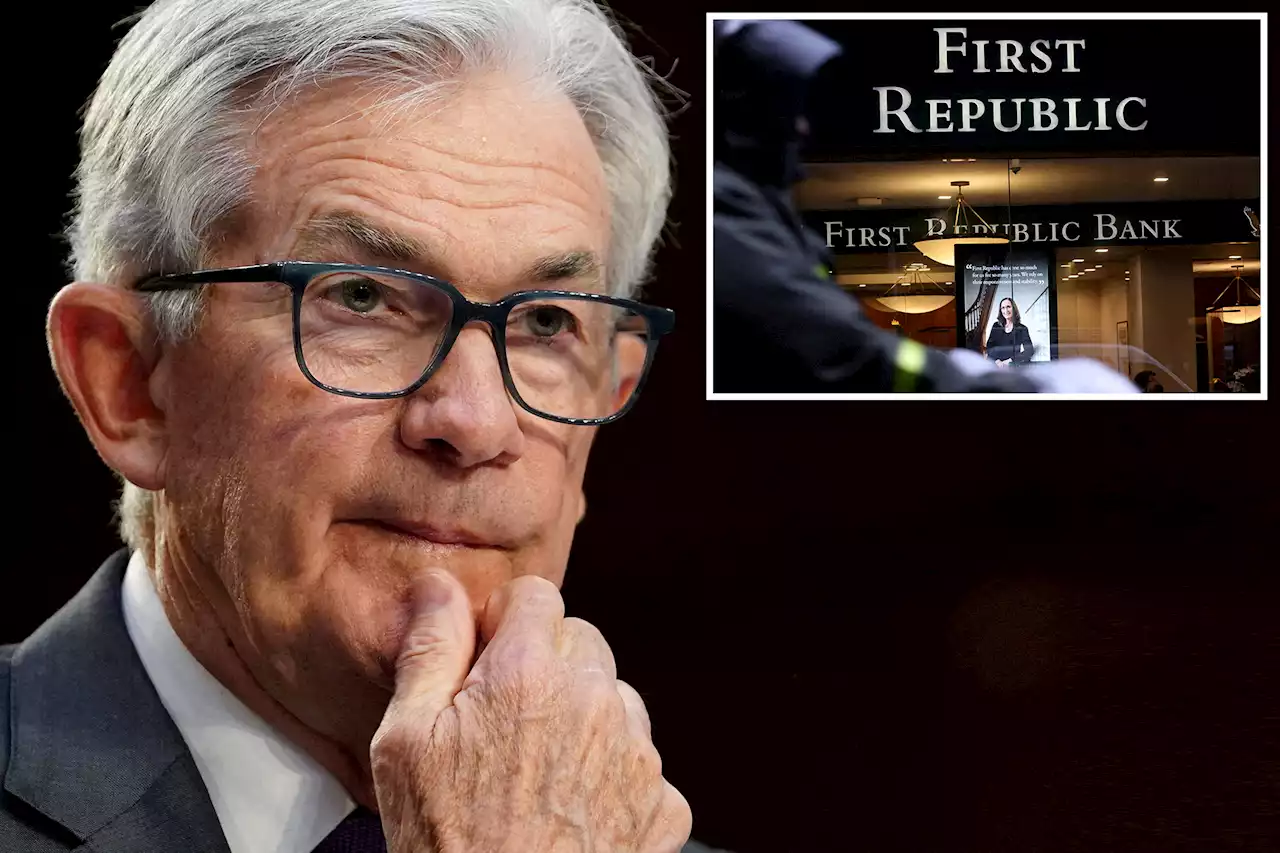

Federal Reserve emergency lending to banks, which hit record levels last week, remained high in the latest week, amid continued large scale extensions of credit to the financial system, which now includes official foreign borrowing.

The Fed reported that discount window borrowing, its main source of emergency credit to depository institutions, ticked down to $110.2 billion as of Wednesday, from the $152.9 billion reported last week.

The facility allows eligible financial firms to borrow against a range of bonds without the penalties normal imposed on this type of credit. Borrowing from the Fed caused the size of its overall balance sheet to move to $8.8 trillion from $8.7 trillion the prior week. Powell justified the fast-moving response of the central bank by saying “history has shown that isolated banking problems, if left unaddressed, can undermine confidence in healthy banks and threaten the ability of the banking system as a whole.”

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Live Fed updates: Federal Reserve will announce key rate decision Wednesday afternoonThe Federal Reserve will announce its decision on interest rates Wednesday afternoon. Markets anticipate the central bank will enact a 25 basis point rate hike.

Live Fed updates: Federal Reserve will announce key rate decision Wednesday afternoonThe Federal Reserve will announce its decision on interest rates Wednesday afternoon. Markets anticipate the central bank will enact a 25 basis point rate hike.

Read more »

Biden White House closely watching Federal Reserve following bank failures | CNN PoliticsAll eyes are trained on the Federal Reserve as it prepares to announce another potential interest rate hike Wednesday afternoon -- exactly 10 days after the Biden administration stepped in with dramatic emergency actions to contain the fallout from two bank failures.

Biden White House closely watching Federal Reserve following bank failures | CNN PoliticsAll eyes are trained on the Federal Reserve as it prepares to announce another potential interest rate hike Wednesday afternoon -- exactly 10 days after the Biden administration stepped in with dramatic emergency actions to contain the fallout from two bank failures.

Read more »

SVB collapse: San Francisco Federal Reserve president comes under bipartisan fire for missing signs.sffed President MaryDalyEcon could offer Republicans and Democrats a rare point of unity as lawmakers trade blame for the collapse of SVB earlier this month. That’s because Daly’s own failure to act has drawn ire from both sides of the aisle.

SVB collapse: San Francisco Federal Reserve president comes under bipartisan fire for missing signs.sffed President MaryDalyEcon could offer Republicans and Democrats a rare point of unity as lawmakers trade blame for the collapse of SVB earlier this month. That’s because Daly’s own failure to act has drawn ire from both sides of the aisle.

Read more »

Here's everything the Federal Reserve is expected to do WednesdayThe Fed will close its two-day meeting Wednesday with a heavy air of uncertainty.

Here's everything the Federal Reserve is expected to do WednesdayThe Fed will close its two-day meeting Wednesday with a heavy air of uncertainty.

Read more »

Federal Reserve hikes key interest rate despite US bank chaosThe Fed faces the challenge of lowering inflation amidst US banking sector crisis.

Federal Reserve hikes key interest rate despite US bank chaosThe Fed faces the challenge of lowering inflation amidst US banking sector crisis.

Read more »

Federal Reserve raises benchmark rate by 0.25 point despite bank turmoilThe Federal Reserve raises its benchmark rate by 0.25 point, balancing fight against inflation with risks to banking system

Federal Reserve raises benchmark rate by 0.25 point despite bank turmoilThe Federal Reserve raises its benchmark rate by 0.25 point, balancing fight against inflation with risks to banking system

Read more »