European Markets Muted as Focus Turns to U.S. Inflation, Fed Outlook

Investors are trying to assess the potential pace of the U.S. Federal Reserve's monetary policy tightening efforts.

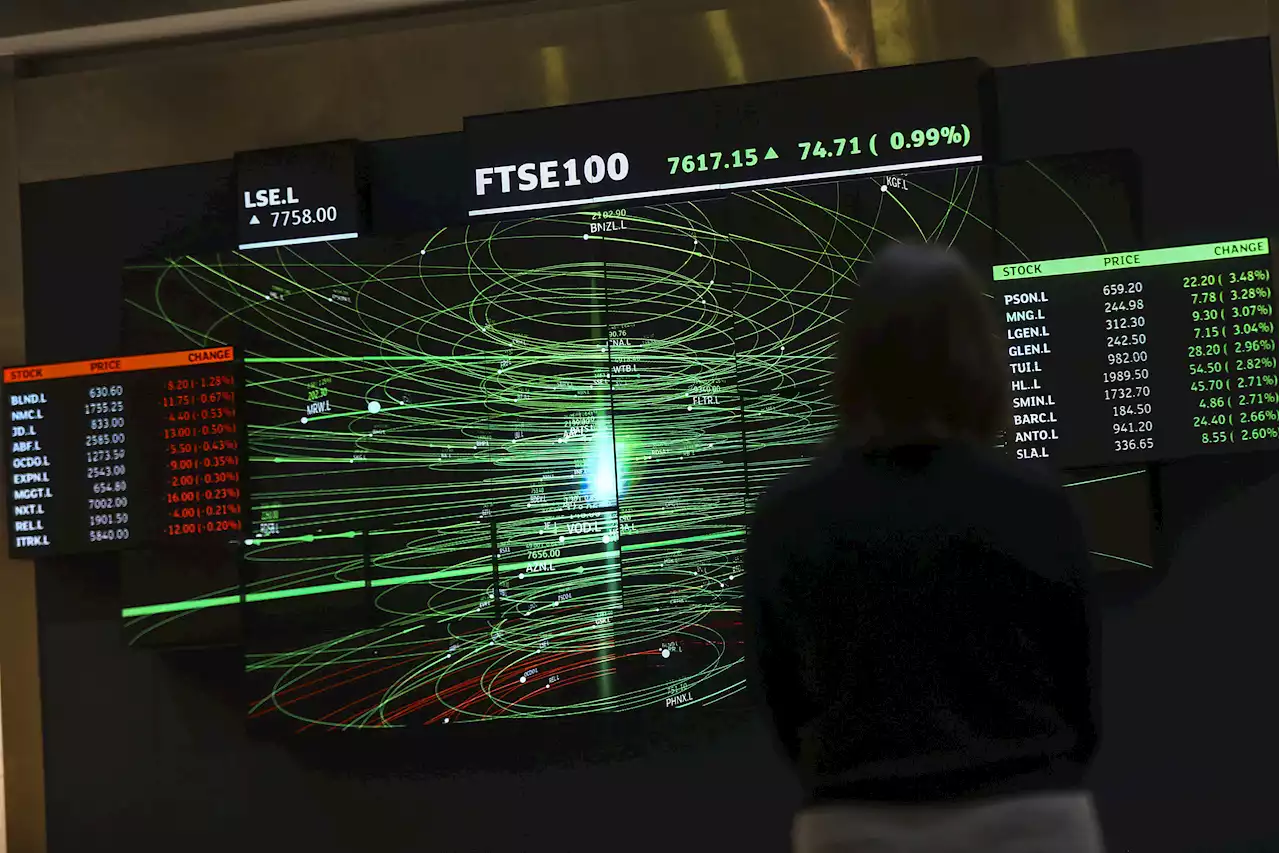

Earnings also remain a key driver of individual share price movement in Europe, with Abrdn, IHG, L&G, Continental and Munich Re among those reporting before the bell on Tuesday. LONDON — European markets were slightly lower on Tuesday as focus in global markets turns to a key U.S. inflation print due Wednesday.slipped 0.2% by mid-morning, with travel and leisure stocks shedding 1.2% to lead losses while insurance stocks gained 0.8%.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

![]() STOCK MARKET NEWS: Dow rises, oil, crypto higher, gas, diesel lower, iconic toy store returnsMarkets moving higher after finishing close to flat on Friday. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

STOCK MARKET NEWS: Dow rises, oil, crypto higher, gas, diesel lower, iconic toy store returnsMarkets moving higher after finishing close to flat on Friday. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Read more »

AUD/USD: Corrective pullback fades around 0.6900, Taiwan, US inflation in focusAUD/USD struggles to extend the week-start gains as the Aussie traders flirt with the 0.6900 threshold amid a risk-off mood during Monday’s Asian sess

AUD/USD: Corrective pullback fades around 0.6900, Taiwan, US inflation in focusAUD/USD struggles to extend the week-start gains as the Aussie traders flirt with the 0.6900 threshold amid a risk-off mood during Monday’s Asian sess

Read more »

USD/CAD picks up bids towards 1.2900 despite firmer oil, US inflation in focusUSD/CAD licks its wounds as it renews daily tops near 1.2870 while paring the biggest loss since July 19 during Tuesday’s Asian session. The loonie pa

USD/CAD picks up bids towards 1.2900 despite firmer oil, US inflation in focusUSD/CAD licks its wounds as it renews daily tops near 1.2870 while paring the biggest loss since July 19 during Tuesday’s Asian session. The loonie pa

Read more »

Wall Street closes little changed on Fed policy fears By Reuters*U.S. STOCKS CLOSE LITTLE CHANGED ON MIXED INFLATION MESSAGES, FED POLICY FEARS - 🇺🇸🇺🇸

Wall Street closes little changed on Fed policy fears By Reuters*U.S. STOCKS CLOSE LITTLE CHANGED ON MIXED INFLATION MESSAGES, FED POLICY FEARS - 🇺🇸🇺🇸

Read more »

U.S. Treasury Yields Fall as Investors Weigh Fed Rate Hike OutlookU.S. Treasury yields fell on Monday after unexpectedly robust jobs data increased the likelihood of aggressive rate hikes by the Federal Reserve.

U.S. Treasury Yields Fall as Investors Weigh Fed Rate Hike OutlookU.S. Treasury yields fell on Monday after unexpectedly robust jobs data increased the likelihood of aggressive rate hikes by the Federal Reserve.

Read more »

Stock Futures Are Flat Following S&P 500's Third Winning Week in a RowInvestors shifted focus to a key inflation report this week for more clarification about the Fed’s next move at its policy meeting in September.

Stock Futures Are Flat Following S&P 500's Third Winning Week in a RowInvestors shifted focus to a key inflation report this week for more clarification about the Fed’s next move at its policy meeting in September.

Read more »