Richard Cordray, the first director of the Consumer Financial Protection Bureau (CFPB), warns against abolishing the agency, stating it would leave consumers vulnerable to predatory practices. He compares the potential scenario to 'the wild, wild west,' emphasizing the lack of oversight that would result. The CFPB has faced a leadership shake-up since Trump took office, and its new acting director, Russell Vought, has called for the agency's funding to be cut off. Vought's move is seen by some as influenced by Elon Musk, who has publicly advocated for the CFPB's elimination.

The first director of the Consumer Financial Protection Bureau warned against eliminating the independent watchdog agency, telling Business Insider that it would strip oversight of financial firms and harm US consumers.'We'd be back to the wild, wild west for financial services that affect families all over the country in terms of what their terms would be on their credit cards, on their mortgages, and other products.

On January 28, X CEO Linda Yaccarino announced a partnership with Visa that will allow peer-to-peer money transfers with what the company calls XMoney, set to debut later this year.'It's a direct conflict of interest and totally unethical for him to be making judgments about how the CFPB should exist that are not legislated by Congress and that might serve his own financial interests at the expense of the public across the country,' Corday said.

CONSUMER FINANCIAL PROTECTION BUREAU ELON MUSK GOVERNMENT REGULATION FINANCIAL SERVICES PUBLIC INTEREST

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

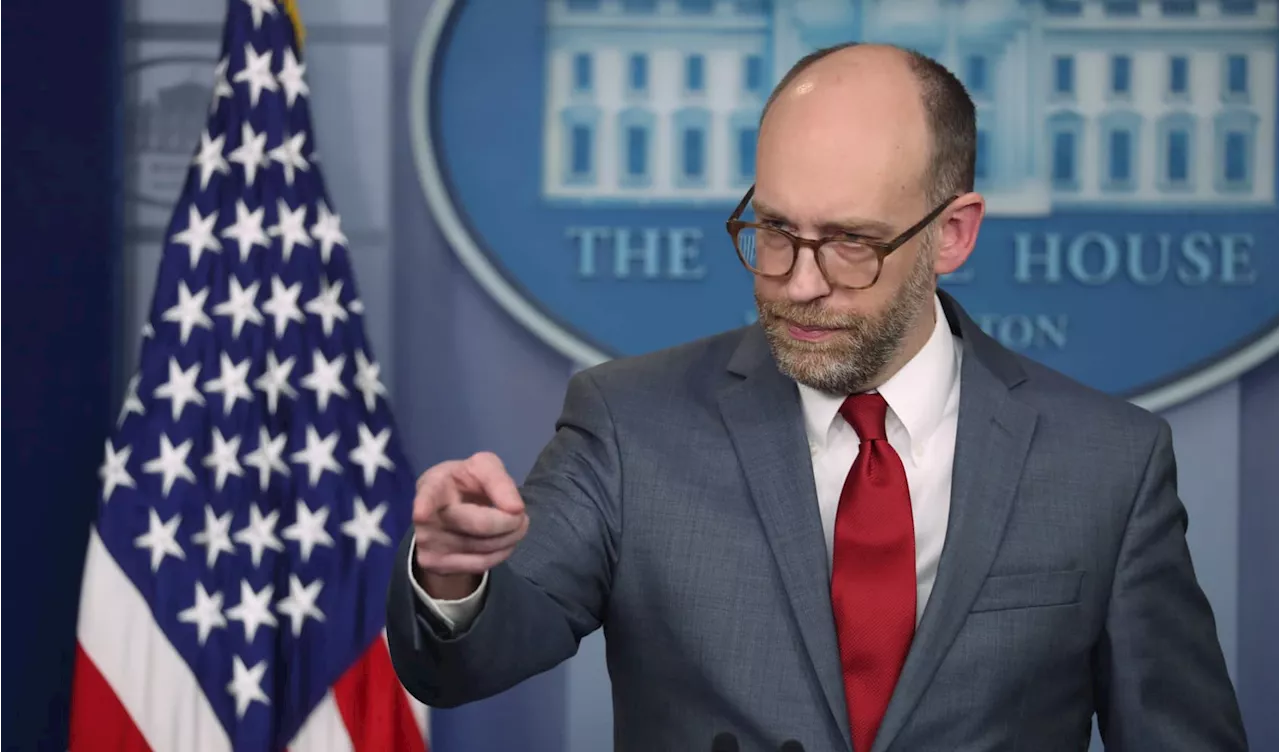

OMB Director Vought Halts CFPB Operations, Claiming Bureau Is 'Unaccountable'Russell Vought, the director of the Office of Management and Budget, has issued a series of directives that effectively halt the operations of the Consumer Financial Protection Bureau (CFPB). Vought, who is also serving as the acting head of the CFPB, cited concerns about the bureau's 'unaccountability' and its $711.6 million budget surplus as justification for his actions.

OMB Director Vought Halts CFPB Operations, Claiming Bureau Is 'Unaccountable'Russell Vought, the director of the Office of Management and Budget, has issued a series of directives that effectively halt the operations of the Consumer Financial Protection Bureau (CFPB). Vought, who is also serving as the acting head of the CFPB, cited concerns about the bureau's 'unaccountability' and its $711.6 million budget surplus as justification for his actions.

Read more »

Musk's DOGE Launches Review of CFPB, Agency Website Goes DownElon Musk's Department of Government Efficiency (DOGE) has initiated a comprehensive review of the Consumer Financial Protection Bureau (CFPB), leading to the agency's website becoming inaccessible. DOGE representatives have gained access to CFPB's internal systems, including personnel and financial records. This move comes after Musk posted 'RIP CFPB' on X, his social media platform, and President Trump appointed Russell Vought as acting head of the CFPB. The review's objective is reportedly to uncover corruption within the agency, as DOGE believes the CFPB lacks Congressional oversight due to its connection with the Federal Reserve.

Musk's DOGE Launches Review of CFPB, Agency Website Goes DownElon Musk's Department of Government Efficiency (DOGE) has initiated a comprehensive review of the Consumer Financial Protection Bureau (CFPB), leading to the agency's website becoming inaccessible. DOGE representatives have gained access to CFPB's internal systems, including personnel and financial records. This move comes after Musk posted 'RIP CFPB' on X, his social media platform, and President Trump appointed Russell Vought as acting head of the CFPB. The review's objective is reportedly to uncover corruption within the agency, as DOGE believes the CFPB lacks Congressional oversight due to its connection with the Federal Reserve.

Read more »

CFPB Employees Told to Work Remotely as Musk-Backed DOGE Operatives Gain Access to Agency DataConsumer Financial Protection Bureau (CFPB) employees were directed to work remotely as their Washington, D.C. headquarters closed through February 14th. This follows a directive from acting CFPB director Russell Vought to suspend nearly all regulator activities, including supervising financial firms. The move comes amid concerns about the CFPB's future after operatives from Elon Musk's DOGE gained access to agency data, including staff performance reviews. Musk previously called for the CFPB's deletion and recently halted funding flow to the agency.

CFPB Employees Told to Work Remotely as Musk-Backed DOGE Operatives Gain Access to Agency DataConsumer Financial Protection Bureau (CFPB) employees were directed to work remotely as their Washington, D.C. headquarters closed through February 14th. This follows a directive from acting CFPB director Russell Vought to suspend nearly all regulator activities, including supervising financial firms. The move comes amid concerns about the CFPB's future after operatives from Elon Musk's DOGE gained access to agency data, including staff performance reviews. Musk previously called for the CFPB's deletion and recently halted funding flow to the agency.

Read more »

Russell Vought takes over as CFPB's acting headKatherine Doyle is a White House reporter for NBC News.

Russell Vought takes over as CFPB's acting headKatherine Doyle is a White House reporter for NBC News.

Read more »

Russell Vought, CFPB's new acting head, issues directives to halt portions of bureau activityDirector Russell Vought issued a series of directives to CFP Bureau employees Saturday night in his new capacity as the bureau's acting head.

Russell Vought, CFPB's new acting head, issues directives to halt portions of bureau activityDirector Russell Vought issued a series of directives to CFP Bureau employees Saturday night in his new capacity as the bureau's acting head.

Read more »

Acting CFPB Head Vought Halts Major Bureau OperationsRussell Vought, the Office of Management and Budget director, has taken over as the acting head of the Consumer Financial Protection Bureau (CFPB) and issued directives that effectively halt a significant portion of the bureau's activities. These directives include ceasing all supervision and examination activities, stakeholder engagement, and enforcement actions. Vought has also instructed employees to suspend the effective dates of final rules and not to approve or issue any new rules or guidance. He justified the actions by claiming the CFPB's current funding level is excessive and that it is not 'reasonably necessary' to carry out its duties.

Acting CFPB Head Vought Halts Major Bureau OperationsRussell Vought, the Office of Management and Budget director, has taken over as the acting head of the Consumer Financial Protection Bureau (CFPB) and issued directives that effectively halt a significant portion of the bureau's activities. These directives include ceasing all supervision and examination activities, stakeholder engagement, and enforcement actions. Vought has also instructed employees to suspend the effective dates of final rules and not to approve or issue any new rules or guidance. He justified the actions by claiming the CFPB's current funding level is excessive and that it is not 'reasonably necessary' to carry out its duties.

Read more »