EUR/USD has finally found some support on the softer US rates story.

EUR vs. USD two-year swap differentials have narrowed dramatically – from 113bp last Thursday to 83bp today. Weaker global growth isnot good for the pro-cyclical Euro , but the fact that the 'US exceptionalism'narrative could be coming back to earth with a bump should be EUR/USD supportive, ING’s FX strategist Chris Turner notes. EUR/USD to trade up towards 1.10 “Were it not for the heavy sell-off in equities, yield differentials would make a case for EUR/USD to be trading well above 1.

In terms of the risk environment, we are keeping our eye on measures of financial risks such as the three-month Ted Spread and also on the three-month EUR:USD cross-currency basis swap.” “It is a quiet week for eurozone data. Look out for the August Sentix investor survey today - although that was taken before the recent rout in equity markets.Overall we think EUR/USD should be able to press the 1.0950/80 region and break above 1.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

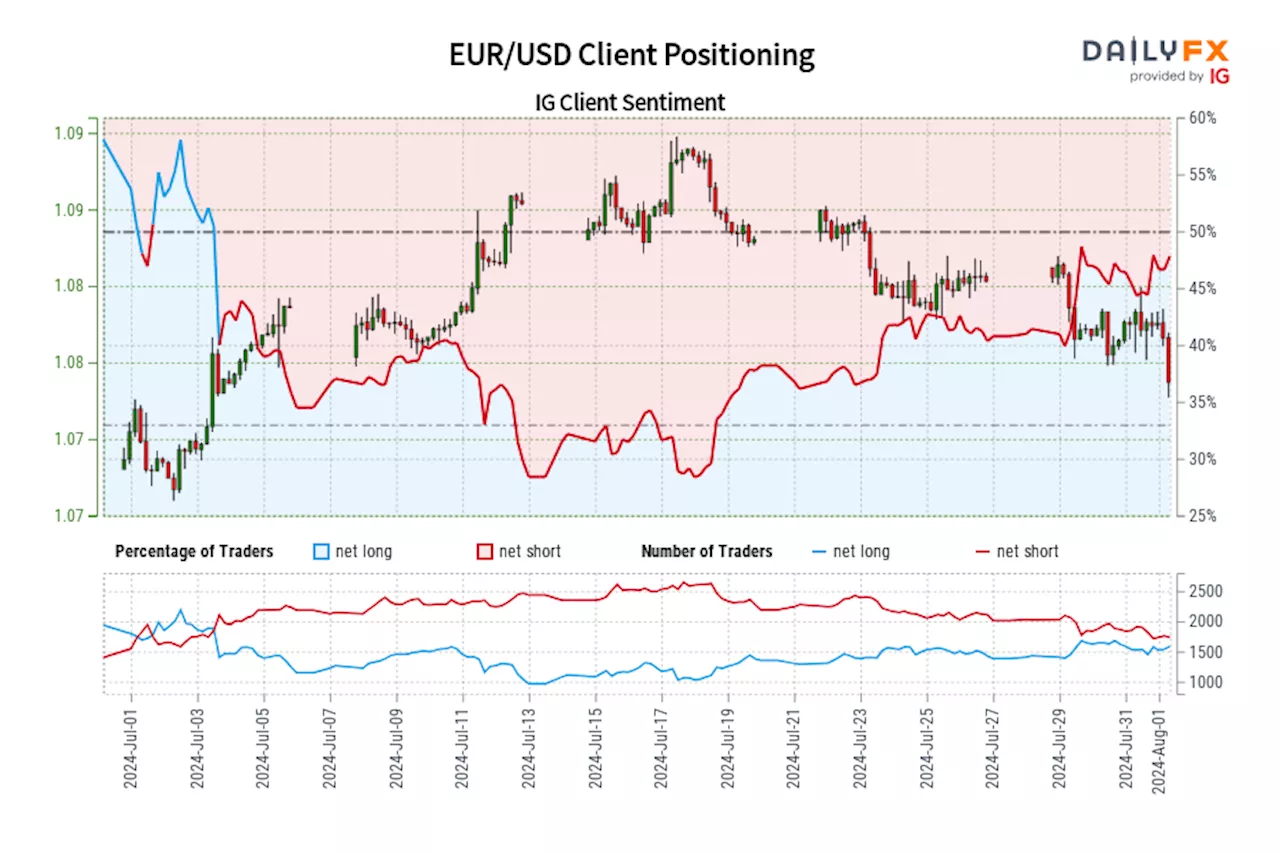

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Jul 03, 2024 when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Jul 03, 2024 when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Read more »

EUR/USD: Risk of EUR breaking above 1.0850 increasesThe Euro (EUR) is expected to trade in a 1.0795/1.0845 range.

EUR/USD: Risk of EUR breaking above 1.0850 increasesThe Euro (EUR) is expected to trade in a 1.0795/1.0845 range.

Read more »

EUR/USD: To trade in a range between 1.0845 and 1.0945The Euro (EUR) strength has ended; for the time being, it is likely to trade in a range between 1.0845 and 1.0945, UOB Group FX strategists Quek Ser Leang and Peter Chia note.

EUR/USD: To trade in a range between 1.0845 and 1.0945The Euro (EUR) strength has ended; for the time being, it is likely to trade in a range between 1.0845 and 1.0945, UOB Group FX strategists Quek Ser Leang and Peter Chia note.

Read more »

EUR/USD: Likely to trade towards 1.0815The Euro (EUR) is likely to trade with a downward bias. Tentative buildup in momentum suggests downside risk; any further decline in EUR is unlikely to break clearly below 1.0815, UOB Group FX analysts Quek Ser Leang and Lee Sue Ann.

EUR/USD: Likely to trade towards 1.0815The Euro (EUR) is likely to trade with a downward bias. Tentative buildup in momentum suggests downside risk; any further decline in EUR is unlikely to break clearly below 1.0815, UOB Group FX analysts Quek Ser Leang and Lee Sue Ann.

Read more »

EUR/USD: Clear signals, or neither fish nor fowl?Last week European Central Bank (ECB) President Christine Lagarde emphasized the data dependency of future interest rate decisions.

EUR/USD: Clear signals, or neither fish nor fowl?Last week European Central Bank (ECB) President Christine Lagarde emphasized the data dependency of future interest rate decisions.

Read more »

Euro (EUR/USD) Weakens After German PMIs Disappoint, Rate Cut Expectations RiseThe German Composite PMI fell to a four-month low and back into contraction territory in July, strengthening the case for further rate cuts in the Euro Area.

Euro (EUR/USD) Weakens After German PMIs Disappoint, Rate Cut Expectations RiseThe German Composite PMI fell to a four-month low and back into contraction territory in July, strengthening the case for further rate cuts in the Euro Area.

Read more »