While it is too early for the Federal Reserve to declare victory on inflation, there are good reasons to believe that it will continue to cool, according to...

With central bankers heading to Jackson Hole, Wyo., this week for the Federal Reserve’s most important economic policy event of the year, officials have seemed to “draw a line in the sand” on inflation, as there are reasons to believe that four-decade-high inflation will continue to cool while recession risks are rising, a JPMorgan strategist said in a note Monday.

According to David Kelly, chief global strategist at JPMorgan Asset Management, the July CPI report, which showed inflation dropping 0.6% from its June peak for a year-over-year rate of 8.5%, offered some hope that inflation is cooling down.

However, the minutes of the July FOMC meeting showed that Fed officials agreed that it was necessary to move their benchmark interest rate high enough to slow the economy to combat high inflation and then bring it back down to its 2% target. But according to JPMorgan, the danger of recession has already exceeded the risk of inflation, and staying at current levels could inflict long-term economic damage.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

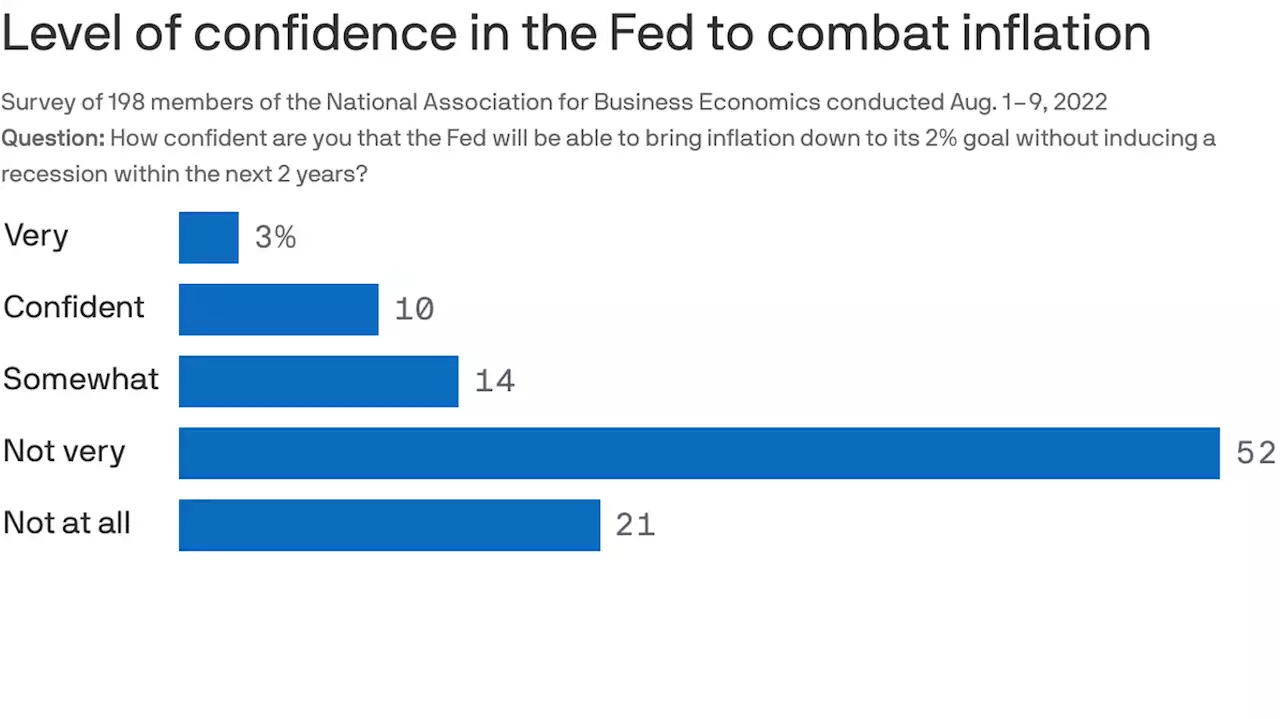

Business economists give soft landing the side-eyeA new survey offers a bit of insight into the way the Fed's actions can affect the psychology of people who help make decisions in corporate America.

Business economists give soft landing the side-eyeA new survey offers a bit of insight into the way the Fed's actions can affect the psychology of people who help make decisions in corporate America.

Read more »

Houston Newsmakers: Inflation reduction act may not help inflation, research saysIf you missed today's episode of Houston Newsmakers, catch up here. 👇 You can also catch a rerun Monday at 12:30 p.m. at KPRC 2+

Houston Newsmakers: Inflation reduction act may not help inflation, research saysIf you missed today's episode of Houston Newsmakers, catch up here. 👇 You can also catch a rerun Monday at 12:30 p.m. at KPRC 2+

Read more »

Inflation: The Fed's hawkish stance risks 'overkill,' economist saysInflation currently sits at 8.5%, which is a decrease from June's 40-year high of 9.1%. The Fed has stated that its goal is to reduce inflation levels down to 2% by 2024 through rapid interest rate hikes.

Inflation: The Fed's hawkish stance risks 'overkill,' economist saysInflation currently sits at 8.5%, which is a decrease from June's 40-year high of 9.1%. The Fed has stated that its goal is to reduce inflation levels down to 2% by 2024 through rapid interest rate hikes.

Read more »

U.K. inflation could surge to 19% by next year, Citi economist saysJust as consumers are getting used to double-digit inflation, a new forecast says U.K. inflation could reach 18.6% early next year.

U.K. inflation could surge to 19% by next year, Citi economist saysJust as consumers are getting used to double-digit inflation, a new forecast says U.K. inflation could reach 18.6% early next year.

Read more »

For Republican governors, all economic success is localTexas Gov. Greg Abbott often knocks President Biden for the country's high rate of inflation and fears of a looming recession.

For Republican governors, all economic success is localTexas Gov. Greg Abbott often knocks President Biden for the country's high rate of inflation and fears of a looming recession.

Read more »

Texas, Georgia, Florida leaders blame inflation on Biden, but it’s worse in their statesWASHINGTON — Gov. Greg Abbott, R-Texas, often knocks President Joe Biden for high inflation and a looming recession — a standard GOP...

Texas, Georgia, Florida leaders blame inflation on Biden, but it’s worse in their statesWASHINGTON — Gov. Greg Abbott, R-Texas, often knocks President Joe Biden for high inflation and a looming recession — a standard GOP...

Read more »