March sees a surge in job growth, surpassing economists' predictions, while the unemployment rate experiences a marginal change.

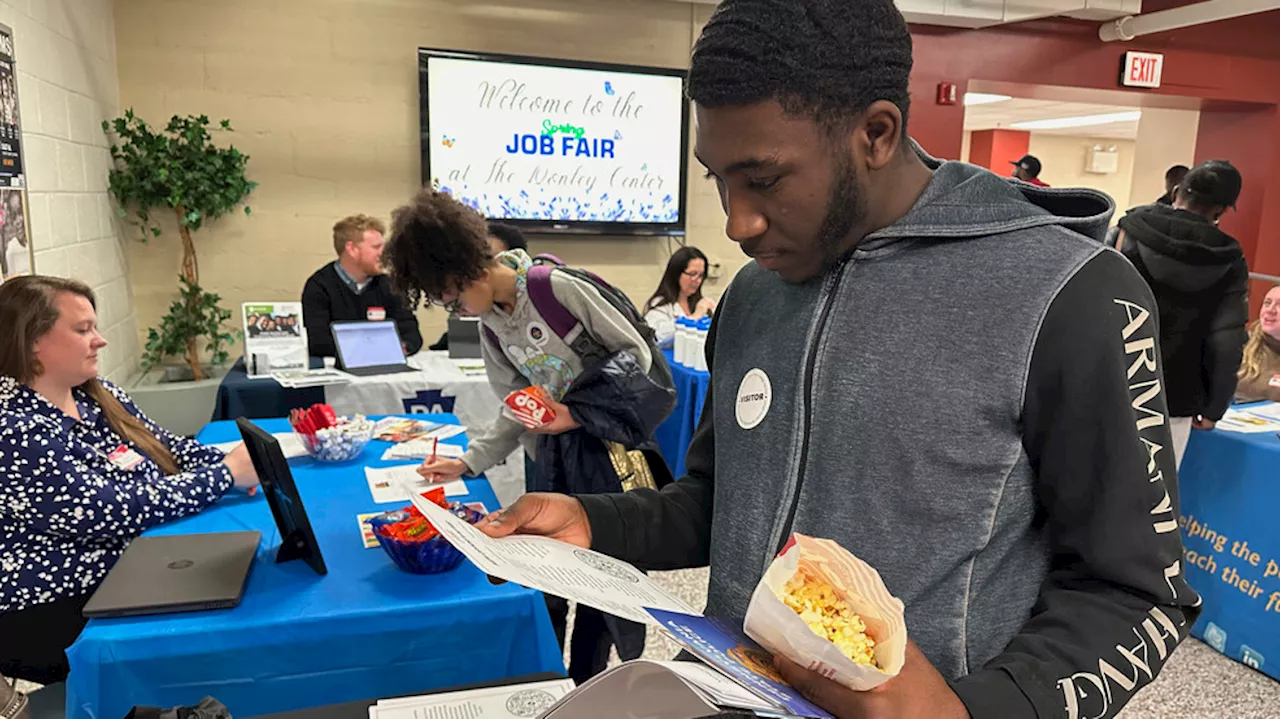

Job seeker Johannes Oveida looks over a brochure at a job fair at Lehigh Carbon Community College in Allentown, Pa., on Thursday, March 7, 2024. In an attempt to lower inflation, the Federal Reserve has implemented 11 interest rate hikes. This move coincides with the recent release of the, March saw an addition of 303,000 jobs to the economy, surpassing economists' predictions, which were closer to 200,000. This surge marks the highest one-month boost in payrolls since May 2023.

However, there are potential revisions to these reports made by the Department of Labor. These revisions often provide a different view of the job market, sometimes altering the initial narrative presented in the initial release.due to the inclusion of additional data not available during the initial report. These revisions occur in multiple stages, with the Department of Labor publishing two more estimates in subsequent months.

Recent months have seen January's job numbers revised upward by 27,000 while February's figures were revised downward by 5,000. Over the past decade, absolute benchmark revisions

Federal Reserve Interest Rate Hikes Inflation Job Growth Economists' Predictions Unemployment Rate

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Federal Reserve Holds Interest Rates Steady, Plans to Reduce Them LaterThe Federal Reserve announced that it would maintain interest rates but plans to reduce them later this year. Inflation increased in February, and the central bank will continue to monitor economic indicators to determine when to lower rates.

Federal Reserve Holds Interest Rates Steady, Plans to Reduce Them LaterThe Federal Reserve announced that it would maintain interest rates but plans to reduce them later this year. Inflation increased in February, and the central bank will continue to monitor economic indicators to determine when to lower rates.

Read more »

Federal Reserve Keeps Interest Rates Steady, Plans to Reduce Them LaterThe Federal Reserve announced that it would maintain interest rates but plans to reduce them later this year. Inflation increased by 3.2% in February. Fed Chair Jerome Powell stated that they will continue to monitor inflation and economic indicators.

Federal Reserve Keeps Interest Rates Steady, Plans to Reduce Them LaterThe Federal Reserve announced that it would maintain interest rates but plans to reduce them later this year. Inflation increased by 3.2% in February. Fed Chair Jerome Powell stated that they will continue to monitor inflation and economic indicators.

Read more »

Federal Reserve Maintains Interest Rates, Plans to Reduce ThemThe Federal Reserve announced that it would maintain interest rates but plans to reduce them sometime this year. Inflation increased by 3.2% in February. Fed Chair Jerome Powell stated that they will continue to monitor inflation and economic indicators to determine when to lower rates.

Federal Reserve Maintains Interest Rates, Plans to Reduce ThemThe Federal Reserve announced that it would maintain interest rates but plans to reduce them sometime this year. Inflation increased by 3.2% in February. Fed Chair Jerome Powell stated that they will continue to monitor inflation and economic indicators to determine when to lower rates.

Read more »

Federal Reserve Considers Cutting Interest Rates Amid Inflation ConcernsThe Federal Reserve left the door open to cutting interest rates in the near future at the conclusion of its March meeting as officials try to walk the fine line of bringing inflation down without inducing a recession. Fed chairman Jerome Powell said the underlying data is still positive that inflation is moving in the right direction to start cutting rates this year. Projections also showed the central bank is still planning on three cuts this year.

Federal Reserve Considers Cutting Interest Rates Amid Inflation ConcernsThe Federal Reserve left the door open to cutting interest rates in the near future at the conclusion of its March meeting as officials try to walk the fine line of bringing inflation down without inducing a recession. Fed chairman Jerome Powell said the underlying data is still positive that inflation is moving in the right direction to start cutting rates this year. Projections also showed the central bank is still planning on three cuts this year.

Read more »

Federal Reserve keeps waiting for more data before cutting interest ratesThe Federal Reserve left the door open to cutting interest rates in the near future at the conclusion of its March meeting.

Federal Reserve keeps waiting for more data before cutting interest ratesThe Federal Reserve left the door open to cutting interest rates in the near future at the conclusion of its March meeting.

Read more »

Federal Reserve still foresees 3 interest rate cuts this year despite bump in inflationFederal Reserve officials signaled that they still expect to cut their key interest rate three times in 2024 despite signs that inflation remained elevated at the start of the year.

Federal Reserve still foresees 3 interest rate cuts this year despite bump in inflationFederal Reserve officials signaled that they still expect to cut their key interest rate three times in 2024 despite signs that inflation remained elevated at the start of the year.

Read more »