The past two years saw significant gains for equities investors, but 2023 is projected to be more volatile. Analysts predict a 19% increase in the S&P 500, but a potential pullback at the start of the year due to less dovish Fed policies and market uncertainties.

This is the time of year when we all wish one another a healthy, happy, and prosperous new year. The past two years were certainly prosperous ones for equities investors, as the gains more than offset the 19.4% loss during 2022. On average, the S&P 500 is up 9.4% per year over the past three years, consistent with its long-run average growth rate of 7.2% (chart). Of course, in the case of dividends, returns are even higher than performance suggests.

Three consecutive years of double-digit gains don't happen too often. Nevertheless, that’s what we are expecting: We see the S&P 500 increasing 19.0% this year to 7000. However, we think it could be a bumpier ascent than in recent years, especially during the next couple of months. Fed officials are likely to be less dovish in the coming weeks. In addition, uncertainty about fiscal, trade, and immigration policies might continue to put upward pressure on bond yields.Last year's advance was heavily skewed by the Magnificent-7 stocks, which collectively soared 62.7% and currently account for a whopping 32% of the market cap of the S&P 500 (chart). They will probably continue to outperform at the start of the year. We also think that the will outperform in 2025. While we believe a significant stock market pullback is likely at the start of the new year, we expect the bull market to broaden again starting in the spring, once monetary and fiscal policies become clearer. In 2024, the S&P 1500's outperforming stock sectors were dominated by large-cap growth stocks, particularly the Mag-7 (chart). However, the S&P 500 managed to beat the S&P 500. We aren't keen on small caps, which have been disappointing underperformers for several years now. The problem is that the best of the bunch get acquired before they can grow into the next Microsoft (NASDAQ:MSFT). The bull market since October 12, 2022 has been a broad one, with plenty of stock market indexes up by more than 25% (chart)

STOCK MARKET S&P 500 ECONOMIC FORECAST DIVIDENDRETURNS FED POLICY

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Honda recalls nearly 206,000 SUVs to fix tubes that can leak gasoline, risking a fireThe recall covers certain 2023 and 2024 Passports and some 2023 through 2025 Pilots.

Honda recalls nearly 206,000 SUVs to fix tubes that can leak gasoline, risking a fireThe recall covers certain 2023 and 2024 Passports and some 2023 through 2025 Pilots.

Read more »

Honda recalls nearly 206,000 SUVs to fix tubes that can leak gasoline, risking a fireThe recall covers certain 2023 and 2024 Passports and some 2023 through 2025 Pilots.

Honda recalls nearly 206,000 SUVs to fix tubes that can leak gasoline, risking a fireThe recall covers certain 2023 and 2024 Passports and some 2023 through 2025 Pilots.

Read more »

All Star Wars Movie & TV Show News Expected In 2025The posters for Andor (2022), Ahsoka (2023), and The Mandalorian (2023)

All Star Wars Movie & TV Show News Expected In 2025The posters for Andor (2022), Ahsoka (2023), and The Mandalorian (2023)

Read more »

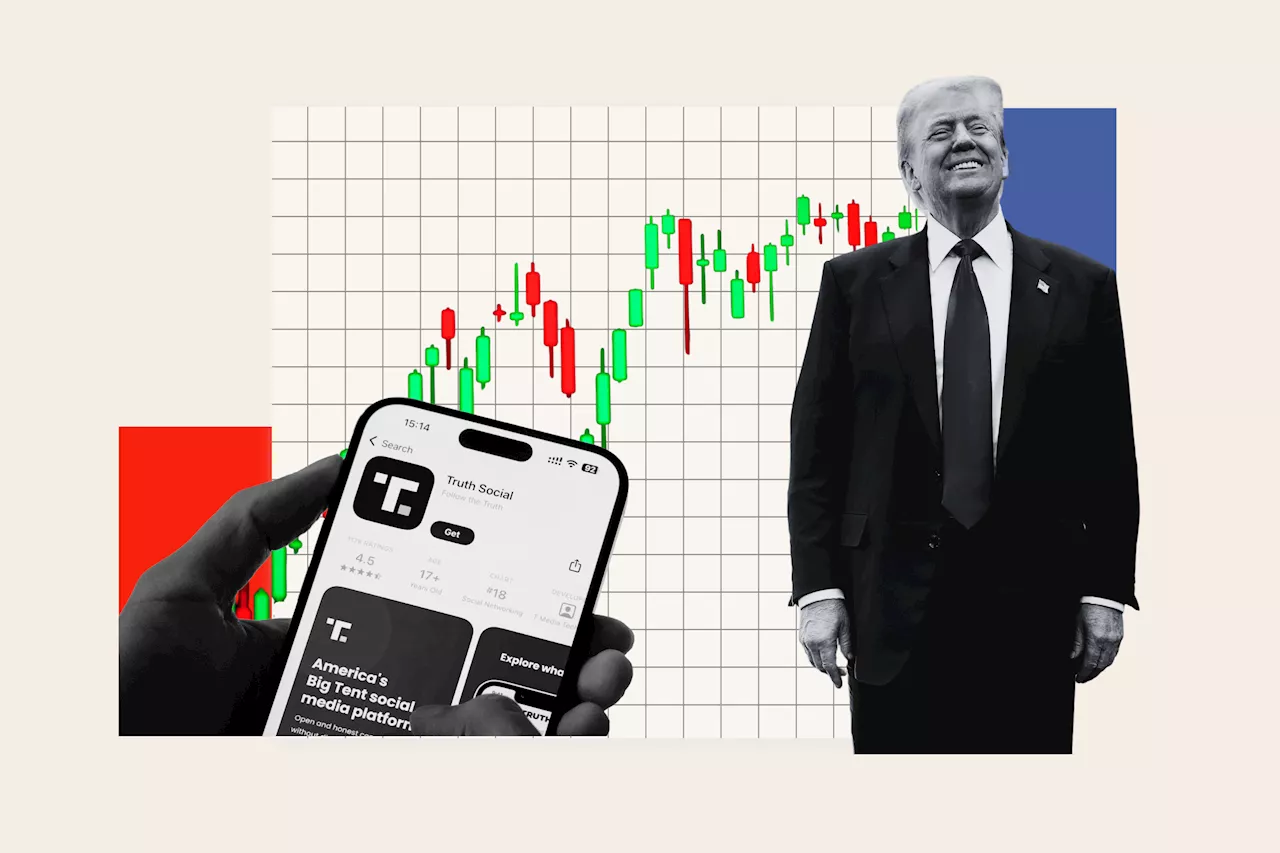

Trump Media's Stock Takes Wild Ride in 2023Trump Media & Technology Group (TMTG), the media company owned by former President Donald Trump, has seen its stock price fluctuate dramatically since going public in March. The company's performance has often been linked to major events involving Trump, including legal troubles and political announcements.

Trump Media's Stock Takes Wild Ride in 2023Trump Media & Technology Group (TMTG), the media company owned by former President Donald Trump, has seen its stock price fluctuate dramatically since going public in March. The company's performance has often been linked to major events involving Trump, including legal troubles and political announcements.

Read more »

Retail Traders Flock to Nvidia, Making It the Most-Bought Stock of 2023Retail investors have poured nearly $30 billion into Nvidia shares this year, making it the most popular stock among everyday traders. The AI chipmaker's impressive performance, driven by its leadership in artificial intelligence, has captivated both Wall Street and Main Street. Nvidia's stock is on track to finish 2023 with a gain of over 180%, and its presence in the average retail investor's portfolio has surged to over 10%.

Retail Traders Flock to Nvidia, Making It the Most-Bought Stock of 2023Retail investors have poured nearly $30 billion into Nvidia shares this year, making it the most popular stock among everyday traders. The AI chipmaker's impressive performance, driven by its leadership in artificial intelligence, has captivated both Wall Street and Main Street. Nvidia's stock is on track to finish 2023 with a gain of over 180%, and its presence in the average retail investor's portfolio has surged to over 10%.

Read more »

1 Stock to Buy, 1 Stock to Sell This Week: Oracle, AutoZoneStocks Analysis by Investing.com (Jesse Cohen) covering: Nasdaq 100, S&P 500, Dow Jones Industrial Average, Oracle Corporation. Read Investing.com (Jesse Cohen)'s latest article on Investing.com

1 Stock to Buy, 1 Stock to Sell This Week: Oracle, AutoZoneStocks Analysis by Investing.com (Jesse Cohen) covering: Nasdaq 100, S&P 500, Dow Jones Industrial Average, Oracle Corporation. Read Investing.com (Jesse Cohen)'s latest article on Investing.com

Read more »