Gabelli Funds, which owns nearly 4.9 million Class-A voting shares in Paramount, is seeking greater transparency around the National Amusements deal.

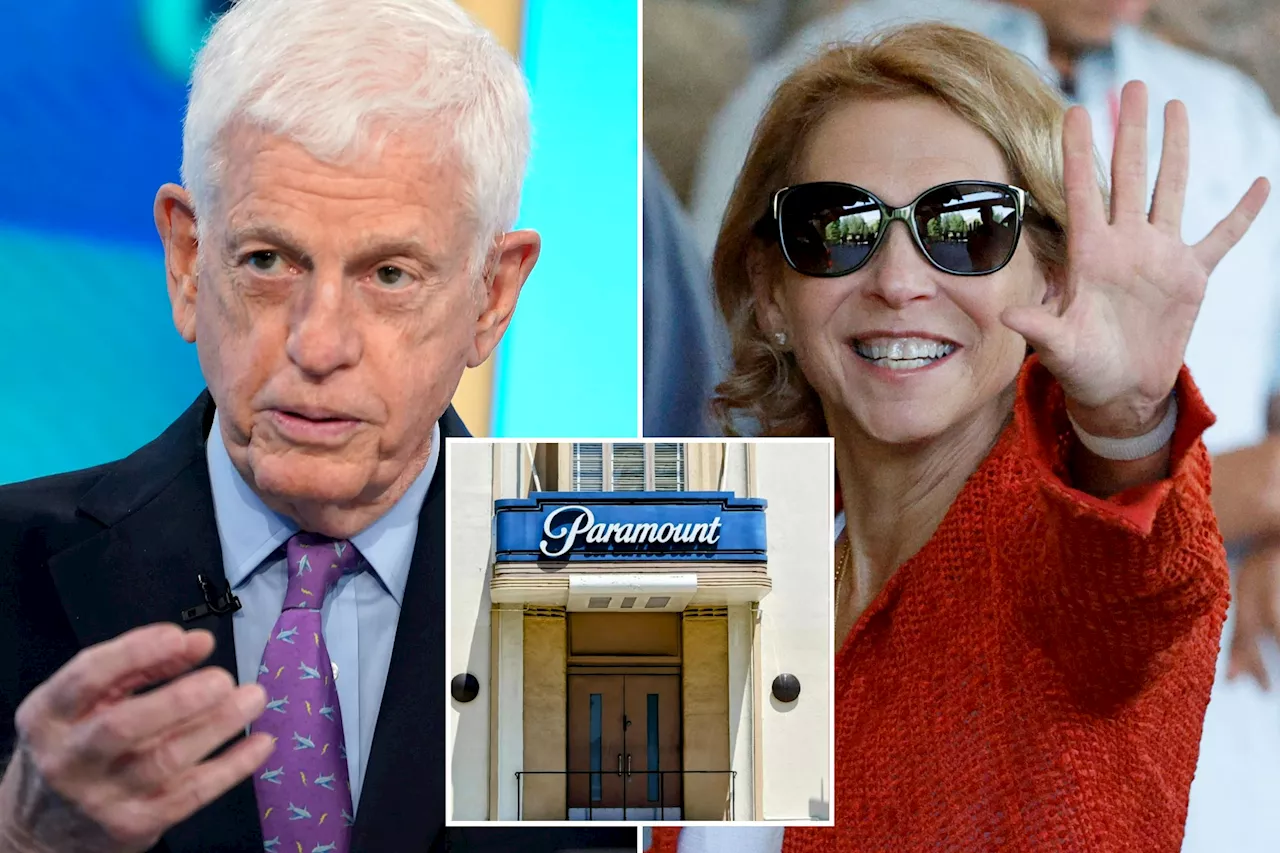

Billionaire investor Mario Gabelli ’s investment firm is seeking more details about the valuation of National Amusements assets, the investor told Reuters on Friday, signaling the firm, in a deal that would entail Skydance acquiring the Redstone family’s holding company, National Amusements, which owns a controlling stake in Paramount .

Gabelli Funds, which owns nearly 4.9 million Class-A voting shares in Paramount, is seeking greater transparency around the National Amusements deal, according to another source at Gabelli. It sent a letter to Paramount’s general counsel on Friday, requesting information, the source said.Mari Gabelli’s “Operation fish bowl … most likely starts today,” Gabelli, the 82-year old chief executive of Gabelli Asset Management Company Investors wrote on social media platform X.

Skydance Media and its deal partners plan to acquire National Amusements for $2.4 billion in cash. In a related transaction, thewould merge with Paramount in an all-stock deal that values Skydance at $4.75 billion, creating a company with an enterprise value of $28 billion.CNN quietly disbands 'Race and Equality' team as part of layoffsThe companies have declined to disclose how much money Shari Redstone would be paid for her Paramount shares compared to other shareholders.

Skydance’s deal to buy Redstone’s National Amusements values the holding company at $37.79 per Paramount share, and the Redstone family stands to pocket $27.55 per Paramount share because of $650 million in net debt.The companies have declined to disclose how much money Shari Redstone would be paid for her Paramount shares compared to other shareholders.

The parties have declined to provide sufficient information for a direct comparison with the $23 that Class-A stockholders will receive for each share and the $15 Class-B stockholders will receive for each share.The independent media company led by David Ellison would merge with Paramount in an all-stock deal that values Skydance at $4.75 billion, creating a company with an enterprise value of $28 billion.

Business Mario Gabelli Mergers & Acquisitions Paramount Shari Redstone

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Paramount investor Mario Gabelli 'may not sell stock' in proposed Skydance mergerEarlier this week, heiress Shari Redstone surprised media insiders with her announcement that she was accepting a merger proposal from Skydance.

Paramount investor Mario Gabelli 'may not sell stock' in proposed Skydance mergerEarlier this week, heiress Shari Redstone surprised media insiders with her announcement that she was accepting a merger proposal from Skydance.

Read more »

Gabelli asks Paramount for details on National Amusements valuationGabelli asks Paramount for details on National Amusements valuation

Gabelli asks Paramount for details on National Amusements valuationGabelli asks Paramount for details on National Amusements valuation

Read more »

How famed investor Mario Gabelli could derail Paramount's Skydance merger: 'We want to see all the details'Cardinale knows the new Paramount run by a new generation of media mogul in David Ellison in an era of AI and technological change, could be the test-case for the industry’s future.

How famed investor Mario Gabelli could derail Paramount's Skydance merger: 'We want to see all the details'Cardinale knows the new Paramount run by a new generation of media mogul in David Ellison in an era of AI and technological change, could be the test-case for the industry’s future.

Read more »

Paramount+ Price Increase Set for Ad and Showtime TiersParamount Global is raising prices for Paramount+ With Showtime, the Paramount+ Essential plan, and the Paramount+ Limited Commercial plan.

Paramount+ Price Increase Set for Ad and Showtime TiersParamount Global is raising prices for Paramount+ With Showtime, the Paramount+ Essential plan, and the Paramount+ Limited Commercial plan.

Read more »

10 Best Mario Kart Tracks We Want To See In The Super Mario Bros. Movie 2Topping the Rainbow Road scene won’t be easy.

10 Best Mario Kart Tracks We Want To See In The Super Mario Bros. Movie 2Topping the Rainbow Road scene won’t be easy.

Read more »

Mario & Luigi: Brothership is a brand-new Mario RPG for SwitchMario & Luigi: Brothership is the first new entry in the Mario & Luigi series in nine years and debuts on the Nintendo Switch in November.

Mario & Luigi: Brothership is a brand-new Mario RPG for SwitchMario & Luigi: Brothership is the first new entry in the Mario & Luigi series in nine years and debuts on the Nintendo Switch in November.

Read more »