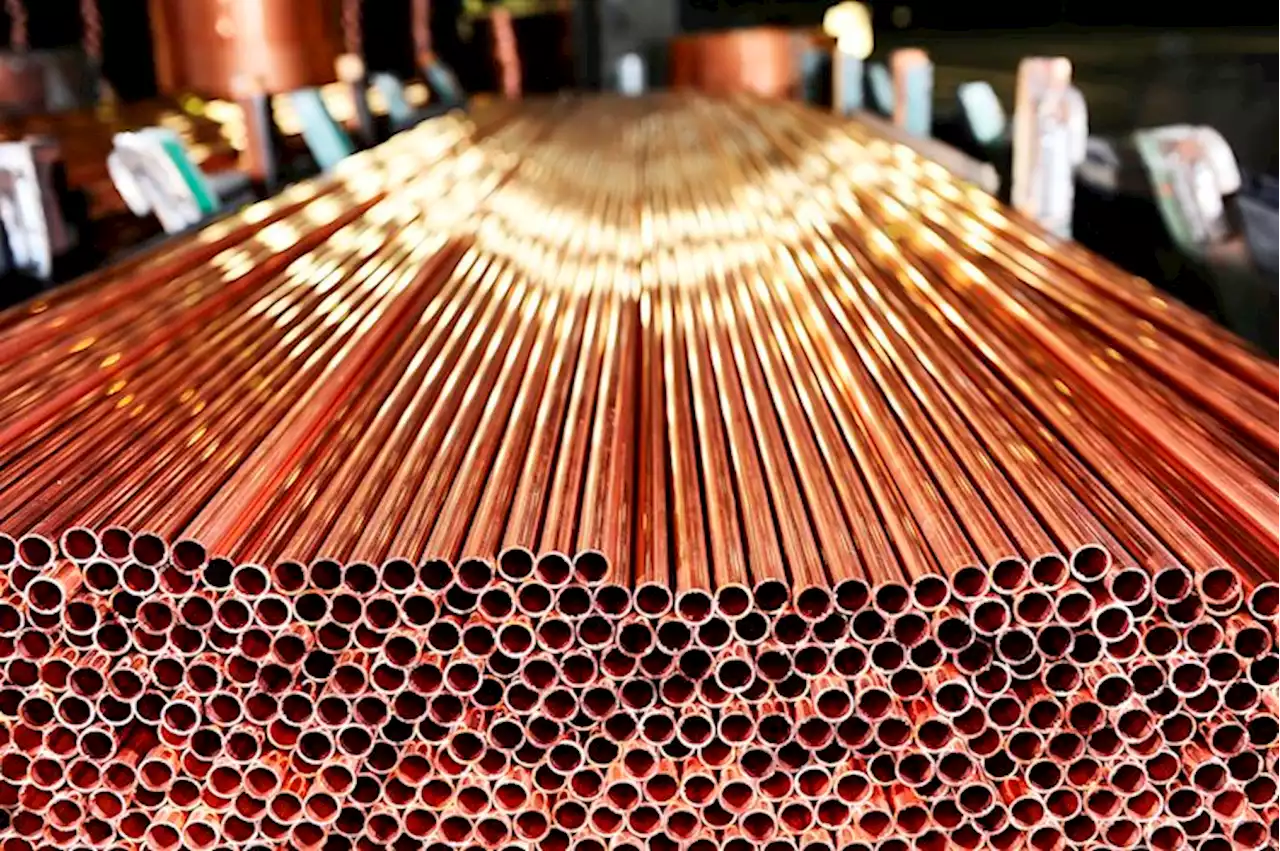

Copper retreats from five-month high as Fedspeak, cautious mood favor US DollarCopper price dropped from a five-month high as buyers take a breather amid mixed sentiment, as well as the US Dollar’s rebound, during early Monday mo

Copper retreats from five-month high as Fedspeak, cautious mood favor US DollarCopper price dropped from a five-month high as buyers take a breather amid mixed sentiment, as well as the US Dollar’s rebound, during early Monday mo

Read more »

US Dollar Index regains 107.00 as Fedspeak underpins firmer yields, focus on US PPI, Retail SalesUS Dollar Index regains 107.00 as Fedspeak underpins firmer yields, focus on US PPI, Retail Sales – by anilpanchal7 DollarIndex RiskAppetite Fed China Macroeconomics

US Dollar Index regains 107.00 as Fedspeak underpins firmer yields, focus on US PPI, Retail SalesUS Dollar Index regains 107.00 as Fedspeak underpins firmer yields, focus on US PPI, Retail Sales – by anilpanchal7 DollarIndex RiskAppetite Fed China Macroeconomics

Read more »

Week Ahead: Retail Sales Next Catalyst in Short-Term Rally; Yields Rise | Investing.comMarket Overview Analysis by Pinchas Cohen/Investing.com covering: GBP/USD, Nasdaq 100, XAU/USD, JPY/USD. Read Pinchas Cohen/Investing.com's latest article on Investing.com

Week Ahead: Retail Sales Next Catalyst in Short-Term Rally; Yields Rise | Investing.comMarket Overview Analysis by Pinchas Cohen/Investing.com covering: GBP/USD, Nasdaq 100, XAU/USD, JPY/USD. Read Pinchas Cohen/Investing.com's latest article on Investing.com

Read more »

USDIDR: Range of 15,390 to 15,590 for the week ahead – MUFGUSDIDR gapped lower on Friday after being in a narrow range of about 15,650-15,750 over the past week. Economists at MUFG Bank expect the pair to trad

USDIDR: Range of 15,390 to 15,590 for the week ahead – MUFGUSDIDR gapped lower on Friday after being in a narrow range of about 15,650-15,750 over the past week. Economists at MUFG Bank expect the pair to trad

Read more »