The Personal Consumption Expenditures (PCE) index rose by 6.8% in the year through June, the fastest rate since 1982. See the potential biases and similarities in reports from marketwatch, foxbusiness and nytimes:

measures the prices that people in the United States pay for goods and services

, and is the Federal Reserve's preferred gauge for price inflation. Core prices, which exclude the more volatile measurements of food and energy, rose 0.6% from the previous month and 4.8% on an annual basis, according to the Commerce Department. Both numbers were higher than economists predicted.employers spent 5.1% more on compensating workers

in the second quarter of 2022 compared with the same period a year earlier, which marked the fastest annual pace on records back to 2001.more prominently than right-rated sources did, which instead tended to

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Fed hikes interest rate by 0.75 percentage points in bid to curb inflationThe Federal Reserve raised its benchmark interest rate by a hefty three-quarters of a point for a second straight time in its most aggressive drive in three decades to tame high inflation.

Fed hikes interest rate by 0.75 percentage points in bid to curb inflationThe Federal Reserve raised its benchmark interest rate by a hefty three-quarters of a point for a second straight time in its most aggressive drive in three decades to tame high inflation.

Read more »

Fed set to impose another big rate hike to fight inflationIt will be the Fed's fourth rate hike since March. Since then, with inflation setting new four-decade highs, the central bank has tightened credit ever more aggressively.

Fed set to impose another big rate hike to fight inflationIt will be the Fed's fourth rate hike since March. Since then, with inflation setting new four-decade highs, the central bank has tightened credit ever more aggressively.

Read more »

Fed Unleashes Another Big Rate Hike in Bid to Curb InflationThe Fed’s move will raise its key rate, which affects many consumer and business loans, to a range of 2.25% to 2.5%, its highest level since 2018. — The Associated Press

Fed Unleashes Another Big Rate Hike in Bid to Curb InflationThe Fed’s move will raise its key rate, which affects many consumer and business loans, to a range of 2.25% to 2.5%, its highest level since 2018. — The Associated Press

Read more »

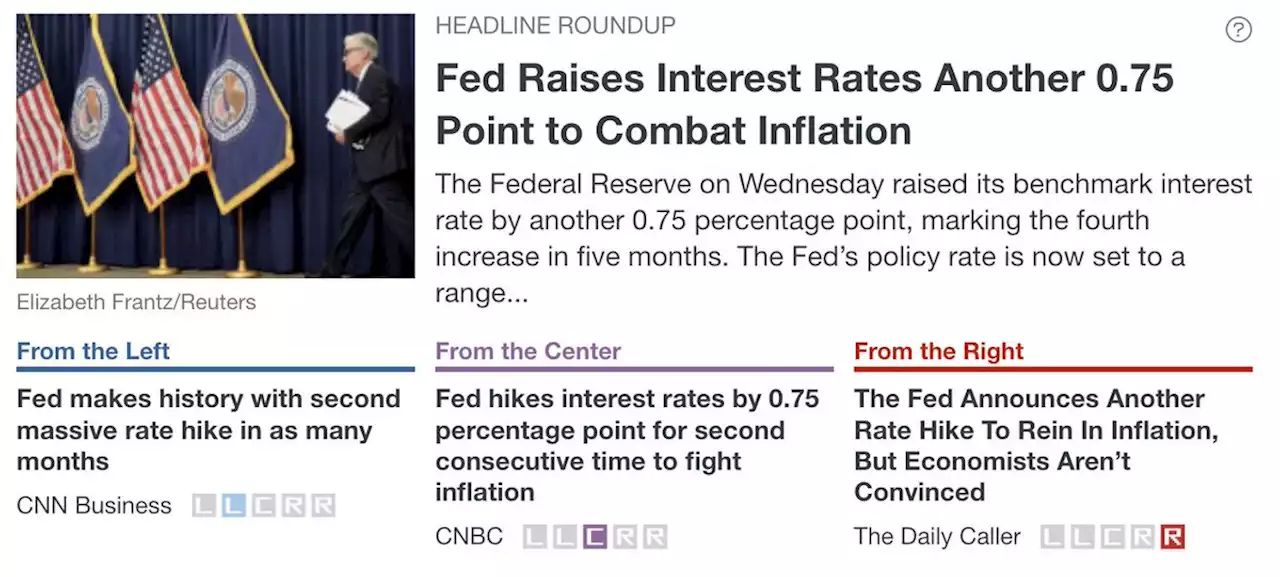

Fed Raises Interest Rates Another 0.75 Point to Combat InflationThe Federal Reserve on Wednesday raised its benchmark interest rate by another 0.75 percentage point, marking the fourth increase in five months. See potential bias and similarities in coverage from CNNBusiness, CNBC and DailyCaller:

Fed Raises Interest Rates Another 0.75 Point to Combat InflationThe Federal Reserve on Wednesday raised its benchmark interest rate by another 0.75 percentage point, marking the fourth increase in five months. See potential bias and similarities in coverage from CNNBusiness, CNBC and DailyCaller:

Read more »

Fed Raises Rates by 75 Basis Points at July FOMC in Fight to Quell InflationThe Fed raises the federal funds rate by 75 basis points to 2.25%-2.50%, in line with market expectations. The statement retains the guidance that ongoing increases in the target range will be appropriate, a sign that more hikes are on the horizon.

Fed Raises Rates by 75 Basis Points at July FOMC in Fight to Quell InflationThe Fed raises the federal funds rate by 75 basis points to 2.25%-2.50%, in line with market expectations. The statement retains the guidance that ongoing increases in the target range will be appropriate, a sign that more hikes are on the horizon.

Read more »

Experts hope Fed rate hikes tamp inflation, avoid recession'I'm worried the Fed is going too quickly, too aggressively. They're going to break something,' said one expert.

Experts hope Fed rate hikes tamp inflation, avoid recession'I'm worried the Fed is going too quickly, too aggressively. They're going to break something,' said one expert.

Read more »